Amidst notable fluctuations in GitLab’s stock, the company continues to hold its ground as a pioneering force in the DevSecOps realm. With a projected Total Addressable Market (TAM) of $23 billion, the company’s dedication to innovation is evident through the incorporation of AI and machine learning functionalities, potentially catalyzing growth and bolstering its competitive stance.

The valuation of GitLab hinges on its anticipated multi-year Compound Annual Growth Rate (CAGR). Although the present valuation might dissuade certain investors, Some believe the potential for growth remains underrated. As GitLab systematically enhances its profitability landscape, the likelihood of achieving positive free cash flow in one or more quarters this year adds to its positive trajectory.

| Gitlab | Key Points |

|---|---|

| Company Overview | GitLab is a prominent player in the DevSecOps space, providing a comprehensive integrated DevOps platform for software development, emphasizing efficiency, speed, and security. With market share under 12%, there’s room for competitive growth. The company boasts reference customers including IBM, Goldman Sachs, Sony, and NASA. |

| Financial Performance | GitLab reported revenues of $127 million, marking a 45% YoY growth. Non-GAAP gross margins stood at 91%, and the non-GAAP operating loss margin improved to 12%. The company exceeded Q1 revenue forecasts and guided for full year revenues of $542 million, projecting positive trends. |

| Generative AI Focus | GitLab’s core AI offering, Code Suggestions, aids developers with real-time code suggestions as they type, enhancing productivity. The AI capabilities are in beta and show potential, targeting efficiency in software development. Additional AI features are expected, catering to code review, vulnerability identification, and predicting team efficiency. |

| Competitive Landscape | GitLab faces competition from GitHub, a Microsoft subsidiary. Both offer DevOps platforms, with GitLab positioning itself as a unified, security-focused option. GitHub’s Copilot AI also plays in this field. GitLab’s strategic partnerships and AI push position it for continued growth, while user preferences and specific needs influence adoption decisions. |

| Risks and Challenges | GitLab operates in a volatile macro environment with ongoing uncertainties, affecting demand for software solutions. The introduction of Generative AI presents challenges in terms of model accuracy and user satisfaction. Potential backlash from price increases could impact customer loyalty. Ensuring the success of new offerings amid evolving market conditions is a concern. |

| Business Model and Valuation | GitLab’s financials have improved, with higher gross margins, reduced operating loss margins, and cost-containment efforts. However, it’s not yet profitable or generating positive cash flow. Valuation aligns with similar growth companies, but relative valuation can deter some investors. The investment case rests on its competitive position, AI expansion potential, and path to positive cash flow, although macroeconomic trends and market sentiment play roles. |

| Investment Prospects | GitLab’s leadership in the DevSecOps space, demonstrated growth, and introduction of Generative AI features indicate a promising investment prospect. The expanding DevOps market and the company’s focus on comprehensive solutions position it well. The potential to accelerate growth via AI, strong competitive stance, and improving business model may drive positive returns for long-term investors. |

| Potential Risks and Considerations | Challenges include ongoing macroeconomic uncertainties affecting software demand and the risk of AI feature imperfections. Pricing increases could lead to customer churn. Market sentiment and interest rate expectations are relevant factors impacting GitLab’s performance. The success of AI initiatives and cash flow generation are also contingent on evolving market dynamics. |

What you'll learn:

➤ GitLab’s Outlook & Market Dynamics

Within the realm of IT, trends and developments rarely lead to dull moments. The IT sector witnesses continuous shifts, making long-standing trends hard to identify. GitLab (NASDAQ:GTLB) emerged on the scene post its 2021 IPO, soaring to impressive heights. However, its subsequent trajectory has been marked by fluctuations.

Following its IPO, GitLab’s stock surged but later encountered a decline of over 40% from its peak. This trend didn’t last, as the stock fell another 46% by the close of 2022. Yet, it rebounded by 48% only to stumble again post an earnings release that featured layoffs and revenue forecast reductions. The IT sector’s characteristic volatility played out in full force.

The question at hand is whether GitLab’s stock is currently valued reasonably for potential long-term investors. Determining an accurate baseline growth rate for GitLab and other high-growth IT firms is a complex task. In light of discussions surrounding potential economic shifts, IT growth rates have decelerated. This phenomenon can be attributed to declining demand, prompting companies to adopt more cautious IT spending strategies. Moreover, accounting for the potential impact of Artificial Intelligence (AI) on growth projections adds another layer of complexity.

Attempting to predict AI’s influence on GitLab’s performance within a year or two, let alone across two decades, presents considerable challenges. This ambiguity has left analysts and investors grappling with how to define appropriate Compound Annual Growth Rates (CAGR) for companies within this sector.

GitLab’s most recent call added to the uncertainty, making it difficult to project a realistic CAGR beyond the current quarter. The company’s prospects post the recent share price surge are up for consideration. For longer-term investors, GitLab’s potential as a technology leader in the DevSecOps sector stands out. The anticipated Compound Annual Growth Rate (CAGR) for this sector hovers around 25% over the next five years. The estimated market size is projected to exceed $23 billion by the end of the decade. However, these figures should be juxtaposed with GitLab’s current revenue forecast of under $550 million for the year, indicating substantial growth potential.

Is now the opportune moment to invest in GitLab? The answer rests on factors such as time horizons, risk tolerance, and portfolio structure. Following a surge of nearly 70% since May 4th, the stock’s consolidation phase is anticipated. Entry points might be more favorable during reversal days, potentially posing lower risks compared to the current price. A measured, phased investment approach might be prudent for those looking to take a longer view. While the most recent quarter’s results exceeded expectations, challenges remain.

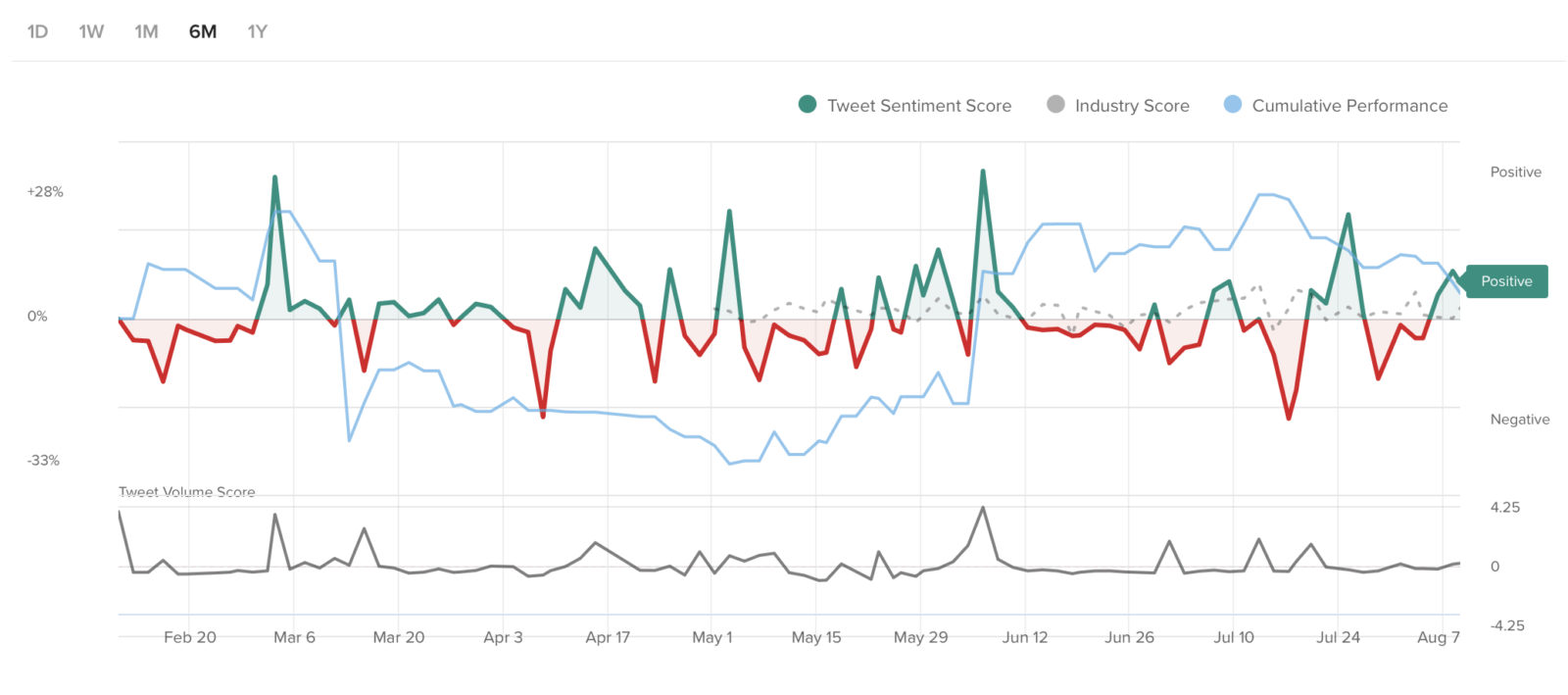

GitLab’s shares are contingent on a bullish tech rally to showcase significant gains. A flourishing tech market is pivotal for GitLab’s shares to outperform. In other market scenarios, it’s less likely for them to exhibit remarkable relative strength. Should consolidation occur, the shares could offer noteworthy upside potential.

It’s important to note that this analysis does not reflect an opinion on the market. The recent tech rally has surprised many and the economic landscape remains uncertain. GitLab shares would require a risk-on market sentiment to experience appreciable growth.

GitLab’s recent earnings release unveiled new AI-driven products and platform enhancements. AI’s impact on software’s Return on Investment (ROI) and users’ willingness to make purchases has garnered widespread recognition. However, investing solely based on AI integration isn’t advisable. AI’s transformative influence unfolds gradually over years, rather than impacting productivity and revenue instantly. While some companies, such as NVIDIA (NVDA) and possibly Pure Storage (PSTG), are already witnessing the impact of AI and Generative AI on demand, these cases remain exceptions rather than the norm.

The company’s guidance includes its new AI products, which prompted a slightly elevated revenue forecast. Although AI’s profound impact on this year’s growth is uncertain, given the AI extension service’s beta status and limited availability, the guidance likely accounts for macroeconomic challenges. However, it’s worth noting that AI, while revolutionary, cannot be expected to resolve all challenges instantaneously.

Despite making strides towards profitability, GitLab might continue reporting losses through the fiscal year. Yet, there is potential for the company to achieve break-even free cash results by the end of the fisGitLab’s Financial Highlights and Guidancecal year.

➤ GitLab’s Financial Highlights & Guidance

GitLab’s recent earnings report revealed significant financial metrics, showcasing its performance and outlook. For the quarter, the company reported revenues of $127 million, along with a non-GAAP gross margin of 91% and a non-GAAP operating loss margin of 12%. These figures represented a 45% increase in revenues year over year, as well as a 3% sequential growth from the company’s fiscal Q4. Notably, the company’s Q1 revenues surpassed its initial forecast of $118 million, while its non-GAAP operating loss margin improved from the projected 22%, reflecting an impressive reversal from prior guidance.

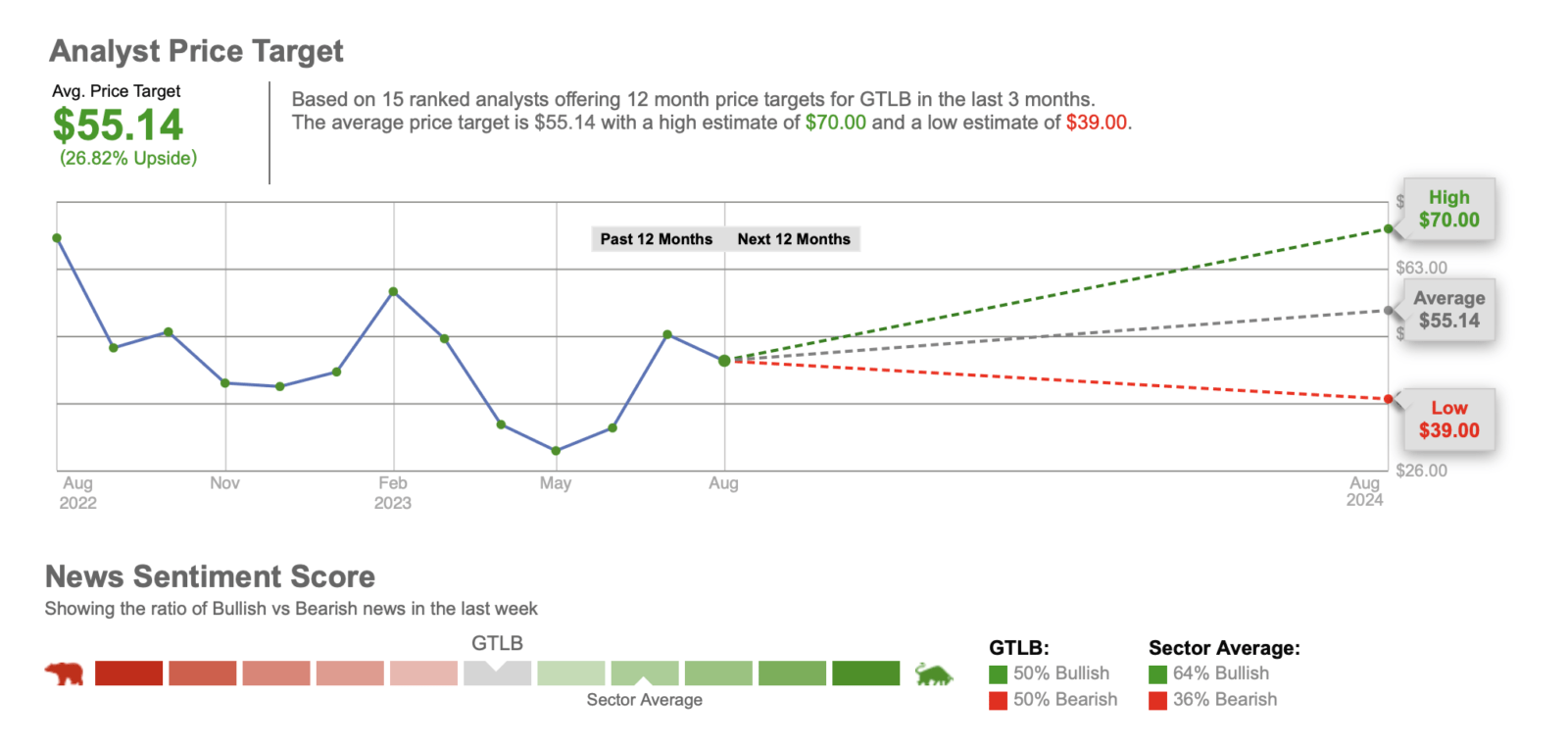

In terms of its full-year outlook, GitLab anticipates revenues of $542 million and a non-GAAP operating loss margin of 8%. This forecast marks an incremental increase in revenue compared to its Q1 beat, and a noticeable enhancement in margin compared to its prior guidance.

GitLab’s Remaining Performance Obligation (RPO) balance experienced a 37% year-over-year growth and a 7% sequential increase in line with expectations for a fiscal Q1. The company’s net expansion rate registered at 128%, slightly lower than the previous quarter’s 133%, a reflection of the broader economic uncertainties affecting customer expansion.

The company’s free cash flow burn for the quarter amounted to approximately $11 million, a notable decrease from the prior year’s $30 million. GitLab has projected reaching free cash flow breakeven in fiscal year 2025, reaffirming this commitment in the latest call. Considering the inherent fluctuations in cash flow metrics, there is a likelihood of witnessing at least one quarter of positive free cash flow generation within the current year.

The CFO’s commentary emphasized an improved visibility into bookings during the quarter, with deals closing as scheduled—an encouraging shift from the prior quarter. Additionally, GitLab observed limited seat contraction and minimal enterprise churn. The company implemented price hikes in early April, reporting no substantial resistance from customers. The impact of these changes will become more pronounced beyond the current quarter and extend into the following fiscal year.

GitLab’s CEO, Sid Sijbrandij, offered insight into the company’s AI strategy, providing a detailed perspective on its approach. However, the CFO’s focus was primarily on containing the costs associated with accelerating AI development within the company’s expense structure. Although AI’s potential impact on revenue growth remains unaddressed thus far, the company’s strategic alignment with AI was underscored.

Notably, GitLab’s guidance incorporates its Chinese joint venture, JiHu, into its financial projections. While the company consolidates the JV’s losses based on GAAP, the actual agreement outlines a sharing of both losses and revenues. A significant portion of the projected operating loss for the fiscal year is attributed to incorporating JiHu’s losses into GitLab’s financial reporting. There is a potential that JiHu’s results will be excluded from GitLab’s published earnings over the coming year.

➤ AI Role in GitLab’s Strategy

AI holds immense potential, with Generative AI poised to revolutionize productivity. While the impact of AI is undeniable, investors continue to scrutinize financials and growth rates, a trend that applies to GitLab just as much as any other company, irrespective of the integration of AI products.

For those unfamiliar, GitLab stands as a key player in the DevSecOps sphere, primarily competing with GitHub, a Microsoft subsidiary. DevSecOps extends the DevOps concept with a security emphasis, enhancing software development efficiency and speed in a secure environment.

GitLab, an industry pioneer with consistent feature expansion, retains an estimated market share below 12%, highlighting competitive opportunities. Its user base includes prominent names like IBM, Goldman Sachs, Sony, and NASA.

At the core of GitLab’s AI offering lies “Code Suggestions,” currently in beta. The feature, prioritizing privacy, aids developers by providing real-time code suggestions as they type.

Microsoft’s counterpart, “Copilot,” is often perceived as superior in AI. The CEO’s response emphasized security, partnerships, and a platform approach as GitLab’s differentiators. A definitive judgment on AI superiority remains premature.

While productivity enhancements from Code Suggestions remain unquantified, GitLab has introduced 10 AI features. These range from code review and vulnerability identification to value stream prediction. An uncharted area lies in the potential of Generative AI, suggesting broader demand for developer capabilities.

The CEO’s perspective indicates AI’s ability to broaden the developer community by empowering less skilled developers, subsequently reducing software development costs. This cycle of efficiency gains could increase software output, thereby bolstering demand for developers.

GitLab introduced “ModelOps,” a nascent element enhancing outcomes through machine learning algorithms. The feature remains a growth driver yet to fully materialize within the next year.

The addition of an AI extension at $9/month/user could yield substantial revenue given GitLab’s large user base. An AI-focused expansion strategy may lead to a positive impact on user count, particularly among large users.

While AI-related costs are included in the fiscal year guidance, their influence on FY ’25 remains uncertain. Despite this, revenue estimates for FY ’25 indicate a 28% growth, mirroring the projected growth rate for the current year.

The company’s approach of incorporating “consumptive” elements into pricing, especially for AI, aligns with a long-term focus on revenue growth. Consumption-based models, though temporarily affecting growth, demonstrate profitability and user preference over time.

As of now, revenue forecasts stand at $599 million with a free cash flow margin of -2% over the next four quarters. These projections are expected to evolve once the impact of price increases, consumption pricing adoption, and user demand for AI is quantified.

➤ GitLab’s Competition

For those unfamiliar with Git, it’s a fundamental version control system for software development, favored by most developers and the cornerstone of major vendors in this space.

The DevSecOps space is relatively new, with several vendors offering DevOps platforms. GitLab and Microsoft’s GitHub emerge as leaders in the Gartner Magic Quadrant analysis. Atlassian ranks third, with others like IBM’s Red Hat and VMware trailing.

Gartner highlights GitLab’s unified platform and built-in security as strengths, while Microsoft’s Copilot AI is an advantage for GitHub. GitHub dominates market share, with GitLab gaining traction.

GitHub boasts 56 million users, while GitLab has 31 million. GitLab’s Premium plan recently increased from $19 to $29 per user/month. Its Ultimate tier, accounting for 42% of ARR, remains unchanged.

Ultimate, GitLab’s pricier tier, outpaces Premium and aligns with the DevSecOps vision. GitLab’s AI integration may bolster its competitive standing, emphasizing its growth potential beyond current forecasts.

➤ GitLab’s Path to Profitability and Cash Flow

Initially, GitLab reported a negative non-GAAP operating margin of 35%, a non-GAAP EPS loss of $0.16, and a $53 million cash burn, despite an 89% non-GAAP gross margin and 70% growth.

In the latest quarter, the non-GAAP gross margin improved to 91%, non-GAAP operating loss margin decreased to 12%, and non-GAAP EPS loss was $0.06. Growth was 45% last quarter, with a projected 3% sequential growth for the current quarter.

Sales and marketing expense dropped to 54% of revenues non-GAAP, down from 69% last year, with a layoff’s impact likely to show. R&D expenses lowered slightly to 29% from 31%, and there’s room for improvement.

General and administrative expenses remained at 19% of revenue, while cash burn reduced to $11 million from $30 million last year. Full-year cash burn in FY’23 was $52 million.

The company aims to achieve full-year cash flow break-even in FY’25, and its free cash flow metric is variable, sensitive to revenue variations and pricing changes. The potential for breakeven cash flow this fiscal year exists.

In forecasting rapid growth in free cash flow with a strong gross margin and disciplined expenses, projecting an absolute price target remains uncertain due to technological shifts. GitLab’s growth prospects, aligned with DevOps adoption, make it appealing for long-term investment.

➤ GitLab’s Challenges

Macroeconomic headwinds persist within the software industry, affecting GitLab’s performance and causing uncertainty in forecasts. While last quarter showed some improvement, the software sector remains influenced by these external factors.

Generative AI, a novel capability, introduces uncertainties. The success of Code Suggestions is not guaranteed, and initial outputs may not satisfy all users. Flawed models can lead to negative outcomes, as demonstrated by past instances in other companies.

The introduction of Generative AI could encounter challenges, as the iterative nature of model development poses potential obstacles.

Additionally, GitLab’s recent 50% price increase carries inherent risks. While early indicators suggest limited churn, negative user feedback has been observed. Despite the relatively modest price increase in a professional context, it remains a consideration for user adoption and revenue growth.

➤ GitLab’s Valuation & Considerations

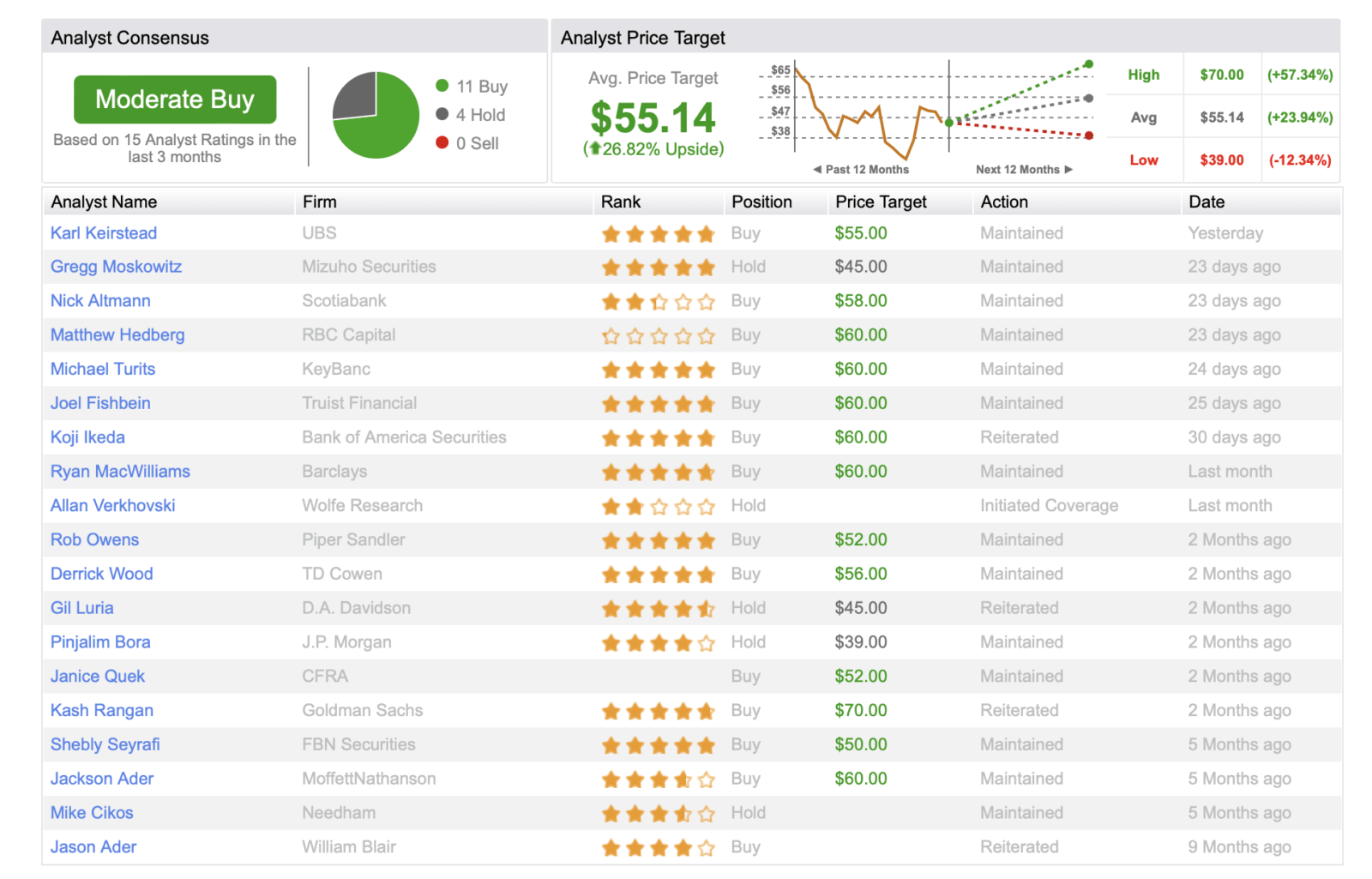

Following a recent surge in its share price, GitLab’s valuation now aligns more closely with prevailing market norms. However, its growth trajectory will likely depend on a favorable risk environment. The dynamics of high-growth IT stocks remain uncertain, and the market’s course will significantly influence GitLab’s future performance, as well as that of its peers.

The company utilizes share-based compensation, with share-based comp accounting for 25% of revenue in the last quarter, up from 20% in the prior year. This increase partly stems from vesting, with options vested due to layoffs.

For valuation, share dilution is often considered more insightful than stock-based compensation. GitLab forecasts around 153 million outstanding shares for the current quarter and full fiscal year, signifying prudent cost control efforts. In this valuation analysis, 154 million fully diluted average shares are used, resulting in an EV/S ratio of 10.5X, slightly above the average for its growth cohort.

Comparatively, GitLab’s valuation aligns with other players like MongoDB, Confluent, and The Trade Desk. Valuation hinges on a multi-year CAGR estimation, which is inherently uncertain. With a 38% estimated 3-year CAGR, based on numerous unknowns including the adoption pace of Generative AI, GitLab’s valuation appears conservative.

The investment thesis centers on GitLab’s dominant position in the DevSecOps space, evident by consistent market share gains. The DevOps market’s underpenetration provides ample room for growth. The company’s Generative AI features, although in Beta, present revenue potential. Despite macroeconomic challenges, GitLab exceeded revenue and bookings forecasts in the last quarter.

The company’s recent staff reductions improved expense ratios, with further improvements expected. An important decision point for potential investors is the current market risk outlook. GitLab’s performance is correlated with macro trends, especially interest rate expectations and sentiment shifts.

The investment case lies in the underestimated growth potential, propelled by the Generative AI extension’s impact on growth, strong competitive positioning, and an improving business model showing signs of eventual positive cash flow.