Options trading offers investors a versatile and dynamic approach to managing risk, generating income, and capitalizing on market movements. Options are financial derivatives that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe.

Options strategies encompass a wide range of techniques that traders and investors can employ to achieve various objectives, such as hedging, speculation, income generation, and risk mitigation.

From basic to advanced strategies, options provide a spectrum of opportunities for participants in the financial markets. Basic strategies often involve straightforward concepts like buying and selling options to take bullish or bearish positions.

As strategies become more advanced, they may incorporate multiple options contracts and intricate combinations to create tailored risk and reward profiles. This comprehensive coverage of options strategies aims to equip traders with the tools they need to navigate the complexities of the options market effectively.

What you'll learn:

➤ Novice

➤ Basic Strategies:

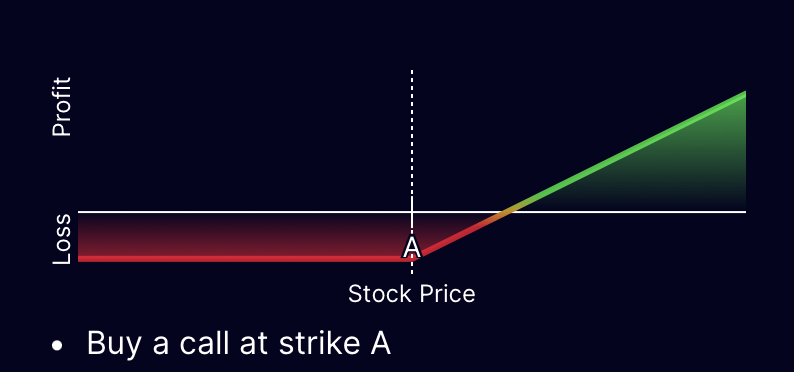

Long Call:

Objective: Bullish, unlimited profit potential, limited loss.

Description: This strategy involves buying a call option, granting the right to purchase the underlying asset at a specified strike price. It’s a straightforward bullish strategy where the investor profits from the underlying asset’s price rise.

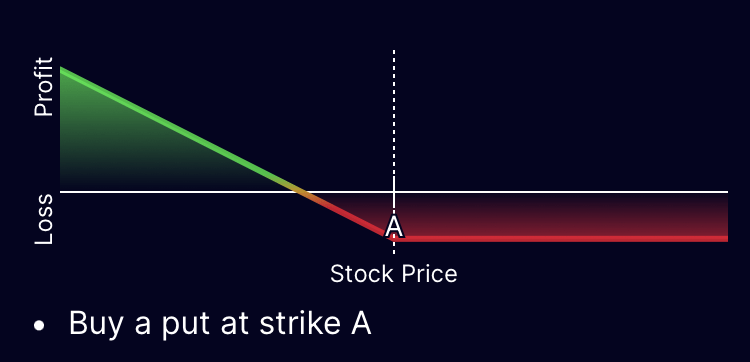

Long Put:

Objective: Bearish, nearly unlimited profit potential, limited loss.

Description: Buying a put option allows the holder to sell the underlying asset at a predetermined strike price. It’s a basic bearish strategy used to profit from an expected decline in the underlying asset’s price.

➤ Income Strategies:

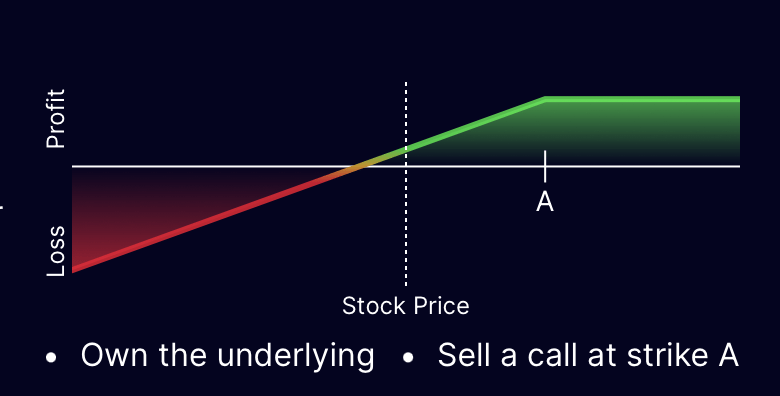

Covered Call:

Objective: Income generation, limited profit, nearly unlimited loss.

Description: This income strategy involves owning the underlying asset and selling a call option against it. If the stock price remains below the strike, the investor keeps the premium collected; if it rises, the investor might need to sell the stock at the strike price.

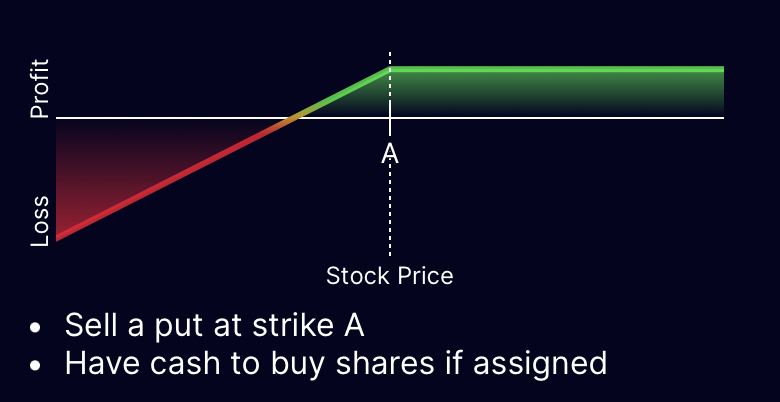

Cash-Secured Put:

Objective: Income generation, limited profit, nearly unlimited loss.

Description: In this strategy, the investor sells a put option while having enough cash to cover the potential purchase of the underlying asset. If the stock price remains above the strike, the investor keeps the premium; if it falls, they might be obligated to buy the stock at the strike price.

➤ Other Strategies:

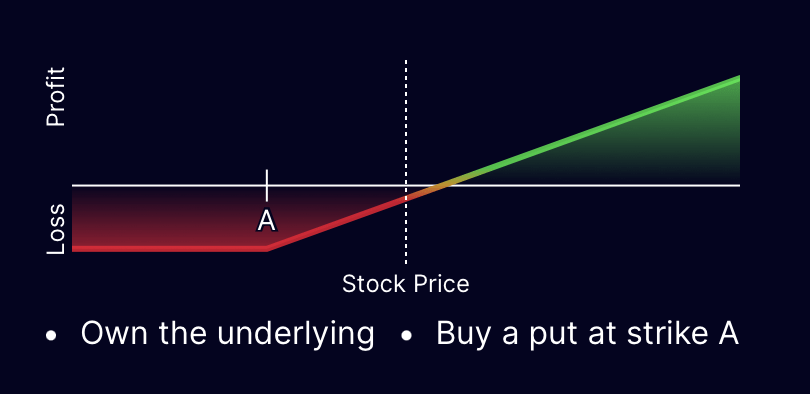

Protective Put:

Objective: Risk management for a bullish position.

Description: This strategy involves buying a put option on a stock the investor owns. It acts as insurance against potential price declines. If the stock price drops significantly, the put option helps mitigate losses.

➤ Intermediate

➤ Credit Spreads:

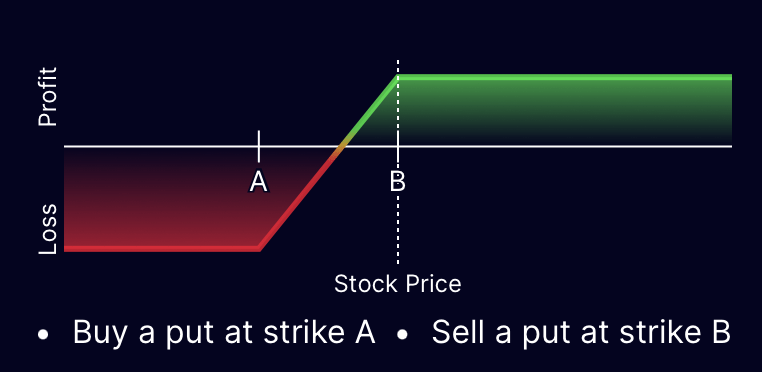

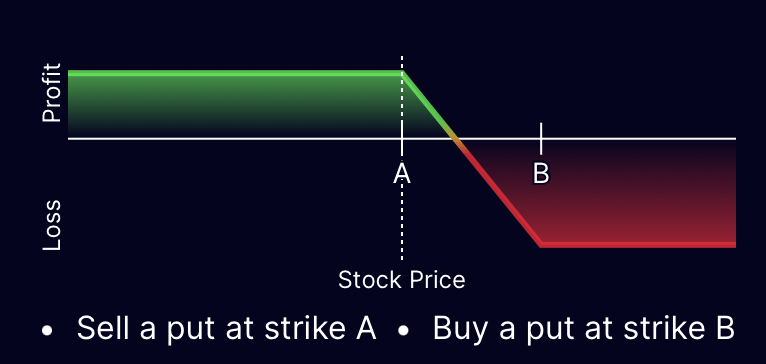

Bull Put Spread

Objective: Bullish

Profit Potential: Limited

Loss Potential: Limited

Description: This vertical spread strategy combines a long put with a short put, capping both potential gains and losses. The goal is for the stock to remain above strike B, allowing both puts to expire worthless. This strategy maintains relative neutrality to changes in volatility. While profitable, time decay is advantageous, but it becomes detrimental when unprofitable.

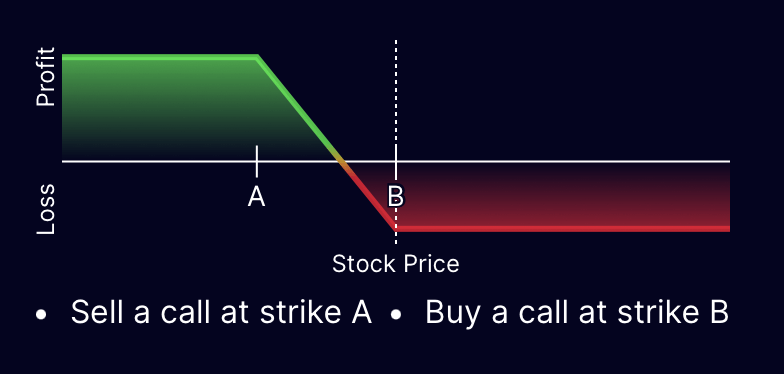

Bear Call Spread

Objective: Bearish

Profit Potential: Limited

Loss Potential: Limited

Description: This bearish vertical spread involves a short call and a long call, limiting both potential gains and losses. The objective is for the stock to stay below strike A, rendering both calls worthless. Similar to the previous strategy, it is nearly neutral to volatility changes. Time decay benefits profitability and works against the strategy when unprofitable.

➤ Debit Spreads:

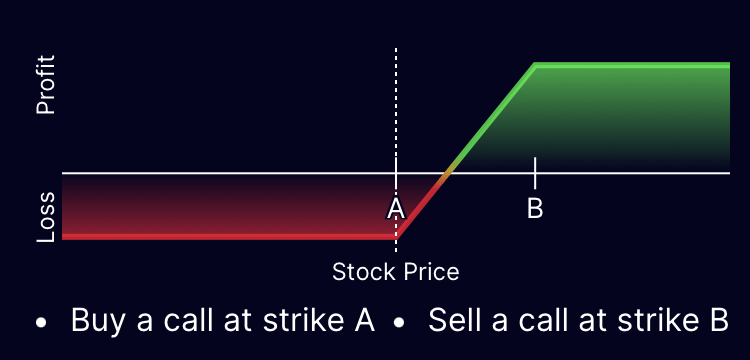

Bull Call Spread

Objective: Bullish

Profit Potential: Limited

Loss Potential: Limited

Description: This bullish vertical spread combines a long call and a short call, capping potential gains and losses. The aim is for the stock to exceed strike B upon expiration. Like other spreads, it remains relatively neutral to changes in volatility. Time decay aids profitability but is unfavorable during unprofitable periods.

Bear Put Spread

Objective: Bearish

Profit Potential: Limited

Loss Potential: Limited

Description: A bearish vertical spread strategy that involves a short put and a long put, with limited potential gains and losses. The goal is for the stock to remain below strike A at expiration. It maintains a neutral stance towards changes in volatility. Time decay is beneficial during profitable phases and detrimental when unprofitable.

➤ Neutral Strategies:

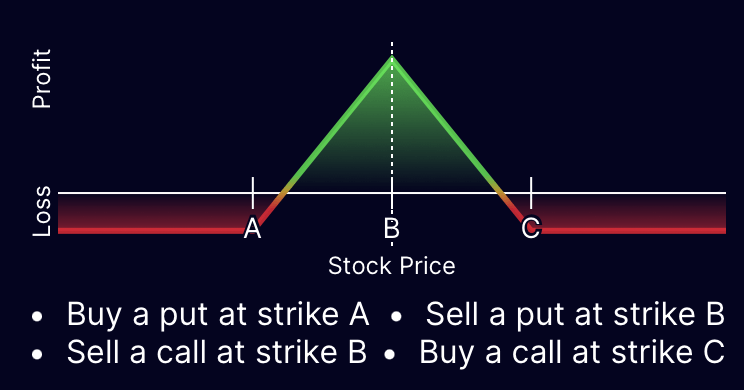

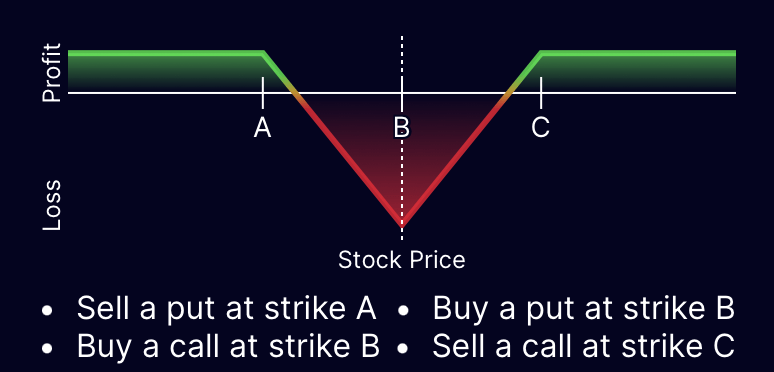

Iron Butterfly

Objective: Neutral

Profit Potential: Limited

Loss Potential: Limited

Description: This neutral strategy, established as a net credit, combines a bull put spread and a bear call spread. Profits are realized within a specific range, with volatility and time decay influencing profitability. Decreasing volatility expands the profitable region, while increasing volatility narrows it. Time assists profitability and hampers unprofitable periods.

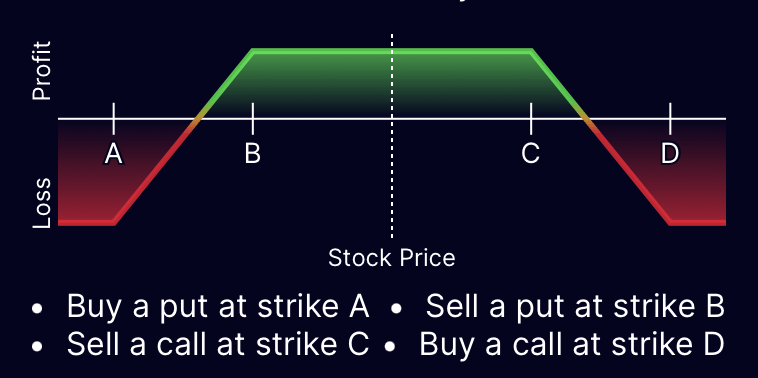

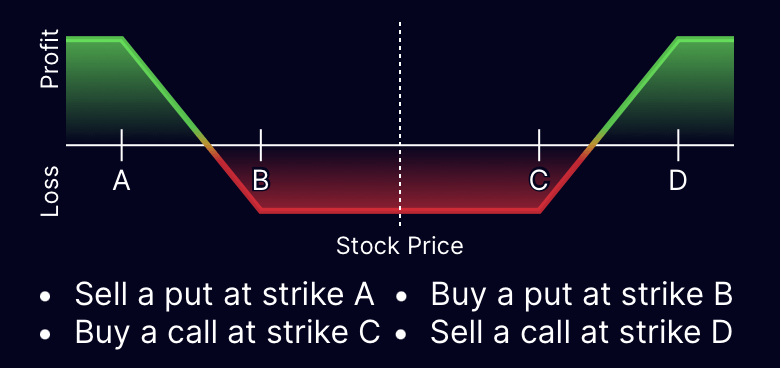

Iron Condor

Objective: Neutral

Profit Potential: Limited

Loss Potential: Limited

Description: An iron condor, a neutral strategy, yields profit when the stock stays between the inner strikes B and C. It offers a wider profitable range compared to an iron butterfly, albeit with lower potential profit. Similar to other neutral strategies, volatility changes and time decay significantly impact profitability.

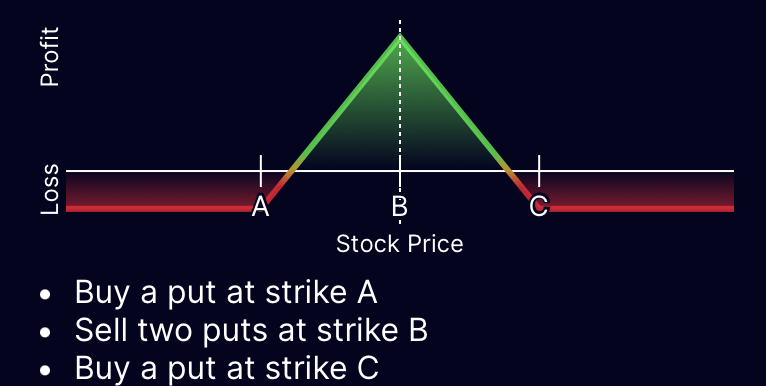

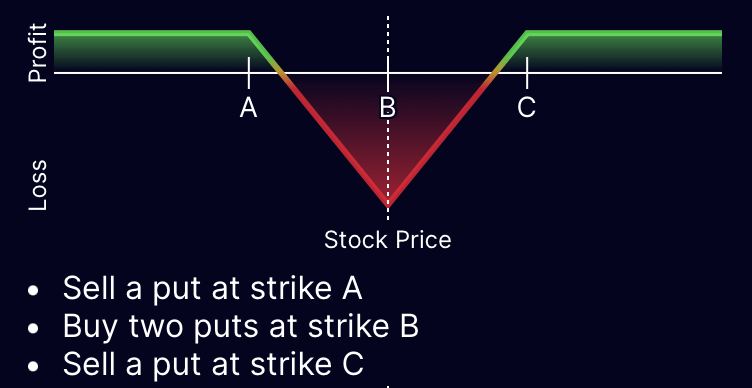

Long Put Butterfly

Objective: Neutral

Profit Potential: Limited

Loss Potential: Limited

Description: A neutral strategy, the long put butterfly, combines a bull put spread and a bear put spread. It is cost-effective and offers a favorable risk/reward ratio. Profitable regions expand with decreasing volatility, while increasing volatility narrows them. Time assists during profitable periods but hampers unprofitable ones.

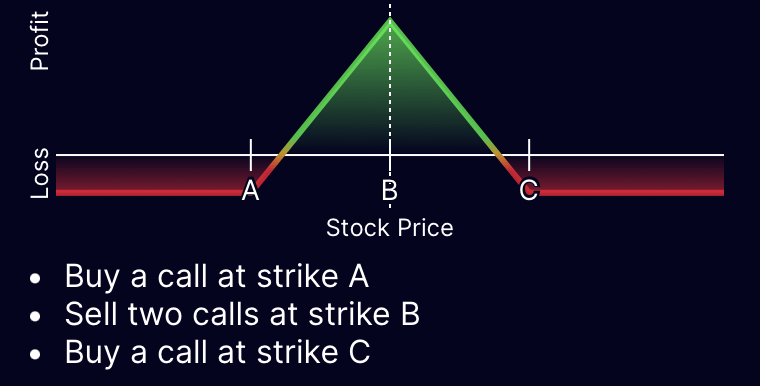

Long Call Butterfly

Objective: Neutral

Profit Potential: Limited

Loss Potential: Limited

Description: A neutral strategy, the long call butterfly, is composed of a bull call spread and a bear call spread. It is budget-friendly and offers an attractive risk/reward ratio. Profitable regions expand with decreasing volatility, while increasing volatility narrows them. Time aids profitability and impedes unprofitable periods.

➤ Directional:

Inverse Iron Butterfly

- Objective: Directional

- Profit Potential: Limited

- Loss Potential: Limited

- Description: The inverse of an iron butterfly, this strategy involves a net debit. Unlike the long butterfly, it offers a less favorable risk/reward ratio. Small profits are possible if the stock moves in either direction. As volatility increases, the profitable range and chances of profit expand. While time harms unprofitable positions, it becomes beneficial once profitability is achieved.

Inverse Iron Condor

- Objective: Directional

- Profit Potential: Limited

- Loss Potential: Limited

- Description: The opposite of an iron condor and similar to a short iron butterfly, this strategy has a wider unprofitable range and improved potential profit. Increased volatility leads to an expanded profitable range and greater chances of profit. Time detrimentally affects unprofitable positions but aids profitable ones.

Short Put Butterfly

- Objective: Directional

- Profit Potential: Limited

- Loss Potential: Limited

- Description: This volatility strategy profits from significant moves in either direction. It contrasts with the long put butterfly. Profitability depends on increased volatility or substantial stock movement. Time negatively affects unprofitable phases but is beneficial during profitable periods.

Short Call Butterfly

- Objective: Directional

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Similar to the short put butterfly, this strategy seeks profit from substantial moves in either direction. It is the opposite of the long call butterfly. Increased volatility or significant stock movement is necessary for profitability. Time harms unprofitable phases but benefits profitable ones.

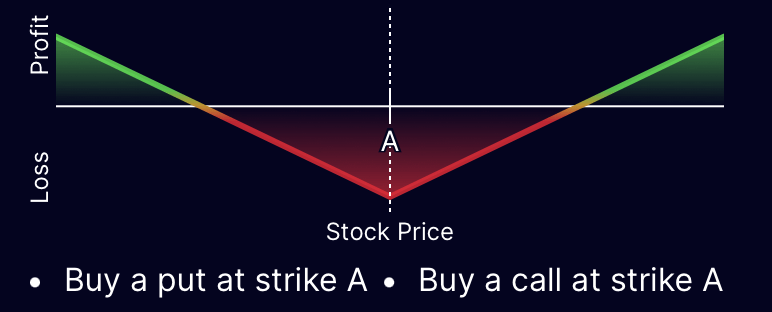

Straddle

- Objective: Directional

- Profit Potential: Unlimited

- Loss Potential: Limited

- Description: The straddle is a volatility strategy allowing profit from moves in either direction. This approach involves buying both a call and a put, making it relatively expensive and requiring substantial movement to cover costs. Time adversely affects this strategy due to its reliance on long options, but volatility works in its favor. Straddles can be employed pre-earnings to capitalize on significant post-earnings moves (bearing in mind IV crush) or ahead of rising IV.

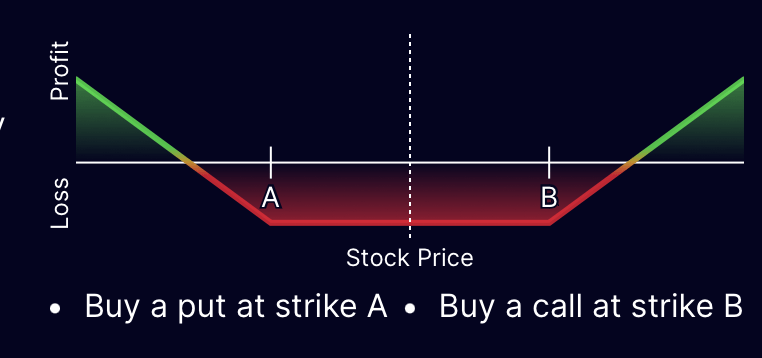

Strangle

- Objective: Directional

- Profit Potential: Unlimited

- Loss Potential: Limited

- Description: A variation of the straddle, the strangle uses out-of-the-money options at different strikes. This strategy is cheaper than a straddle but necessitates larger price movements for profit. Similar to the straddle, time is detrimental due to the long options, while volatility supports profitability.

➤ Calendar Spreads:

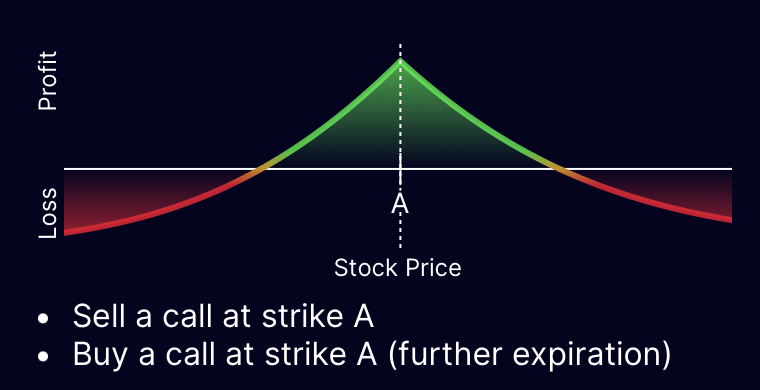

Calendar Call Spread

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Limited

- Description: This neutral to mildly bearish/bullish strategy employs two calls of the same strike with different expiration dates. If the stock is near strike A when the earlier call expires, it can be closed for profit. Using an at-the-money strike makes the strategy neutral, while slightly out-of-the-money or in-the-money strikes introduce a bullish or bearish bias.

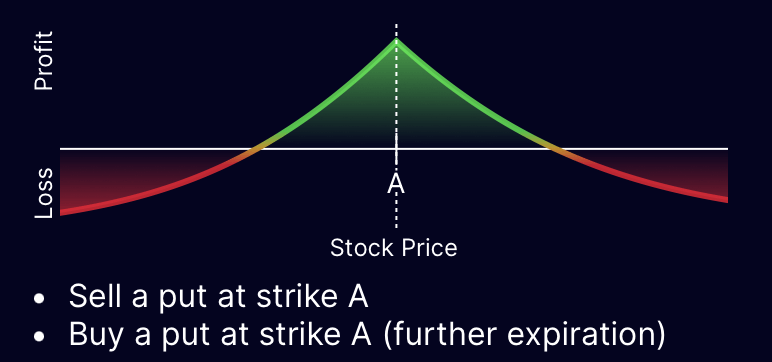

Calendar Put Spread

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Similar to the calendar call spread, this strategy utilizes two puts of the same strike but different expiration dates. If the stock is near strike A when the earlier put expires, it can be closed for profit. The choice of an at-the-money strike establishes neutrality, while slightly out-of-the-money or in-the-money strikes create bullish or bearish leanings.

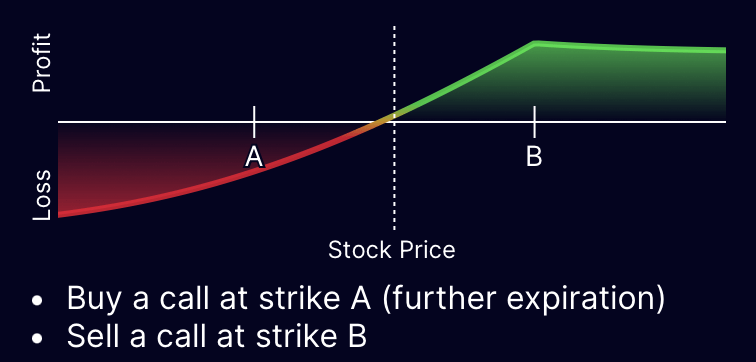

Diagonal Call Spread

- Objective: Bullish

- Profit Potential: Limited

- Loss Potential: Limited

- Description: A variation of the calendar spread, the diagonal call spread incorporates a long call with a later expiration that is further in the money. This modification alters the risk profile. Sometimes referred to as a “Poor Man’s Covered Call,” it involves buying a call at strike A with an extended expiration and selling a call at strike B.

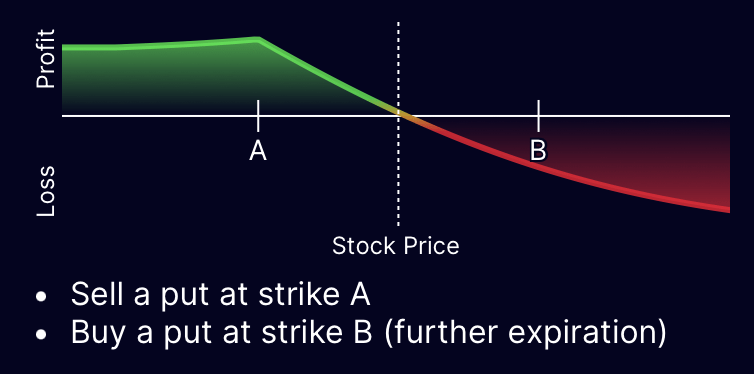

Diagonal Put Spread

- Objective: Bearish

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Another variant of the calendar spread, the diagonal put spread integrates a long put with a later expiration that is further in the money. This adjustment changes the risk profile. It involves selling a put at strike A and buying a put at strike B with an extended expiration.

➤ Other:

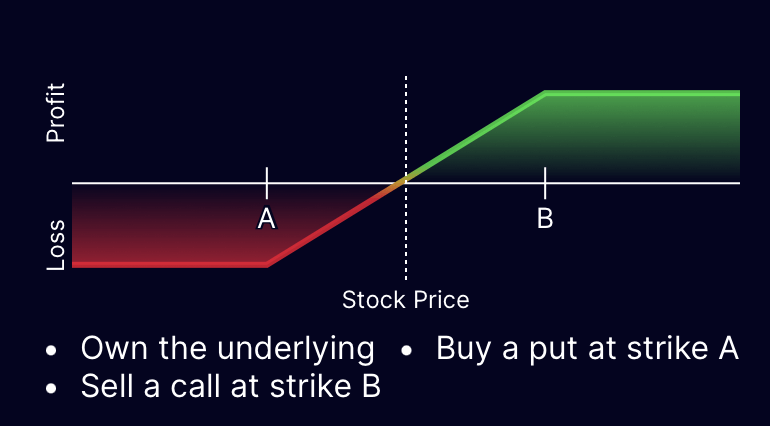

Collar (Risk-reversal)

- Objective: Bullish with risk management

- Profit Potential: Limited

- Loss Potential: Limited

- Description: A strategy for those somewhat bullish but apprehensive about a stock, owning 100 of the underlying shares. It combines elements of a covered call and a protective put. This approach shields against the stock falling beyond strike A while limiting upside by selling the stock if it reaches strike B. It can be likened to a protective put, where the credit from the short call offsets stop-loss insurance costs. The trade-off is a capped profit potential.

➤ Advanced

➤ Naked Strategies:

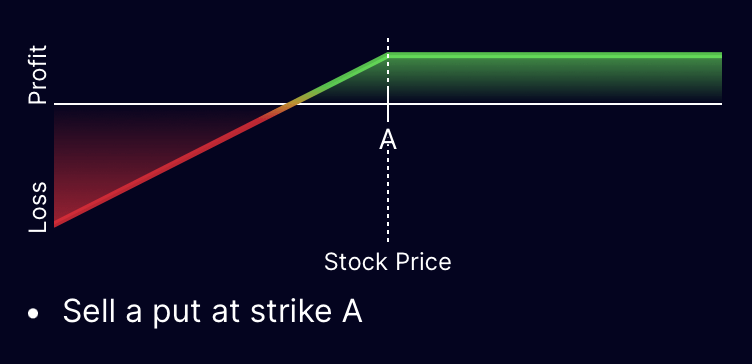

Short Put

- Objective: Bullish

- Profit Potential: Limited (initial credit)

- Loss Potential: Nearly Unlimited

- Description: This straightforward yet risky strategy involves selling a put, resulting in an initial credit. If assigned, you must buy 100 shares of the underlying stock at strike price A. This strategy necessitates a willingness to purchase the stock at that price. If it expires above strike A, you keep the full credit.

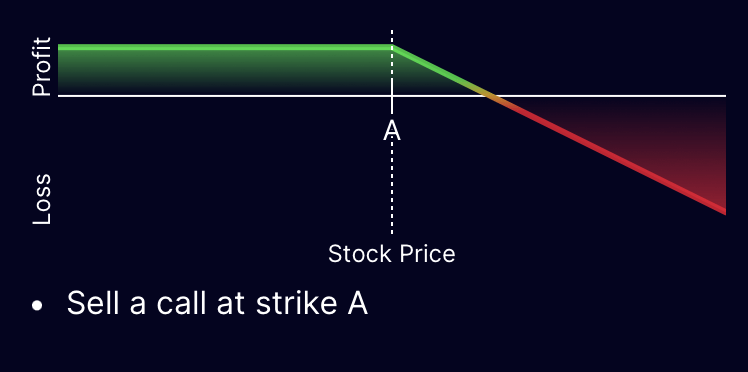

Short Call

- Objective: Bearish

- Profit Potential: Limited (initial credit)

- Loss Potential: Unlimited

- Description: Similar to a short put, this risky strategy entails selling a call, leading to an initial credit. If assigned, you must sell 100 shares of the underlying stock at strike price A. Cash or stock to cover this obligation is necessary. If it expires below strike A, you retain the full credit.

➤ Income Strategies:

Covered Short Straddle

- Objective: Bullish

- Profit Potential: Limited (income)

- Loss Potential: Nearly Unlimited

- Description: A high-risk income strategy that boosts the yield of a covered call by selling an uncovered put for additional income. The put introduces significant risk, and if the stock drops significantly, losses can be substantial. This strategy involves a short put and call, one of which will likely be exercised unless the price is at strike A at expiration.

Covered Short Strangle

- Objective: Bullish

- Profit Potential: Limited (income)

- Loss Potential: Nearly Unlimited

- Description: Another risky income strategy enhancing a covered call’s yield by selling an out-of-the-money put for extra income. It resembles a covered straddle but with lower risk. The put’s exercise and the call’s exercise occur if the stock falls below strike A and rises above strike B, respectively.

➤ Neutral Strategies:

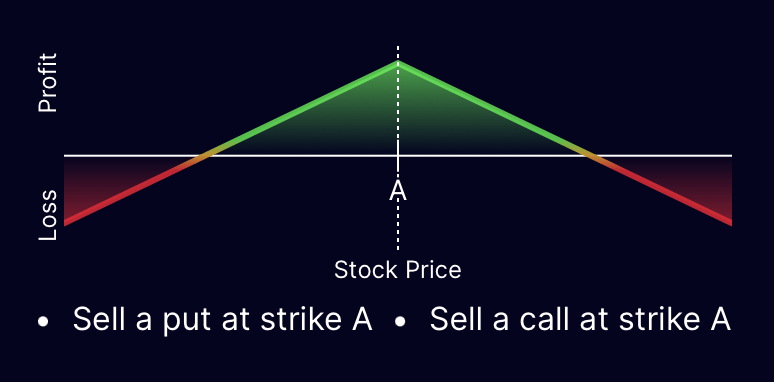

Short Straddle

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Unlimited

- Description: The converse of a long straddle, this strategy involves selling both a put and a call. Although it generates income, it requires minimal stock movement. The maximum loss is uncapped in both directions. Time decay is advantageous, but the unlimited risk demands careful management.

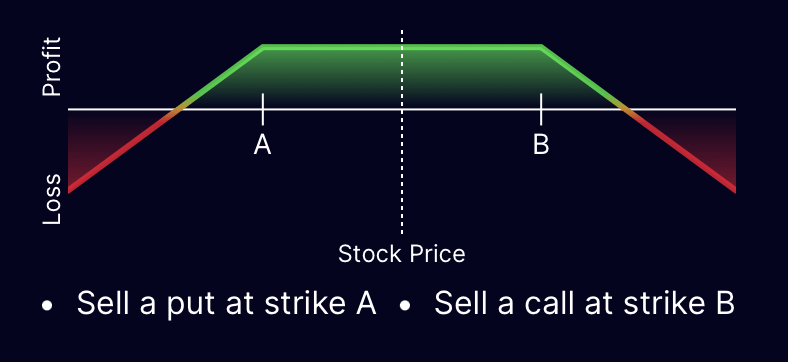

Short Strangle

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Unlimited

- Description: This strategy, similar to a short straddle, sells a put and a call, but with differing strikes. Although it generates less income than a short straddle, its wider profitable range reduces the worst-case scenario likelihood. Time decay is beneficial, but unlimited risk requires vigilance.

Long Call Condor

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Resembling a long call butterfly, this strategy employs different middle option strikes, creating a broader profitable range. Compared to a long call butterfly, it offers lower potential profit and higher maximum loss. It involves buying a call at strike A, selling a call at strike B, selling another call at strike C, and buying a call at strike D.

Long Put Condor

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Limited

- Description: This strategy, resembling a long put butterfly, utilizes varying middle option strikes to expand the profitable range. Like the long call condor, it presents lower potential profit and higher maximum loss. The strategy includes buying a put at strike A, selling a put at strike B, selling another put at strike C, and buying a put at strike D.

➤ Directional Strategies:

➤ Ladders

Short Call Condor

- Objective: Directional

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Similar to a short call butterfly, this strategy involves different middle option strikes. It possesses a broader unprofitable range compared to a short call butterfly, but offers higher potential profit outside that range and a lower maximum loss.

- Trade Setup:

- Sell a call at strike A

- Buy a call at strike B

- Buy a call at strike C

- Sell a call at strike D

Short Put Condor

- Objective: Directional

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Similar to a short put butterfly, this strategy features varying middle option strikes. It has a wider unprofitable range than a short put butterfly, but offers higher potential profit outside that range and a lower maximum loss.

- Trade Setup:

- Sell a put at strike A

- Buy a put at strike B

- Buy a put at strike C

- Sell a put at strike D

Bull Call Ladder

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Unlimited

- Description: An extension of the bull call spread with an additional short call. While it increases the maximum profit potential, it introduces unlimited risk. Despite its name, it’s actually neutral to slightly bullish, with uncapped loss potential if a significant upward move occurs.

- Trade Setup:

- Buy a call at strike A

- Sell a call at strike B

- Sell a call at strike C

Bear Call Ladder

- Objective: Directional

- Profit Potential: Unlimited

- Loss Potential: Limited

- Description: An extension of the bear call spread with an extra long call. Though it seems bearish, it can be bearish or very bullish, with a capped gain on the downside and infinite gain on the upside.

- Trade Setup:

- Sell a call at strike A

- Buy a call at strike B

- Buy a call at strike C

Bull Put Ladder

- Objective: Directional

- Profit Potential: Nearly Unlimited

- Loss Potential: Limited

- Description: An extension of the bull put spread with another long put. Despite its name, it’s actually very bearish or bullish, offering nearly infinite gain on the downside and a capped gain on the upside.

- Trade Setup:

- Buy a put at strike A

- Buy a put at strike B

- Sell a put at strike C

Bear Put Ladder

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Nearly Unlimited

- Description: An extension of the bear put spread with an additional short put. Despite its name, it’s actually neutral to slightly bearish, with nearly uncapped loss potential on the downside.

- Trade Setup:

- Sell a put at strike A

- Sell a put at strike B

- Buy a put at strike C

➤ Ratio Spreads

Call Ratio Backspread

- Objective: Bullish

- Profit Potential: Unlimited

- Loss Potential: Limited

- Description: An extremely bullish strategy that aims for substantial profits during significant upward stock movement. It may result in a loss if the stock only moves slightly. If established with a net credit and the stock declines, a small profit can still be achieved. Increasing volatility is advantageous, while time decay is generally harmful.

- Trade Setup:

- Sell a call at strike A

- Buy two calls at strike B

Put Broken Wing (Skip Strike Butterfly)

- Objective: Bullish

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Similar to a put butterfly spread, this strategy has a slight bullish bias. It has an increased chance of profit and reduces risk on one side. Time decay is generally harmful, except when it becomes profitable near strike B.

- Trade Setup:

- Buy a put at strike A

- Sell two puts at strike B

- Buy a put at strike C

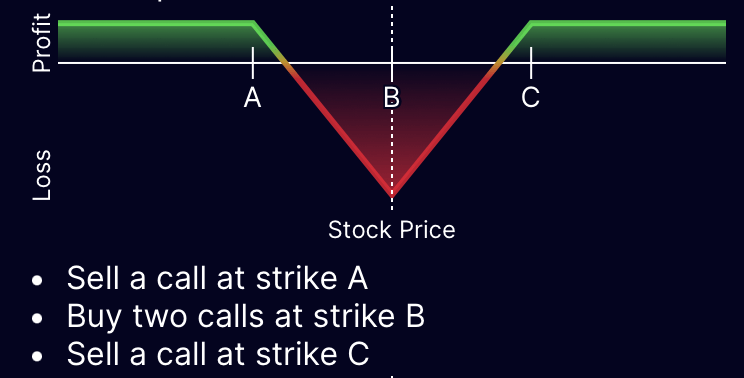

Inverse Call Broken Wing (Inverse Skip Strike Butterfly)

- Objective: Bullish

- Profit Potential: Limited

- Loss Potential: Limited

- Description: The opposite of a call broken wing and similar to a short call butterfly. It has a bullish bias and a lower chance of profit compared to a butterfly, but offers a higher maximum profit.

- Trade Setup:

- Sell a call at strike A

- Buy two calls at strike B

- Sell a call at strike C

Put Ratio Backspread

- Objective: Bearish

- Profit Potential: Unlimited

- Loss Potential: Limited

- Description: The opposite of a call ratio backspread. An extremely bearish strategy that aims for significant profits during substantial downward stock movement. It may result in a loss if the stock only moves slightly. If established with a net credit and the stock rises, a small profit can still be made. Increasing volatility is beneficial, while time decay is generally harmful.

- Trade Setup:

- Buy two puts at strike A

- Sell a put at strike B

Call Broken Wing (Skip Strike Butterfly)

- Objective: Bearish

- Profit Potential: Limited

- Loss Potential: Limited

- Description: Similar to a call butterfly spread, this strategy has a slight bearish bias. It has an increased chance of profit and reduces risk on one side. Time decay is generally harmful, except when it becomes profitable near strike B.

- Trade Setup:

- Buy a call at strike A

- Sell two calls at strike B

- Buy a call at strike C

Inverse Put Broken Wing (Inverse Skip Strike Butterfly)

- Objective: Bearish

- Profit Potential: Limited

- Loss Potential: Limited

- Description: The opposite of a put broken wing and similar to a short put butterfly. It has a bearish bias and a lower chance of profit compared to a butterfly, but offers a higher maximum profit.

- Trade Setup:

- Sell a put at strike A

- Buy two puts at strike B

- Sell a put at strike C

Jade Lizard

- Objective: Bullish

- Profit Potential: Limited

- Loss Potential: Nearly Unlimited

- Description: A slightly bullish strategy that combines an out-of-the-money short put and an out-of-the-money bear call spread. When executed correctly, this strategy has no upside risk. It is most suitable for oversold stocks with high implied volatility.

- Trade Setup:

- Sell a put at strike A

- Sell a call at strike B

- Buy a call at strike C

Reverse Jade Lizard

- Objective: Bearish

- Profit Potential: Limited

- Loss Potential: Unlimited

- Description: A slightly bearish strategy that combines an out-of-the-money short call and an out-of-the-money bull put spread. When executed properly, this strategy has no downside risk. It is best suited for overbought stocks with high implied volatility.

- Trade Setup:

- Sell a call at strike A

- Buy a put at strike B

- Sell a put at strike C

➤ Expert

➤ Ratio Spreads

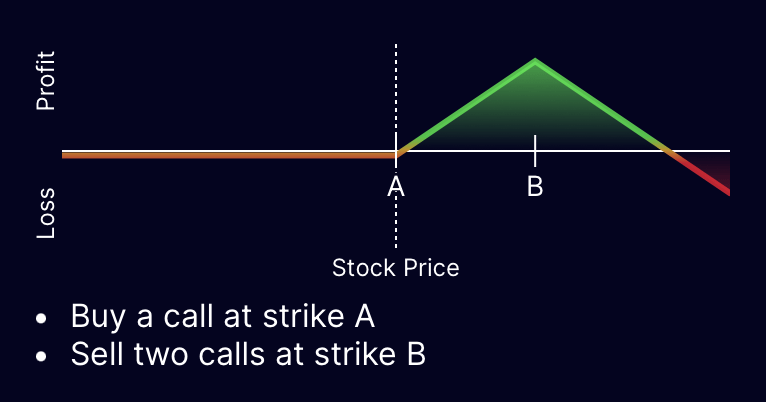

Call Ratio Spread

- Objective: Bullish

- Profit Potential: Limited

- Loss Potential: Unlimited

- Description: The opposite of a call ratio backspread. A neutral to slightly bullish strategy with unlimited risk if the stock moves up significantly. Time is helpful to this strategy (though not for extended periods), but increasing volatility is detrimental.

- Trade Setup:

- Buy a call at strike A

- Sell two calls at strike B

Put Ratio Spread

- Objective: Bearish

- Profit Potential: Limited

- Loss Potential: Nearly Unlimited

- Description: The opposite of a put ratio backspread. A neutral to slightly bearish strategy with unlimited risk if the stock moves down significantly. Time is helpful to this strategy (though not for extended periods), but increasing volatility is detrimental.

- Trade Setup:

- Sell two puts at strike A

- Buy a put at strike B

Synthetic

Long Synthetic Future

- Objective: Bullish

- Profit Potential: Unlimited

- Loss Potential: Nearly Unlimited

- Description: This strategy replicates the risk profile of a long stock position by buying an at-the-money call and selling an at-the-money put. It is often established with a very small credit or debit, offering a “no cost” alternative to stock ownership and providing leverage without an initial cost.

- Trade Setup:

- Sell a put at strike A

- Buy a call at strike A

Short Synthetic Future

- Objective: Bearish

- Profit Potential: Nearly Unlimited

- Loss Potential: Unlimited

- Description: This strategy replicates the risk profile of a short stock position by selling an at-the-money call and buying an at-the-money put. It is usually established with a very small credit or debit.

- Trade Setup:

- Buy a put at strike A

- Sell a call at strike A

Synthetic Put

- Objective: Bearish

- Profit Potential: Nearly Unlimited

- Loss Potential: Limited

- Description: A bearish strategy used to replicate the profit potential of a put using a call and shorting the underlying stock. The call will protect the short position from significant losses if the stock moves upwards. (also known as: Protective Call)

- Trade Setup:

- Short the underlying

- Buy a call at strike A

➤ Arbitrage

Long Combo

- Objective: Bullish

- Profit Potential: Unlimited

- Loss Potential: Nearly Unlimited

- Description: Similar to a long synthetic future, but with a gap between strikes. This trade yields no return or loss between the strikes at expiration, gaining or losing only if the stock goes below strike A or above strike B. Closer to expiration, it behaves like a synthetic future.

- Trade Setup:

- Sell a put at strike A

- Buy a call at strike B

Short Combo

- Objective: Bearish

- Profit Potential: Nearly Unlimited

- Loss Potential: Unlimited

- Description: Similar to a short synthetic future, but with a gap between strikes. This trade yields no return or loss between the strikes at expiration, gaining or losing only if the stock goes below strike A or above strike B. Closer to expiration, it behaves like a short synthetic future.

- Trade Setup:

- Buy a put at strike A

- Sell a call at strike B

➤ Other

Strip

- Objective: Bearish

- Profit Potential: Directional

- Loss Potential: Unlimited

- Description: Similar to a straddle, but more bearish, involving the purchase of double the amount of puts. Profit is realized if the stock moves, particularly downwards.

- Trade Setup:

- Buy a call at strike A

- Buy two puts at strike A

Strap

- Objective: Bullish

- Profit Potential: Directional

- Loss Potential: Unlimited

- Description: Similar to a straddle, but more bullish, involving the purchase of double the amount of calls. Profit is realized if the stock moves, particularly upwards.

- Trade Setup:

- Buy two calls at strike A

- Buy a put at strike A

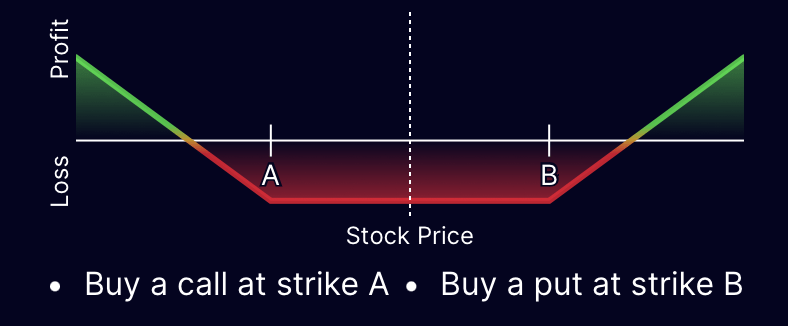

Guts

- Objective: Directional

- Profit Potential: Unlimited

- Loss Potential: Limited

- Description: Similar to a strangle in terms of maximum profit, maximum risk, and chance of profit, but more expensive as the put and call positions are reversed. Generally, there is little reason to trade a guts over a strangle. (A strangle usually has more liquid options as they are out-of-the-money, whereas guts uses in-the-money options.)

- Trade Setup:

- Buy a call at strike A

- Buy a put at strike B

Short Guts

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Unlimited

- Description: The opposite of guts, similar to a short straddle.

- Trade Setup:

- Sell a call at strike A

- Sell a put at strike B

Double Diagonal

- Objective: Neutral

- Profit Potential: Limited

- Loss Potential: Limited

- Description: A combination of a diagonal call spread and a diagonal put spread. Can be thought of as an iron condor stretched across two expirations. The profitability range widens as time passes.