Online trading is hard. Searching for the best trading platforms is even harder. Here at thoughts.money, we do the hard work, so you don’t have to.

We make it fast, easy, and secure for you — and all our readers — to enter the fascinating world of online trading. If you are searching for the best trading platforms in 2023, you’ve come to the right place. Without further ado, let’s dive right in.

What you'll learn:

⓵ What’s an online trading platform?

Every trader or investor nowadays uses an online trading platform to speculate or invest in the financial markets. Long gone are the days where you needed to actually visit a stock exchange or call a stockbroker to place a trade for you.

Today, with the click of a button you can place the best trades anytime, anywhere. The global financial markets are within arm’s reach. Almost anybody can gain access to online trading through a stock trading platform.

⓶ How to choose the best online broker

To find the best online broker you’ll first need to understand the trading conditions they offer. Then you’ll be able to choose the one that best suits your exact needs and goals.

Here are the basic questions you need to answer when searching for the best online broker. And these are the exact questions we seek to answer in this guide where we review the best online trading platforms.

❖ Is your online broker regulated?

Regulation is the number one thing we check when reviewing an online broker. And this is what you should do too. Unregulated brokers can — and sometimes do — run away with your money.

❖ How many trading platforms do they offer?

Most legitimate brokers offer several options when it comes to online trading platforms. The ones that make it in the top of our list usually offer web, desktop, and mobile versions of their platform.

This is ideal so you can trade on the go, use advanced features, apply different strategies, create alerts, and much more.

❖ Are the fees & commissions low?

To maximize your returns, you need to identify brokers who offer low or no commissions at all. This will make it easier for you to grow your wealth as you get to keep most of your profits instead of spending it away in fees and commissions.

❖ What’s the maximum leverage?

Leverage is the ratio with which you trade when on margin. Most regulated traders offer 1:30 leverage for retail clients and 1:400 for professional clients. There are certain criteria that you need to meet to apply for different client categorization.

However, we advise our readers to be extremely cautious when using leveraged products as you can end up losing your entire capital.

❖ How many tradable assets can you trade?

The more financial instruments you can trade, the more opportunities you can find. Most brokers recommended here at thoughts.money offer thousands of tradable assets including Stocks, Forex, Crypto, Indices, Funds, Bonds, Futures, and Commodities.

❖ What’s the minimum deposit?

As a beginner you might want to start with a broker that offers a low minimum deposit. Then, once you gain experience you can choose to deposit more.

The brokers we recommend usually accept clients with as low as $10. However, you shouldn’t expect to grow your portfolio to a meaningful level with just $10. It usually takes a lot more.

❖ Do they offer demo & educational material?

Free educational material should come with a free demo account so that new clients can get familiar with the trading platforms, test their strategies, and improve their skills. We only recommend brokers who offer free demo accounts to all their clients.

Demo (paper) accounts usually come with virtual funds up to $100,000 so you can practice without risking your own funds.

❖ What are the funding options?

You should be able to make deposits and withdrawals effortlessly. Trusted brokers in 2023 offer a broad range of payment methods including bank/wire transfers, eWallet (Neteller, Skrill, UnionPay, FasaPay, PayPal), Klarna as well as Credit/Debit cards.

Choose the one that suits you best but remember that you can only withdraw to the original funding account.

⓷ How to start trading with the best online trading platform

Getting started is as easy as 1,2,3. Simply follow the 3 steps below and you’ll be trading in no time. But make sure you understand the risks involved first.

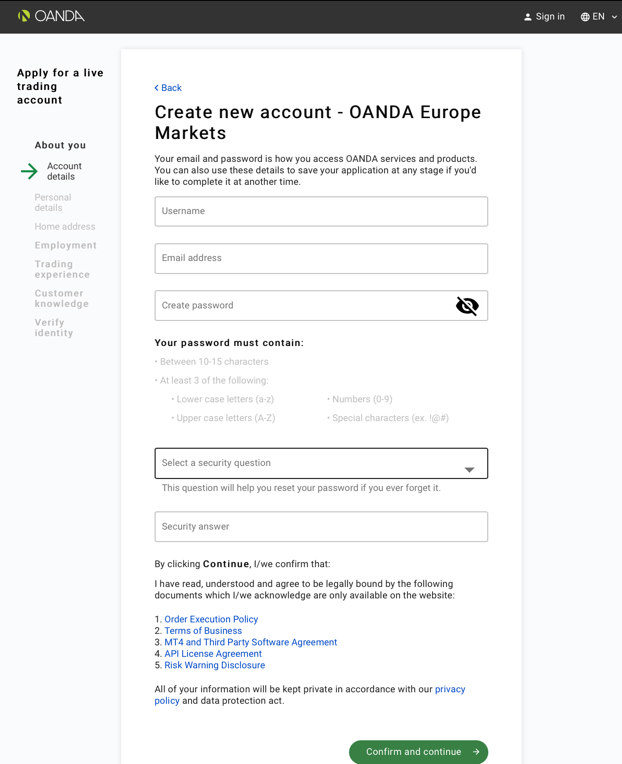

❖ Step 1: Open & verify your account

Opening an account is a simple process as you can see below. You can simply click on the “open an account” button which is usually located at the top right corner of a broker’s website.

Then you’ll need to fill out the registration form and verify your account by answering questions related to “Know Your Client” (KYC).

❖ Step 2: Make a deposit

You can add funds now or at a later stage, but funded accounts get approved much faster. You can start by adding the minimum initial deposit required and add more when and if you wish.

❖ Step 3: Start trading

At this stage you are all set and ready to trade. You can choose from web, desktop, or mobile platforms.

⓸ How to place the best trades in 2023

Thoughts.money is on a mission to help traders and investors around the world succeed. These are some easy tips that you can follow before risking your money.

❖ Practice on a demo account

A demo account allows you to learn the basics. From selecting an instrument and placing a trade to setting a take-profit and using indicators. It also allows you to test different trading strategies so you can stick to the one that works for you before risking your own funds.

❖ Read the free educational material

By reading all the educational material you can get your hands on, you’ll boost your knowledge and gain confidence in your trading skills. This should be combined with a free demo account so you can apply what you learn.

❖ Minimize your risk & maximize your profit

Every trader should choose a broker that offers competitive pricing. This will help you minimize your risk and maximize your profit as you’ll get to keep a larger percentage of your gains instead of paying it back to the broker in fees.

⓹ The top 8 free trading platforms in 2023

If you are searching for a regulated broker with optimal trading conditions for efficient online trading, then look no further. We’ve done the hard work for you so you can focus on what matters — trading.

❖ Oanda: The best trading platform for low spreads

Oanda is a regulated global broker — established in 1996 — with offices in Asia, Europe, and North America.

Also, Oanda offers a wide range of financial assets, award-winning trading platforms, advanced trading tools, competitive pricing, excellent order execution, and customer support teams across the world.

As always, we warn our readers that trading leveraged products is risky and you may end up losing all your capital due to leverage. 78.3% of retail investor accounts lose money when trading with Oanda as shown below (the % changes from time to time so check Oanda’s website first).

◆ Is Oanda regulated?

Oanda holds several licenses and is regulated in several jurisdictions including:

- NFA (US)

- FCA (UK)

- ASIC (Australia)

- MAS (Singapore)

- IIROC (Canada)

- MFSA (Malta)

- BVI (British Virgin Islands)

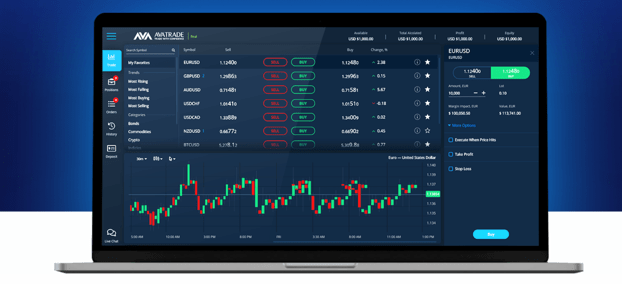

◆ How many trading platforms does Oanda offer?

You can choose between several trading platforms on Oanda to place your trades — or copy others — whether on web, desktop, or mobile including:

- Oanda Trade Web

- Oanda Trade Desktop

- MetaTrader 4 (MT4)

- Mobile App

◆ Are Oanda fees & commissions low?

Spreads on Oanda start from just 0.8 pips. This is in line with the competition, although it fluctuates depending on the underlying asset. There is also an inactivity fee after 12 months ($10/month).

◆ What’s the maximum leverage on Oanda?

Retail clients can use flexible leverage up to 1:30 whereas professional clients can boost their trades with 1:400 leverage.

◆ How many tradable assets can you trade with Oanda?

You can trade or invest in more than 100 financial instruments including:

- FX

- Crypto

- Bonds

- Indices

- Commodities

◆ What’s Oanda’s minimum deposit?

Oanda allows all traders and investors to open an account without any minimum initial deposit. This attracts a lot of beginner traders who don’t want to risk losing a large sum of money. Also, there is no withdrawal fee.

And most deposit and withdrawal requests are fulfilled instantly (eWallet, debit/credit card). Bank transfers take 2-3 days though.

◆ Does Oanda offer demo & educational material?

If you want to test your strategies or get familiar with Oanda’s trading platforms you can do that with a demo account that comes with $100,000 virtual funds. You can also learn about online trading and improve your skills through the educational material offered on Oanda’s website.

◆ What are Oanda’s funding options?

You can make a deposit on Oanda via:

- Bank/wire transfer

- eWallet (Neteller, Skrill)

- Credit/Debit card

❖ AvaTrade: The best overall trading platform

AvaTrade has been pioneering online trading since 2006 and is committed to empowering over 300,000 traders and investors around the world.

Also, AvaTrade offers a secure and optimal trading environment supported by first-class customer support and a plethora of tradable assets including Forex, Stocks, Indices, and more.

Trading CFDs is risky. 71% of retail investor accounts lose money when trading CFDs with AvaTrade as shown in the disclaimer below.

◆ Is AvaTrade regulated?

AvaTrade is considered one of the most secure brokers in the industry and is regulated by:

- PFSA (Poland)

- ASIC (Australia)

- FFAJ (Japan)

- FSRA (UAE)

- CySEC (Cyprus)

- FSCA (South Africa)

- ISA (Israel)

◆ How many trading platforms does AvaTrade offer?

Both retail and institutional clients can choose from a wide variety of trading platforms including:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- Web Trader

- AvaTradeGO

- AvaOptions

- DupliTrade (copy trading)

- ZuluTrade (social trading)

◆ Are AvaTrade fees & commissions low?

AvaTrade’s pricing is very competitive with spreads starting at 0.9 pips. There is no withdrawal fee but there is an inactivity fee after 3 months which is on the high end ($50/3 months).

◆ What’s the maximum leverage on AvaTrade?

As with most regulated brokers, AvaTrade offers flexible leverage up to 1:30 for retail traders and up to 1:400 for professional clients. You can request to change your client categorization (if you meet certain criteria) through AvaTrade’s website.

◆ How many tradable assets can you trade with AvaTrade?

As a trader you want to have access to an ever-expanding number of assets. AvaTrade offers more than 1,250 underlying assets including:

- FX

- Stocks

- Crypto

- Indices

- Commodities

◆ What Is AvaTrade’s minimum deposit?

You can start trading with just $100 on AvaTrade. However, it takes a while to deposit or withdraw. 1-2 days for eWallet and debit/credit card and 5-7 days for bank transfers.

This is slightly higher than the rest of the competition as most brokers offer instant deposits when using an eWallet or your debit/credit card.

◆ Does AvaTrade offer demo & educational material?

AvaTrade offers free educational material so you can learn and improve your trading skills before you risk your money. They also offer a free demo (paper) account with $100,000 virtual funds so that you can apply what you learn before switching to live trading.

◆ What are AvaTrade’s funding options?

You can fund your AvaTrade account via:

- Bank/wire transfer

- eWallet (Neteller, Skrill)

- Credit/Debit card

❖ FXCM: The best platform for trading CFDs & FX

FXCM is an award-winning broker serving both retail and institutional clients since 1999. FXCM’s mission is to provide traders and investors — of every level — with access to the global markets.

And FXCM does — exactly — that by offering intuitive and easy-to-use trading tools, informative educational material, friendly and knowledgeable round-the-clock customer support, competitive pricing, and low ($50) minimum deposit.

63% of retail investor accounts lose money when trading with FXCM. We always caution our readers to make sure they understand the risks involved in online trading before making a deposit and risking their money.

◆ Is FXCM regulated?

FXCM complies to the stringiest regulations including:

- FCA (UK)

- CySEC (Cyprus)

- ASIC (Australia)

- FSCA (South Africa)

- ISA (Israel)

- IIROC (Canada)

◆ How many trading platforms does FXCM offer?

There are many trading platforms that you can use on FXCM:

- Trading Station

- TradingView

- Capitalise AI (automated trading)

- MT4 (most popular)

- ZuluTrade (social copy trading)

- NinjaTrader (advanced charting tools)

◆ Are FXCM fees & commissions low?

FXCM spreads start at 1.3 pips which is on the high end of the brokers in our list. However, the inactivity fee (after 12 months, $50/year) is considered one of the lowest in our comparison.

Even though there is no withdrawal fee for most payment methods, you’ll need to pay $40 for bank transfers.

◆ What’s the maximum leverage on FXCM?

Just like most brokers mentioned in this comparison, FXCM allows retail clients to trade with a 1:30 maximum leverage whereas professional clients can power their trades with a much higher leverage (1:400).

◆ How many tradable ssets can you trade with FXCM?

You can trade 300+ CFDs on:

- FX

- Stocks

- Crypto

- Indices

- Commodities

◆ What’s FXCM’s minimum deposit?

If you are a new trader and you don’t want to risk more than $50 then FXCM might be a good broker for you. And with instant deposits — for most payment methods — you’ll be set and ready to trade in no time (unless you choose the bank transfer option that takes 3-5 days).

◆ Does FXCM offer demo & educational material?

FXCM offers a wide range of free educational material — of all levels — designed to help you get started the right way. You can choose to join live webinars, watch informational videos, and learn from other successful traders.

You can apply what you learn on a demo account first ($20,000 virtual funds) and once you feel confident about your trading skills you can then switch to live trading.

◆ What are FXCM’s funding options?

You can make a deposit via:

- Bank/wire transfer

- eWallet (Neteller, Skrill)

- Credit/Debit card

❖ eToro: Award-winning platform for social trading

eToro was the first online broker who offered social copy trading. Since its inception back in 2007, eToro has been innovating and transforming the online trading world.

In a relatively short period of time, eToro managed to expand its offering to more than 3,000 tradable financial instruments. From Stocks and Forex to ETFs and Crypto, eToro’s got you covered.

Before you open an account with eToro make sure you understand the risks involved with CFD trading and leveraged products. As of this writing, 68% of retail investor accounts lose money when trading with eToro.

◆ Is eToro regulated?

You can rest assured that eToro is a secure online broker as they are authorized and licensed by several top-tier regulators including:

- FCA (UK)

- CySEC (Cyprus)

- ASIC (Australia)

- GFSC (Gibraltar)

- FinCen and FINRA (US)

◆ How many trading platforms does eToro offer?

eToro allows traders to copy other traders as well as manage their portfolio anytime, anywhere, through their two trading platforms:

- Web Trader

- eToro App

◆ Are eToro fees & commissions low?

The spreads on eToro start from just 1 pip. There is no withdrawal fee but there is an inactivity fee after 12 months ($10/month).

◆ What’s the maximum leverage on eToro?

If you are a professional client, you can power your trades with leverage up to 1:400. If you are a retail client however, you’ll have access to flexible leverage up to 1:30.

◆ How many tradable assets can you trade with eToro?

On eToro you can trade CFDs on more than 2,000 underlying assets including:

- FX

- Stocks

- Crypto

- Indices

- Commodities

◆ What’s eToro’s minimum deposit?

The minimum deposit on eToro is just $10 but ranges depending on your region. So, make sure you check before opening an account as it can range from $10 – $10,000. All deposits are processed instantly except the bank transfers that can take 4-7 days.

◆ Does eToro offer demo & educational material?

You can take advantage of all the free educational material on Etoro’s website to boost your online trading learning. Then, you can apply your learning on eToro’s demo account that comes with $100,000 virtual funds before risking your real money.

◆ What are eToro’s funding options?

You are free to choose between:

- Bank/wire transfer

- eWallet (Neteller, Skrill)

- Credit/Debit card

❖ Interactive Brokers (IBKR): The best online trading platform for pros

Interactive Brokers (IBKR) is the top choice for seasoned pros when it comes to online trading and investing.

IBKR was established in 1977 and until today its mission remains unchanged — to provide liquidity on better terms, better price, better speed, better diversity of global products, and better trading tools.

Trading or investing in financial products is risky and you may lose your entire capital. So, thoughts.money warns our readers to make sure that you are familiar with all the warnings and disclosures before opening an account with IBKR.

◆ Is IBKR regulated?

Interactive Brokers is publicly listed on Nasdaq (ticker symbol: IBKR) with over $10 billion in equity capital and regulated by:

- FINRA and SEC (US)

- CBI (Ireland)

- FCA (UK)

- CBH (Hungary)

- ASIC (Australia)

- IIROC (Canada)

- FFAJ (Japan)

- HKMA (Hong Kong)

- MAS (Singapore)

◆ How any trading platforms does IBKR offer?

IBKR offers a plethora of powerful and reliable trading platforms that traders around the world use. Here is the full list:

- Trader Workstation

- Client Portal

- IBKR Mobile

- IBKR APIs

- Ibot

- Capitalise AI

◆ Are IBKR fees & commissions low?

IBKR offers some of the tightest spreads in the industry starting from just 0.1 pips. You can buy real shares with just $1 in commissions. You can even borrow (margin) up to 50% of your capital (1:2 leverage) with ultra-low margin rates (from 0.75%).

IBKR also removed their inactivity fee and there is no longer the minimum balance requirement. This approach makes it more appealing to newer investors as IBKR was known for being the top choice for pros already.

There is also no withdrawal fee and most deposits and withdrawals are fulfilled within the same day unless you are choosing the bank transfer method that can take between 1-3 days.

◆ What’s the maximum leverage on IBKR?

You can open a margin account and borrow up to 50% of your capital which translates into 1:2 leverage for real equities and 1:30 for CFDs.

◆ How many tradable assets can you trade with IBKR?

With IBKR you can trade and invest in more than 16,500 worldwide financial instruments including:

- FX

- Stocks

- Options

- Bonds

- Funds

- Futures

- Crypto

- Indices

- Commodities

◆ What’s IBKR’s minimum deposit?

There is no minimum initial deposit so you can start with as little or as much as you want.

◆ Does IBKR offer demo & educational material?

IBKR offers a wide range of educational material designed for traders of all levels. From informational videos and articles to webinars and podcasts. You can put your skills to the test through the free demo account (unlimited virtual funds) before switching to real trading.

◆ What are IBKR’s funding options?

You can fund your account via:

- Bank/wire transfer

- Credit/Debit card

- Canadian Electronic Funds Transfer (EFT)

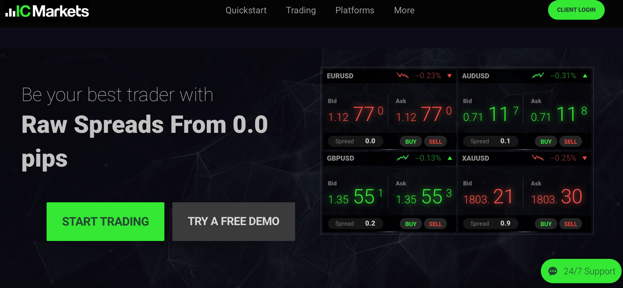

❖ IC Markets: The best online broker for active day traders & scalpers

IC Markets makes online trading accessible to traders around the world. From beginners to active day traders. IC Markets makes it easy and secure to trade the world markets anytime, anywhere.

Strict regulation, tight spreads, fast execution, advanced technology along with 1,000+ financial assets make IC Markets an ideal brokerage firm to open an account with.

As always, make sure you understand the risks involved with CFD trading as you can lose your entire capital. 74.32% of retail investor accounts lose money when trading with IC Markets.

◆ Is IC Markets regulated?

IC Markets operates under several regulators including:

- CySEC (Cyprus)

- Australia (ASIC)

- Seychelles (FSA)

◆ How many trading platforms does IC Markets offer?

Traders on IC Markets can choose between:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

These platforms allow for copy trading too.

◆ Are IC Markets fees & commissions low?

IC Markets has ultra-tight spreads starting from just 0.0 pips. This makes IC Markets the broker with the lowest spreads — and one of the few with no inactivity fee — in this list and it is therefore ideal for beginner traders that want to maximize their profits as well as active day traders who wish to minimize their costs.

◆ What’s the maximum leverage on IC Markets?

As most regulated brokers, IC Markets provides flexible leverage up to 1:30 for retail clients and up to 1:400 for professional traders.

◆ How many tradable assets can you trade with IC Markets?

IC Markets offers more than 1,000 tradable instruments including:

- FX

- Stocks

- Options

- Bonds

- Futures

- Crypto

- Indices

- Commodities

◆ What’s IC Markets’ minimum deposit?

You can start trading with just $200 on IC Markets. This is slightly higher than the rest of the competition. However, there are no fees for withdrawal requests and most deposits and withdrawals are processed instantly with the exception of bank transfers that take between 2-5 working days.

◆ Does IC Markets offer demo & educational material?

You can open a free demo account with unlimited virtual funds to test the platform before you switch to live trading. IC Markets offers free educational material to all their clients including articles and video tutorials. You should use free educational material to hone your online trading skills before risking your funds.

◆ What are IC Markets’ funding options?

Traders and investors have a large array of funding methods to choose from on IC Markets including:

- Bank/wire transfer

- eWallet (Neteller, Skrill, UnionPay, FasaPay, PayPal)

- Klarna

- Credit/Debit card

❖ Qtrade: The best Canadian platform for long-term investors

The popular Canadian broker — created in 1999 — just went through a rebranding, changing its logo, website, look, and even name — Qtrade Direct Investing.

Qtrade is still considered one of the best trading platforms for long-term investors in Canada and is part of the Aviso Wealth group. Their mission is very clear — to help everyone invest with confidence.

◆ Is Qtrade regulated?

Qtrade Direct Investing is authorized and regulated by the Investment Industry Regulatory Organization of Canada (IIROC). This makes it secure for Canadian traders and investors who want to explore self-directed online trading and investing.

◆ How many trading platforms does Qtrade offer?

Qtrade offers its own proprietary trading platforms — Qtrade Web and Mobile. Through the Qtrade platform you can easily plan and set goals for your portfolio, discover trading and investment ideas, evaluate stocks through fundamental analysis, place trades, copy others, monitor your open positions, and review your holdings.

◆ Are Qtrade fees & commissions low?

Qtrade has some of the tightest spreads in the industry starting from just 0.1 pips. On the other hand, there is an inactivity fee after 12 months ($25/3 months).

◆ What’s the maximum leverage on Qtrade?

Since you can only trade real stocks and not leveraged products with Qtrade, you can only borrow up to 50% of your capital. Simply put, the leverage you can get is maximum of 1:2. This is optimal for new investors as it minimizes your risk. However, seasoned pros might prefer a broker with higher leverage to power up their trades.

◆ How many tradable assets can you trade with Qtrade?

You can trade more than 3,000 financial instruments with Qtrade including:

- Stocks

- Bonds

- Funds

- Options

- Guaranteed Investment Contracts (GICs)

◆ What’s Qtrade’s minimum deposit?

Qtrade does not have a minimum deposit requirement. This makes it ideal for people who wish to open an account without having to deposit a large sum of money. Also, there is no withdrawal fee. Most deposits and withdrawals are fulfilled within 2 days.

◆ Does Qtrade offer demo & educational material?

You can open a free demo (trial) account that expires within 30 days. In the meantime, you can start reading all the free educational material offered for both new and experienced investors on Qtrade’s website.

◆ What are Qtrade’s funding options?

With Qtrade you can either fund your account via Electronic Funds Transfer (EFT) or simply select Qtrade as a bill payee in your bank/credit union account.

❖ FxPro: Award-winning trading platform for Stocks, Crypto & more

FxPro was founded in 2006 and has been serving both retail and institutional clients — in over 170 countries — ever since.

With strict regulation, competitive spreads, large range of instruments, intuitive technology, and expert support, it’s no wonder FxPro is a top choice among traders and investors looking to get into CFD and FX trading.

72.87% of retail investor accounts lose money when trading CFDs with FxPro. Make sure you are well aware of the risks involved before opening an account with FxPro as you can lose your money rapidly due to leverage.

◆ Is FxPro regulated?

FxPro is regulated in several jurisdictions including:

- CySEC (Cyprus)

- FCA (UK)

- FSCA (South Africa)

- SCB (Bahamas)

◆ How many trading platforms does FxPro offer?

Clients can trade or copy others on several trading platforms including web, desktop, and mobile versions of:

- MT4

- MT5

- cTrader

- FxPro Platform

◆ Are FxPro fees & commissions low?

FxPro offers competitive pricing with spreads as low as 1.3 pips. There is an inactivity fee after 6 months ($15 one-off and $5/month) that you need to be aware of.

◆ What’s the maximum leverage on FxPro?

Retail clients can trade with a flexible leverage up to 1:30. Professional clients can choose to trade with a powerful leverage all the way up to 1:200.

◆ How many tradable assets can you trade with FxPro?

FxPro provides traders with access to over 1,000 financial assets including:

- FX

- Stocks

- Crypto

- Futures

- Indices

- Commodities

◆ What’s FxPro’s minimum deposit?

FxPro’s minimum deposit is $100 and there is no withdrawal fee for all clients. Most deposit and withdrawal requests are fulfilled within 1 working day.

◆ Does FxPro offer demo & educational material?

FxPro offers a free demo account with $100,000 virtual funds so you can practice, test your strategies, and improve your trading skills. FxPro also offers free educational material including Forex trading courses for both beginners and advanced traders.

◆ What are FxPro’s funding options?

FxPro offers several payment methods including:

- Bank/wire transfer

- eWallet (Neteller, Skrill, UnionPay, PayPal)

- Credit/Debit card

⓺ Top trading platforms FAQ

Helpful answers to the most common questions about online trading platforms.

❖ Who is the best stockbroker for beginners?

As a beginner trader you have a lot of options. The best choice is to open a free demo account with several brokers from our list and see which one you like best. Sometimes, it all comes down to preference.

❖ Which is the best online trading Forex platform?

Most seasoned pros go with advanced trading platforms like IBKR. Beginner investors or traders prefer a more simplistic approach as the one used by AvaTrade or Oanda.

❖ Who are the top 8 brokerage firms?

In this guide we reviewed eight of the best brokerage firms in the world. You can open an account for free, get familiar with their trading platforms, and test your strategies through a free demo account.

❖ What is the most profitable Forex trading platform?

There are many trading platforms that can help you reach your financial goals. However, when choosing a Forex platform, you need to make sure that you go with the one that offers the lowest fees and commissions.

By doing so, you get to keep most of your profit instead of giving it back to your broker in fees.

❖ What does a stockbroker do?

In the past, a stockbroker was someone you would call to place trades on your behalf in a stock exchange. Today, you can find online brokers that allow you to place your own trades via easy-to-use trading platforms such as the ones reviewed here.

❖ Who is the best online broker?

There are several online brokers that can fulfil your financial needs and goals. If you are already a seasoned pro you can go with IBKR. If you are just starting out, you can go with a simpler trading platform like AvaTrade or Oanda. As you mature as a trader, you can test other platforms out too.

❖ What are the best brokers for mobile trading?

Every CFD broker now offers a mobile version of their trading platform. It all comes down to experience and preference. You can simply download a few mobile platforms mentioned in this guide and see which one you like best. You can’t go wrong with any of these.

❖ What are the best online brokers with low fees?

So many options in this guide for you to choose. Any broker mentioned in this review has relatively low fees compared to the competition.

Final thoughts

The primary goal of thoughts.money is to help you — and everyone who wishes to explore online trading — discover fair and reliable brokers. We strive to match your needs and goals with the right trading platforms. Every broker listed in this guide is secure so you can trade with peace of mind.

In addition, all the info provided in this guide is based on 100% unbiased and objective opinions that come from our multi-year experience in the online trading industry.

We want to enable an optimal learning environment so you can boost your skills and knowledge as well as identify the best trading platforms.

[ps: I personally use IBKR for all my stock trading. I rarely use any leverage (including CFDs) as I find the added risk out of my risk appetite. If you do, never risk more than a small percentage of your portfolio as you risk losing all your capital.]