US stocks shrugged off concerns raised by Federal Reserve Chair Jerome Powell regarding potential future rate hikes.

Despite Powell’s caution about further central bank policy tightening to control inflation, markets remained resilient. The Dow surged nearly 250 points during the session, indicating investors’ confidence.

In his speech at the Jackson Hole Symposium, Powell emphasized the need to bring inflation down to the Fed’s 2% target, asserting the central bank’s commitment to doing so.

Though inflation has moderated since its peak in June 2022, Powell stated that rate hikes could be considered “if appropriate.”

Investor sentiment regarding future Fed actions remained relatively unchanged, but there was a slight increase in bets for a 25 basis-point rate hike at the November policy meeting.

The CME FedWatch tool showed a 46% probability for such a move, up from 42% previously.

CIBC Private Wealth’s Gary Pzegeo noted that Powell’s speech had minimal immediate impact on market expectations, suggesting that market outlook adjustments might be necessary beyond September if stronger-than-expected growth continues.

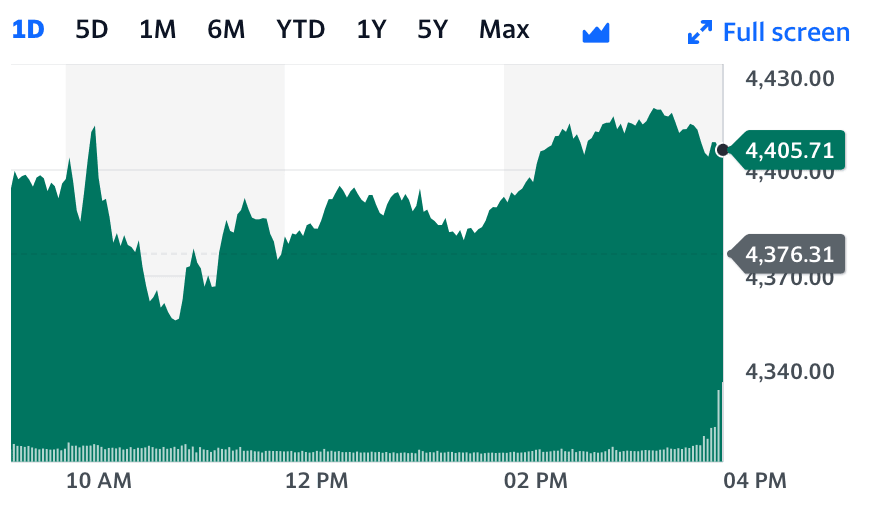

Closing Numbers for Major US Indexes:

- S&P 500: 4,405.73, up 29.42%

- Dow Jones Industrial Average: 34,346.96, up 0.73% (+247.54 points)

- Nasdaq Composite: 13,590.65, up 0.94%

Other Highlights from the Day:

- Zillow offers a 1% down payment option as the housing market’s affordability remains a challenge.

- Redfin analysis indicates an average loss of $71,000 in homebuyer purchasing power over the last year.

- A potential US debt surge could compel the Fed to halt tightening measures to stabilize the financial system.

- Yale data reveals investor concerns about a stock market crash are at their highest since 2020.

- Bank of America warns that the stock market will continue rising until specific conditions change.

- China grapples with a supply and demand imbalance in its economy, a long-standing issue.

- A Bloomberg analysis suggests Taylor Swift, Beyoncé, and “Barbieheimer” could contribute $8.5 billion to the US GDP.

- Billionaire investor Ray Dalio sees India’s moon landing as a sign of its growing economic strength.

Commodities, Bonds, and Crypto Performance:

- West Texas Intermediate crude oil rose 1.32% to $80.09 a barrel.

- Brent, the international benchmark, increased 1.7% to $84.80 a barrel.

- Gold slipped 0.28% to $1,942.60 per ounce.

- The 10-year Treasury yield remained nearly flat at 4.239%.

- Bitcoin marginally decreased by 0.01% to $26,015.

(Source: Business Insider)