Gold holds steady in the face of various global factors. Despite pressures stemming from rising bond yields, a strengthening US dollar, and expectations of higher interest rates, gold prices have managed to maintain stability.

☞ Read More: What Is the Gold Standard? (Pros, Cons, and More)

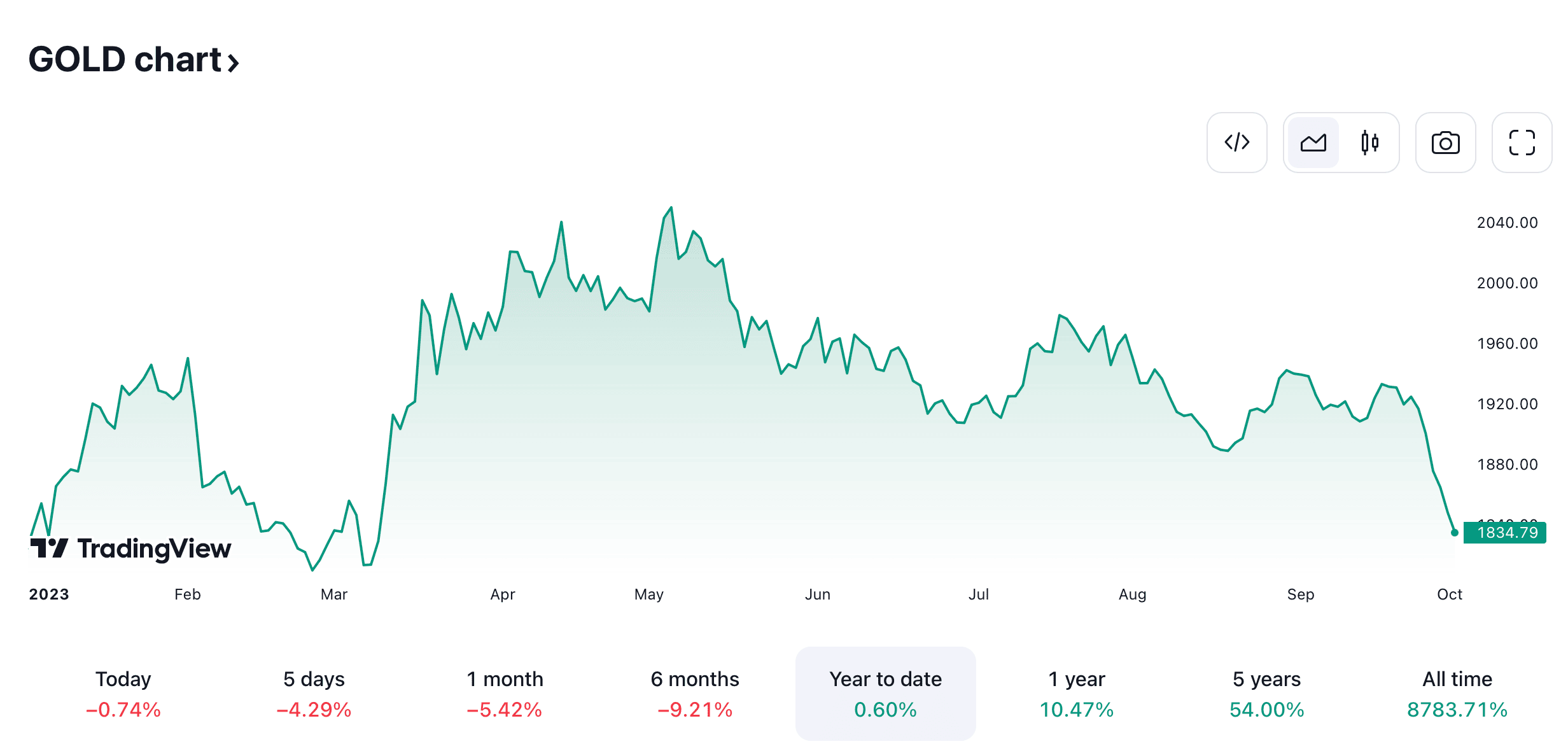

The precious metal recently traded at its lowest level since March, trading below $1,865 per ounce. While these challenges have tested the gold market, it’s worth noting that gold prices are still up year-to-date.

Rising Bond Yields and the Strong Dollar

When bond yields increase, the attractiveness of investing in non-interest-bearing assets like gold diminishes. This trend, coupled with a surging US dollar, has put downward pressure on gold prices. The US dollar reached its highest level since December, further weighing on gold’s performance.

Central Bank Gold Purchases

Central banks worldwide have shown an unprecedented appetite for gold. In the first quarter of this year, central bank purchases of gold reached a record high, according to data from the World Gold Council.

Notable buyers include central banks in Singapore, China, and Turkey. In 2022, central banks globally acquired a net total of 1,136 tons of gold, marking the highest annual amount recorded since 1950. This strong demand from central banks has provided support to gold prices.

☞ Read More: How to Buy Gold (Physical or Not)

Robust Chinese Demand

China, one of the world’s largest consumers of gold, has seen increased purchases of the precious metal. Several factors have contributed to this surge in demand, including a weakening yuan, low yields on government bonds, and an economic slowdown in the country.

The People’s Bank of China (PBoC) has emerged as one of the most significant institutional buyers of gold, significantly expanding its gold holdings since the start of 2023.

Additionally, government-imposed restrictions on gold imports have driven the price premium of Chinese gold to historic highs. Gold prices on the Shanghai Gold Exchange recently surpassed $2,000 per ounce, trading at a roughly 6% premium compared to prices in London or New York.

Challenges in India

In contrast to China’s robust demand, India, another key player in the global gold market, faces significant challenges. The World Gold Council predicts that gold demand in India could plummet to a three-year low, driven by factors such as soaring inflation, elevated domestic gold prices, and an unusually dry monsoon season.

The monsoon season, which typically runs from June to September, has a direct impact on the disposable income of rural farmers. A bountiful monsoon leads to higher agricultural output, resulting in increased disposable income that often finds its way into gold purchases, especially gold jewelry, which holds great cultural and traditional significance in rural India.

Final thoughts

In summary, while gold prices have experienced a recent pullback due to various global economic factors, they are still holding relatively steady. The resilience of gold can be attributed to increased central bank purchases, heightened demand in China, and a challenging backdrop in India.

These dynamics highlight the complex and interconnected nature of the global gold market and its ability to withstand and adapt to changing conditions.

(Source: Investopedia)

References

- Spot Price of Gold ($US/oz)

- DXY Chart

- Gold Demand Trends Q1 2023

- Gold Demand Trends Full Year 2022

- China’s Gold Market in August: Demand Improved on Multiple Fronts

- China’s Gold Prices Surge, Hitting a Record Against the World

- Climate Summary for the Month of August 2023

- India’s 2023 Gold Demand Could Fall 10% to 3-Year Low, World Gold Council Says

- Indian Summer Monsoon

- Gold Demand: India

⬇️ More from thoughts.money ⬇️

- The Science of Success: 17 Proven Steps to Achieve Any Goal

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

🔥 Daily Inspiration 🔥

〝Patience and diligence, like faith, remove mountains.〞

― William Penn