Who is Nick Sleep and why should I care, you ask? Well, finding true success in investing is like discovering a hidden treasure.

And Nick Sleep, alongside his partner Zak, seemed to have unearthed that treasure with their remarkable returns over the span of thirteen years—18% returns that most investors could only dream of achieving.

You might not be familiar with Nick Sleep, but imagine if there were a guidebook to investment success, his letters would be the prized chapters.

These letters held secrets that investors across the globe yearned for, and in recent times, they’ve resurfaced, offering a trove of invaluable insights into the art of investing.

So, what’s the big takeaway from Nick Sleep’s investment wisdom?

Sleep’s letters aren’t just informational; they offer a competitive edge to investors. They grant us a glimpse into the minds and models of exceptional investors, unraveling the strategies behind their success.

Much of the resurgence in Nick Sleep’s acclaim can be attributed to an illuminating chapter in William Green’s captivating book, “Richer, Wiser, and Happier.”

What’s truly astonishing about their long-term success is their focus on just three stocks: Amazon, Costco, and Berkshire Hathaway.

Now, let’s delve into what we can learn:

What you'll learn:

➤ Who Is Nick Sleep?

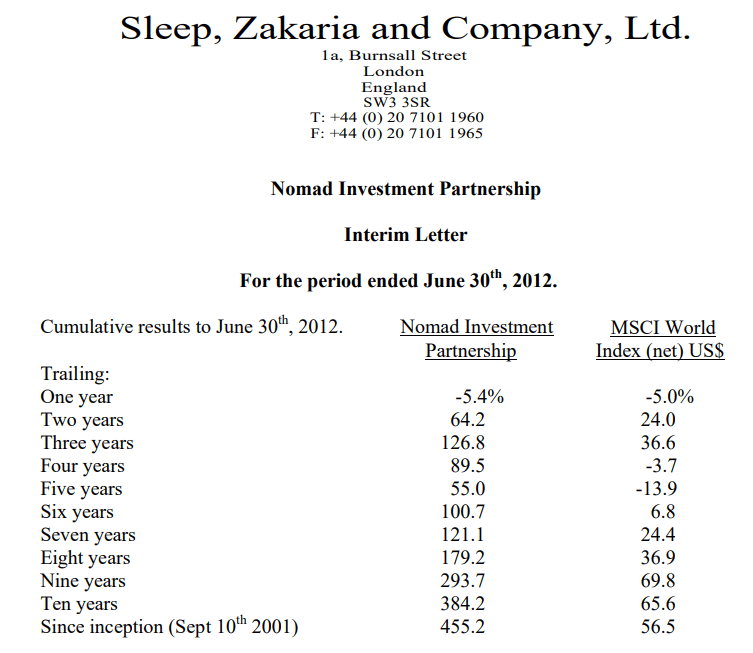

Nick Sleep, co-founder of Nomad Investment Partnership alongside Qais Zakaria, managed to achieve a staggering 921.1% returns over thirteen years, towering over the MSCI World Index at 116.9%.

To put that into perspective, if you’d invested $1 million in the index, you’d have earned $2.7 million. However, that same million invested in Nomad would have resulted in a remarkable $10.21 million.

But who exactly is Nick Sleep?

His journey into investing was anything but typical. Initially drawn to a career in landscape architecture, his aspirations shifted after disillusionment with the realities of the job.

It was a chance encounter with an obscure book, “Investment Trusts Explained,” that piqued his interest and paved the way for his entry into the world of investing.

His life took a pivotal turn when he stumbled upon Robert Pirsig’s profound work, “Zen and the Art of Motorcycle Maintenance.”

This unconventional book became a guiding light for Sleep, advocating a pursuit of excellence irrespective of circumstances. It became his metaphor for leading a different, more purposeful life.

Sleep’s method is grounded in simplicity and deep contemplation. He loves to unravel fundamental questions, probing deeper into their essence.

In 2001, he and Zak launched Nomad Investment Partnership under the guidance of Jeremy Hosking from Marathon Asset Management, eventually spinning out on their own in 2006.

Much like the evolution of master investors like Warren Buffett under the mentorship of Charlie Munger, Sleep’s journey as an investor evolved over the years.

Initially focusing on classic value plays following Benjamin Graham’s principles, Sleep realized the need for an evolved portfolio—a portfolio centered on “honestly run compounding machines.”

By the time Nomad closed its doors in 2013, their portfolio comprised businesses that embodied scale-economic shared models, helmed by their founders.

Taking a cue from Charlie Munger’s famous advice, “Take a simple idea and take it seriously,” Sleep embraced this philosophy wholeheartedly.

He recognized that the market consistently undervalued these scale-economic shared models, exemplified by giants like Amazon, Costco, and Berkshire Hathaway.

Sleep’s unique mental models, combined with a profound understanding of psychology, unwavering patience, and a laser focus on investment goals, underpinned his outstanding track record.

Nick Sleep’s investment journey isn’t just a success story; it’s a testament to the power of simplicity, deep understanding, and unwavering commitment in the world of investing.

➤ 10 Nick Sleep Investment Lessons

Nick Sleep’s letters contain a treasure trove of wisdom, offering a roadmap to visionary investing.

Within these letters lie profound insights that challenge conventional thinking, guiding investors towards a more strategic approach.

Let’s unravel some of the key learnings:

1. Think long term

“Gentle contemplation” and a long investment horizon serve as crucial tools in avoiding knee-jerk reactions.

Creating a speed bump between decisions prevents emotional actions that can interrupt the compounding effect essential for long-term returns.

Sleep’s focus remained steadfast on the business destination, steering clear of short-term noise.

2. Focus on the destination

Analyzing a company’s trajectory helps investors discern its DNA.

Understanding the path a company treads assists in asking pertinent questions about its future, steering clear of misjudgments about its direction.

3. Invest in compounding machines

Investing in compounding machines—the holy grail of investing—like Costco, illustrates the power of consistent returns.

Sleep realized the significance of investing in companies with strong returns on capital, driving long-term growth regardless of short-term market fluctuations.

4. Choose founder-led companies

Founder-led companies often prioritize challenge and identity over monetary gains.

These leaders, like Buffett and Bezos, display a commitment to the company’s ethos rather than personal wealth, fostering a culture of innovation and resilience.

5. Scale economics shared

Companies embracing shared scale economics, like Walmart and Amazon, exhibit the power of passing on cost advantages to customers.

This model, while initially dampening profits, creates immense long-term value, often overlooked due to undue emphasis on short-term market trends.

6. Price give-back

Investments in price give-back, seen in companies like Costco, create enduring customer habits.

These investments, while not reflected on income statements, wield immense influence, fostering customer loyalty through cost savings.

7. Lollapalooza moat

Investing in companies excelling in numerous small aspects over leveraging one substantial advantage creates a formidable moat.

This multiple-pronged approach makes companies like Costco hard to replace, enhancing their competitive edge.

8. Doing nothing = doing something

The art of inactivity within a portfolio is an active decision.

Resisting the urge for unnecessary activity and admitting only superior companies to the portfolio ensures a more robust investment strategy.

9. Cut through the noise

Quality over quantity reigns supreme when it comes to information.

Sleep advocates focusing on data with lasting relevance rather than succumbing to short-lived updates like quarterly earnings reports.

10. Stomach volatility

Market fluctuations are inevitable, but succumbing to short-term market whims often leads to detrimental decisions.

Sleep’s strategy of buy-and-hold, exemplified by his 18-year investment in Costco, emphasizes the power of enduring patience in the face of market volatility.

➤ 10 Nick Sleep Quotes

| Popular Quotes of Nick Sleep |

|---|

| “We own the only permanent capital in a company’s capital structure – everything else in the company, management, assets, board, employees can change but our equity can still be there! Institutional investors have never really reconciled their ability to trade daily with the permanence of equity.” |

| “There is a lot to be said for gentle contemplation. And of course, a long investment holding period allows one time between decisions to ‘retreat and simmer a little.’” |

| “We are genuinely investing for the long term (few are!), in modestly valued firms run by management teams who may be making decisions, the fruit of which may not be apparent for several years to come.” |

| “Destination analysis is consciously central to how we analyse businesses these days. It helps us ask better questions and get to a firm’s DNA.” |

| “The only real, long term risk, is the risk of mis-analysing a company’s destination.” |

| “We can do better with the compounding businesses these days- and they are much less stressful.” |

| “Investors know that in time average companies fail, and so stocks are discounted for that risk. However this discount is applied to all stocks even those that, in the end, do not fail. The shares of great companies can therefore be cheap, in some cases, for decades.” |

| “Information is like food has a sell by date – after all, next quarter’s earnings are worthless after next quarter. And it is for this reason the information Zak and I weigh most heavily in thinking about a firm is that which has the longest shelf life, with the highest weighting going to information that is almost axiomatic: it is, in our opinion, the most valuable information.” |

| “Our job is to pass custody of your investment over at the right price and to the right people.” |

| “One of the things the crowd is not, is patient.” |

➤ Final Thoughts

Nick Sleep’s letters don’t boast revolutionary formulas for success; rather, they echo timeless principles akin to those championed by Warren Buffett and Charlie Munger.

His perspective offers a fresh lens on established ideas: investing in robust companies fortified with enduring moats yields lasting success.

Acquiring these companies at reasonable prices consistently generates impressive returns over the long haul.

Instead of chasing elusive new opportunities, consider this: compile a roster of top-tier companies embodying traits like scaled economics shared, price give-backs, and lollapalooza moats as discussed in this post.

Next, scrutinize your portfolio against these criteria. Are any of your current holdings aligned with these standards?

The essence lies in dedicating ample time to ponder the roots of enduring business triumphs.

More from thoughts.money

- The Science of Success: 17 Proven Steps to Achieve Any Goal

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

- 4 Money Lessons From “Tax-Free Wealth”

- 5 Practical Tips From “The Value of Debt in Building Wealth”

- 8 Emotional Intelligence Lessons From “The Power of Nunchi”

- 6 Down-to-Earth Lessons From “How I Invest My Money”

- 8 Life Lessons From “The Geometry of Wealth”

- 8 Money Lessons From “The Laws of Wealth”

- 11 Stress-Free Lessons From “Why Zebras Don’t Get Ulcers”

- 8 Health Tips From “The Stress Code”

- 8 Psychology Lessons From “The Behavioral Investor”

- 7 Life Secrets From “The Happiness Equation”

- 11 Humankind Lessons From “Sapiens”

- 7 Health Lessons From “The Upside of Stress”

- 9 Smart Lessons From “Emotional Intelligence”

- 10 Controversial Truths From “The Hour Between Dog and Wolf”

- 10 Powerful Sales Lessons From “The 3-Minute Rule”

🔥 Daily Inspiration 🔥

I’d like to live as a poor man with lots of money.

— Pablo Picasso