What you'll learn:

The Laws of Wealth Summary

👇 The Laws of Wealth video summary 👇

What’s the story of The Laws of Wealth?

“The Laws of Wealth (2016)” is a guide that digs into how our not-so-logical behavior can mess with our investment choices.

Daniel Crosby, armed with insights from behavioral psychology, pinpoints the human quirks that can wreck our investments – things like thinking we’re financial wizards and panicking when risks show up.

But fear not! Crosby doesn’t just point out our flaws; he gives us practical strategies to be sharper investors.

Who’s the author of The Laws of Wealth?

Now, a bit about the brain behind the book – Daniel Crosby. After scoring a PhD in psychology from Brigham Young University, he smoothly shifted gears into finance.

He’s like a wizard at understanding how our feelings and actions play puppeteer with our investment decisions.

Before “The Laws of Wealth,” he coauthored the New York Times bestseller “Personal Benchmark,” blending behavioral finance with investment management.

And guess what? He’s the founder of Nocturne Capital, a cool-sounding investment firm.

Who’s The Laws of Wealth summary for?

Anyone fascinated by the dynamics of psychology, money, and investments.

And for those wishing to learn how to maximize their power to their greatest benefit.

Why read The Laws of Wealth summary?

Get ready to up your investment game and become a savvy investor by acknowledging one crucial factor – your limitations.

When you dive into the stock market, you’re not just facing external risks like market crashes or company health; there’s a sneaky, often overlooked risk within you – behavioral risk.

In this summary, we’ll unravel the mysteries of how our own irrationality can be a major stumbling block in investment decisions.

Picture this: getting overwhelmed, panicking, or becoming overly emotional. It happens to the best of us. Even if you think you’re intuitive and sharp, slick sales pitches and clever marketing can cloud your judgment.

But here’s the silver lining – despair not! We’re here to tackle the nitty-gritty of investor fallibility, laying out potential pitfalls and offering practical strategies for making sharp and insightful investment decisions.

In this summary, you’ll learn:

– why the price of wine influences your enjoyment

– how to gauge the trustworthiness of a company’s management

– and why both panic and excitement can throw a wrench into your investment decisions

The Laws of Wealth Lessons

| What? | How? |

|---|---|

| 1️⃣ Don’t overestimate your abilities | Acknowledge limitations and learn from mistakes. Be humble about your skills and seek external advice. |

| 2️⃣ Passion and excitement make you reckless | Recognize the impact of extreme emotions on decision-making. Strive for a balanced and rational approach in investment choices. |

| 3️⃣ You can always get an advisor | Consider hiring a trusted advisor. Research their credentials and ensure they provide valuable behavioral coaching. |

| 4️⃣ Keep your emotions in check | Develop emotional resilience. Understand the long-term perspective and avoid making impulsive decisions based on short-term emotions. |

| 5️⃣ Pay attention to what the management does | Evaluate the actions of company leaders rather than relying solely on their words. Focus on insider behavior for better investment decisions. |

| 6️⃣ Forget hype | Prioritize value over glamour. Resist the allure of novel and exotic investments, and invest based on substance rather than excitement. |

| 7️⃣ Don’t let FOMO kick in | Define personal benchmarks and align investments with your unique goals. Use language strategically to motivate and maintain focus. |

| 8️⃣ Use behavioral psychology to your advantage | Learn a few simple rules and ignore unnecessary advice. Simplify your approach, like folding weaker hands in poker, to become a competent investor. |

1️⃣ Don’t overestimate your abilities

From the get-go, we’re taught to think positively and be confident in ourselves. It sounds great, right? But what if that confidence is a bit misplaced?

Picture this: American high school students thinking they’re math whizzes on a global scale when, in reality, they’re just average. That’s overconfidence bias in action – assuming we’re better than we actually are.

Here’s a gem: a study by researchers Tom Peters and Robert Waterman found that 100% of employees believed they were better than average at interpersonal skills, and 94% thought their athleticism outranked their peers. Impossible, right?

That’s a classic case of people overestimating themselves.

Now, you might wonder, what harm can a little overconfidence do? Well, when it comes to investing, it can do quite a bit.

If you think you’re a stock market genius, you’ll credit wins to your “unique talent” but blame losses on external factors – a classic fundamental attribution error. This mindset hampers your ability to learn from mistakes and grow as an investor.

Thinking you’re the exception to the rules can lead to ignoring risks and making reckless decisions. You might even snub advice from a trusted advisor because, well, you’re the expert, right?

Here’s the golden nugget: Humility and the ability to acknowledge and learn from mistakes are the keys to becoming a successful investor. So, let’s keep those overestimations in check and embrace a more realistic view of our abilities. Your investment journey will thank you for it!

Onwards.

👉 Discover More:

- This Is How to Become a Millionaire in 6 Simple Steps

- So, Money Does Buy Happiness (Here’s How)

- Are You Doing These 8 Investing Mistakes Too?

2️⃣ Passion and excitement makes you reckless

Emotions add spice to life – the tears during a sad movie or the thrill of falling in love. However, when it comes to investments, extreme emotions can throw a wrench into our decision-making skills.

Check this out: Social psychologist Jennifer Lerner conducted an experiment where participants watched either a sad movie or a dull video about fish. The group that watched the sad movie ended up making less shrewd decisions when asked to pretend they were selling pens.

They charged a whopping 33 percent less than the group that watched the boring video. So, a sad investor might be more prone to making gullible decisions.

Now, what about positive emotions, like excitement? Behavioral economist Dan Ariely explored this in his book “Predictably Irrational.” He conducted an experiment with students, asking about their sexual practices before and after showing them explicit images.

The results were eye-opening. After the visual stimulation, students were 136 percent more likely to cheat on a partner and 25 percent more likely to engage in unprotected sex.

While investing isn’t the same as watching explicit content, the parallel is clear. High-stakes deals can trigger strong emotions, affecting decision-making. Positive or negative, emotions can sway your choices.

The big question is: How do we keep our cool and make rational decisions? As we’ll explore in the next blink, one effective way is to enlist the help of an investment advisor. Stay tuned for more insights on navigating the emotional rollercoaster of investments!

Next.

3️⃣ You can always get an advisor

One of the smartest moves you can make in investing is getting yourself an advisor.

Sure, you might have all the rules in your head, devoured countless books, and understand the importance of careful planning and avoiding impulsive buys. But knowledge alone isn’t always enough.

That’s where the game-changer comes in – hiring an advisor. Research highlights that advisors play a crucial role in helping investors make better decisions and stick to their chosen investment plans. And here’s the kicker – this assistance translates into serious financial gains.

Morningstar, the financial analysts, estimate that investors with advisors outperform their counterparts by a solid two to three percent per year.

But it’s not just about the numbers. Advisors become your investment lifeline during crises. Picture this: the 2008 financial crisis hits, and you’ve invested your life savings.

Panic mode, right? Well, investors who had assistance during those critical years of 2009 and 2010 actually outperformed others by 2.92 percent, according to Aon Hewitt and Financial Engines.

Advisors aren’t just number crunchers; they’re your behavioral coaches. Imagine them as professional devil’s advocates, challenging you with tough questions before making an investment.

It might not be the most fun part of investing, especially when you’re riding the enthusiasm wave, but it could save you from major losses. If the investment survives this pre-mortem analysis, it might just be a winner.

Of course, not all advisors are created equal. Before bringing someone on board, rigorously interview them about their credentials, investment philosophy, and communication style.

And crucially, ensure they’re not just about giving investment advice but are also masters at behavioral coaching. That’s where the real value lies.

So, when it comes to investing, having a trustworthy advisor by your side can be a game-changer.

Onwards.

4️⃣ Keep your emotions in check

Imagine putting a chunk of your life savings into a company, only to hear it’s under investigation for fraud. Panic mode, right?

As an investor, you’re bombarded with information from news outlets hungry for scandal and disaster. The danger lies in being unduly influenced by these reports and making decisions based on fear rather than rationality.

We humans have a knack for catastrophizing – hearing something alarming and immediately imagining the worst possible outcome. Your stock takes a dip, and suddenly you envision a retirement on the streets, relying on your kids for handouts.

Here’s a reality check: Media often treats every stock market dip as a crisis, but it’s entirely normal for stocks to lose value occasionally. Sometimes their values are inflated, leading to mass selling and a subsequent drop, known as a correction, happening about once a year.

Interestingly, these dips don’t have a long-term impact on your stock portfolio. However, if your knee-jerk reaction is to sell immediately, you’re selling at a loss, and that’s not ideal.

Ironically, the times when the market feels safest are often when it’s riskiest. In times of prosperity, you might feel confident, but high valuations can signal a bubble. When the market corrects itself after a price drop, you might feel awful, but it’s a sign of a safer, more accurately valued market.

So, resist the urge to jump ship at the first sign of trouble. Successfully navigating market tremors is part and parcel of being a savvy investor.

Keep your emotions in check, and remember that short-term hiccups don’t define your long-term success. Stay steady, and you’ll ride out the waves like a pro.

Next.

👉 Discover More:

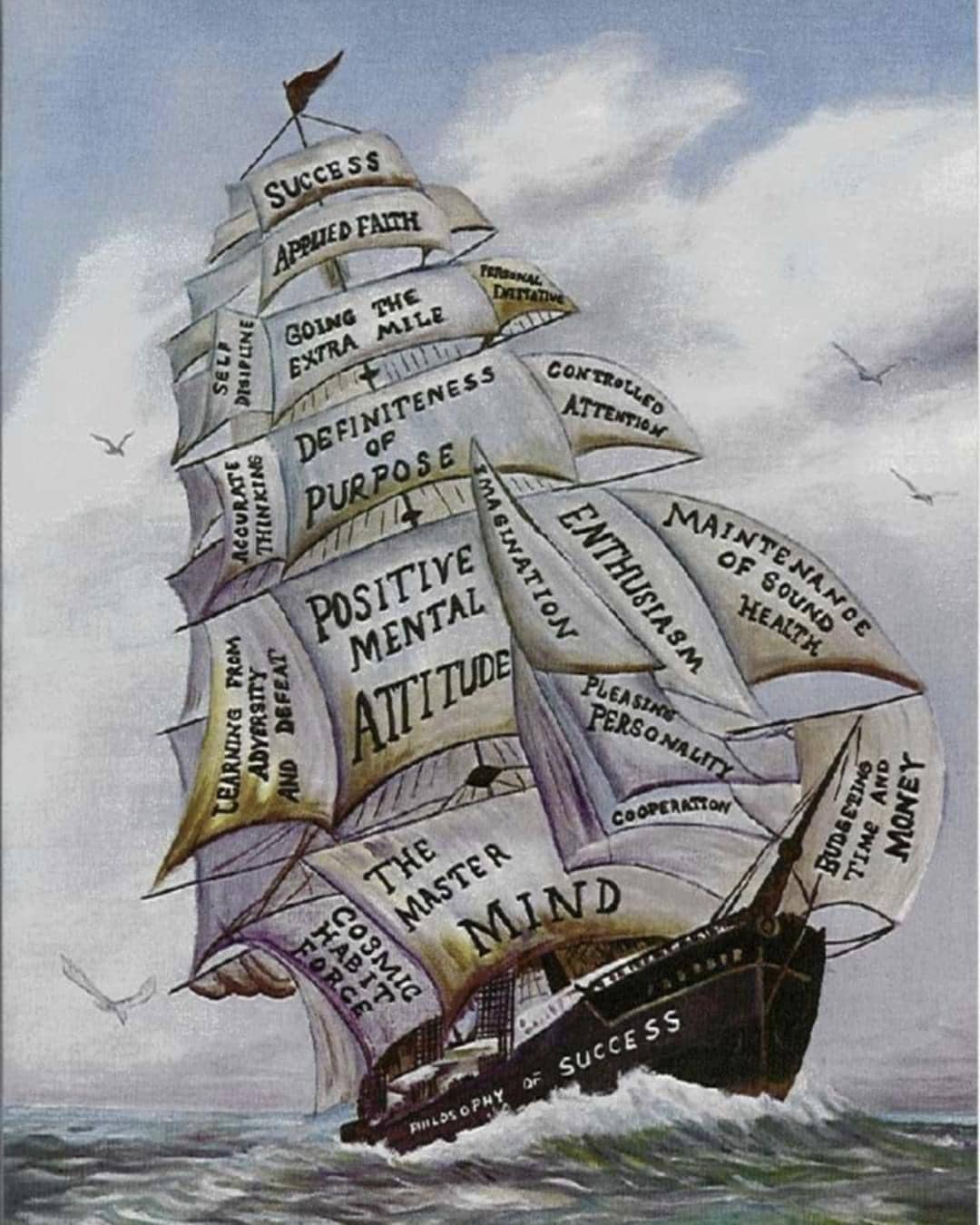

- 10 Powerful Lessons From “Think and Grow Rich”

- 12 Timeless Lessons From “The Daily Stoic”

- 12 Hidden Secrets From “The 48 Laws of Power”

5️⃣ Pay attention to what the management does

We’ve all heard the horror stories of Wall Street con artists, and nobody wants to fall victim to the next Ponzi scheme. But here’s the truth – relying solely on intuition and powers of detection to spot a liar is a risky business.

Research by psychologists Charles Bond, Jr. and Bella de Paulo found that people can only spot liars about 47 percent of the time by studying body language. That’s not much better than flipping a coin.

Even law enforcement professionals were successful in distinguishing true confessions from fake ones only 42 percent of the time!

So, what’s the takeaway for us as investors trying to assess the credibility of a company’s leadership? It’s straightforward – stop just listening to what executives say and start paying attention to what they do.

Specifically, look at how they’re investing their own money. Company managers have the most intimate knowledge about their business. Are they confidently buying their own stock, or are they selling it off hastily?

A study by the investment firm Tweedy, Browne, published in 1992, found that companies with significant insider buying patterns outperformed others on the stock market.

They gained two to four times as much value during the same period. If insiders are putting their money on the line, it’s a strong indicator that the company is a good bet.

Instead of trying to decipher whether leaders are telling the truth about their companies, focus on where they’re investing their own money. Actions truly speak louder than words, especially in the world of investments.

Moving on.

6️⃣ Forget hype

Imagine paying $52 for an old, burnt oven mitt. Sound crazy? What if you were told it belonged to the legendary Julia Child and was used while making her first-ever batch of beef bourguignon? Suddenly, the price seems justified due to its interesting and socially significant past.

Our irrationality about pricing extends to the stock market. We often associate high prices with value, rather than evaluating on objective merits.

A study by Stanford Professor Baba Shiv revealed that people’s pleasure centers lit up more when they believed they were drinking expensive wine, even if all the samples were the same. Believing in a higher price increased their enjoyment.

This assumption that price equals quality might be harmless when buying wine, but it can lead to disastrous consequences in the stock market.

Glamour stocks, often from fast-growing companies, rise quickly and attract investors. However, if you buy them at their peak, you risk an unprofitable investment.

You’re paying a premium for something unlikely to substantially increase in value, and it may even lose money when the bubble bursts.

For a sensible investment, consider value stocks. These are often from smaller, less recognized companies, making them less appealing to investors initially. They aren’t the highest-priced, leaving room for growth.

Despite the counterintuitive nature, like choosing the last kid for the basketball team, value stocks can quietly gain ground while glamour stocks soar and then crash.

In the investment game, it pays to prioritize substance over hype. Choose the undervalued gems, and you might find your portfolio quietly gaining strength over time.

Onwards.

👉 Discover More:

- An Open Letter to My Future Son & Daughter: Step 2

- An Open Letter to My Future Son & Daughter: Step 1

- An Open Letter to My Future Son & Daughter: Intro

7️⃣ Don’t let FOMO kick in

In the early 1600s, the tulip craze took over the Netherlands. The allure of its unique color and shape turned tulips into the ultimate status symbol.

Prices soared, with some people paying up to ten times a worker’s annual salary for a single bulb. However, the tulip frenzy crashed in 1637, marking the end of the first speculative market bubble.

The appeal of the new and exotic has repeatedly led to enthusiasm throughout economic history. A more recent example is the dot-com bubble, where the seemingly limitless possibilities of the internet drove people to believe that any investment ending in .com was a sure bet.

Take eToys.com, a startup founded in 1997. By 1998, it had attracted a staggering $8 billion investment despite reporting only $30 million in actual toy sales.

In contrast, the traditional toy company Toys “R” Us, with $6 billion in investment and 40 times more in sales, was seen as boring and old-fashioned.

Eventually, in 2001, eToys.com went bankrupt and was acquired by Toys “R” Us, highlighting how excitement can prevent rational assessments of companies.

Similarly, air travel, synonymous with exoticism and excitement, has historically been a losing battle for investors due to enormous fixed costs, strong labor unions, and rigid pricing models.

When tempted to invest in something exciting and new, remember the image of the beautiful, exotic tulip. Yes, it’s visually appealing, but is there substance behind the beauty?

Is it truly worth the investment, or are you being lured by the allure of novelty? It’s a crucial question to consider before diving into seemingly exotic opportunities.

Onwards.

8️⃣ Use behavioral psychology to your advantage

The question of how much money is enough doesn’t have a one-size-fits-all answer. Guidelines suggesting ten times your annual income or comparing yourself to others might not capture your unique needs and desires.

The key is to look inward and define your own “hierarchy of needs” – the factors crucial for your fulfillment in life.

Once the basic human needs like food and housing are met, individual needs vary widely. Some prioritize saving several times their annual income for security and their children’s education, while others value ready cash for experiences like world travel.

These personal benchmarks determine your investment strategy and can help you navigate market turbulence without sacrificing your mental well-being.

Knowing when you’ll need to access your savings is crucial. If it’s in fifteen years, you can weather market dips knowing there’s time for recovery. Conversely, if you’re supporting an elderly parent with unpredictable healthcare costs, a less risky, more accessible investment plan is essential.

Aligning your financial decisions with your goals requires a shift in how you talk about money. Using language strategically, as seen when the Great Recession funds were labeled a “bonus,” can influence behavior.

Explicitly naming the purposes of your savings and investments can motivate action. For instance, one study found that low-income couples were more likely to save for their children’s education if the money was kept in an envelope featuring their children’s faces.

When making investment decisions, consider your needs and values. Ensure that your choices align with your unique goals and dreams, allowing your financial strategy to be a personalized reflection of your aspirations.

The Laws of Wealth Review ⭐️⭐️⭐️⭐️✩

The primary threat to investors isn’t the stock market itself but their own behavioral tendencies. Emotions, irrationality, and grandiose thinking often lead to poor investment decisions.

Recognizing these weaknesses and taking proactive steps, such as seeking external advice and aligning investments with personal goals, is crucial.

Amidst the overwhelming volume of investment advice, simplicity is key. You don’t need to delve into the complexities of the stock market to be a successful investor.

Similar to how an amateur poker player can thrive by learning to fold weaker hands and bet on stronger ones, a novice investor can excel by adhering to a few straightforward rules.

For instance, avoiding overreactions to market fluctuations and opting for value stocks over glamour stocks can significantly enhance your investment competence.

The Laws of Wealth Quotes

| Daniel Crosby Quotes |

|---|

| “What I am proposing here is that you consistently bet on inconsistency. What I am asking you to do is bet unfailingly on the failures of human reason…” |

| “The psychology of individuals – warts and all – must be a central consideration in the formulation of any practical investing approach…” |

| “The fact that people are fallible is your biggest enduring advantage in the accumulation of greater wealth. The fact that you are just as fallible…” |

| “Never underestimate the power of doing nothing.” – Winnie the Pooh” |

| “Imagine a world where you could gain more knowledge by reading fewer books, see more of the world by minimizing travel and get more fit by doing less exercise…” |

| “We often analogize our brains to computers – impartial storage apparatus tasked with housing and calling up information objectively. In reality, our brains are far more like beer goggles…” |

| “[The] more confidence an expert had, the worse his predictions tended to be and that the more famous an expert was, the worse her predictions were on average…” |

| “The lessons for behavioral investors are unavoidable: you must automate your process wherever possible and avoid bias in the selection of people and processes…” |

| “I began this process without preconceptions of how the information would shake out. Five consistent types of behavioral risk emerged: Ego, Emotion, Information, Attention, and Conservation…” |

| “Let me say with all forthrightness that the [Rule-Based Behavioral Investing] model is not perfect and that some years following its principles won’t even beat a passive market cap weighted index…” |

| “If you’re relying on your gut rather than a rule-based approach to investing, you can be almost certain that your feelings of risk or safety are exactly the opposite of what they ought to be…” |

| “Get rich fast and get poor fast are opposing sides of the same coin.” |

More from thoughts.money

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

- 4 Money Lessons From “Tax-Free Wealth”

- 5 Practical Tips From “The Value of Debt in Building Wealth”

- 8 Emotional Intelligence Lessons From “The Power of Nunchi”

- 6 Down-to-Earth Lessons From “How I Invest My Money”

- 8 Life Lessons From “The Geometry of Wealth”

- 8 Money Lessons From “The Laws of Wealth”

- 11 Stress-Free Lessons From “Why Zebras Don’t Get Ulcers”

- 8 Health Tips From “The Stress Code”

- 8 Psychology Lessons From “The Behavioral Investor”

- 7 Life Secrets From “The Happiness Equation”

- 11 Humankind Lessons From “Sapiens”

- 7 Health Lessons From “The Upside of Stress”

- 9 Smart Lessons From “Emotional Intelligence”

- 10 Controversial Truths From “The Hour Between Dog and Wolf”

- 10 Powerful Sales Lessons From “The 3-Minute Rule”

- 7 Strategies for Wealth and Happiness by Jim Rohn

- 9 Lessons to Apply Today From “The Daily Laws”

- 7 Must-Know Truths From “What I Learned Losing a Million Dollars”

- 4 Never-Before-Published Lessons From “Pathways to Peace of Mind”

- 4 Long-Lost Lessons From “Outwitting the Devil”

- 8 Untold Secrets From “Napoleon Hill’s Golden Rules”

- 12 Hidden Secrets From “The 48 Laws of Power”

- 8 Practical Lessons From “The New Trading for a Living”

- Financial Wisdom From “Charlie Munger”

- Power Lessons From “13 Things Mentally Strong People Don’t Do”

- 4 Investing Lessons From “Trade Like a Stock Market Wizard”

- 7 Investing Lessons From “How to Make Money in Stocks”

- 12 Timeless Lessons From “The Daily Stoic”

- 6 Simple Lessons From “The Little Book of Common Sense Investing”

- 7 Super Ideas From “One Small Step Can Change Your Life”

- 8 Killer Lessons From “The Millionaire Real Estate Agent”

- 7 Counter-Intuitive Life Lessons From “Lives of the Stoics”

- 5 Important Life Lessons From “Million Dollar Habits”

- 6 School Lessons From “Why A Students Work for C Students”

- 9 Financial Freedom Lessons From “Rich Dad’s Cashflow Quadrant”

- 6 Wealth Lessons From “Millionaire Success Habits”

- 7 Unspoken Truths From Rich Dad’s “Retire Young Retire Rich”

- 9 Must-Know Lessons From “The Intelligent Investor”

- 14 Life Lessons From “The Snowball”

- 5 Investing Lessons From “Warren Buffett’s Ground Rules”

- 8 Money Secrets From “The Richest Man in Babylon”

- 10 Powerful Lessons From “Think and Grow Rich”

- These Are the Top 9 Lessons From “Rich Dad, Poor Dad”

- These Are the Top 5 Lessons From “How Highly Effective People Speak”

- These Are the Top 3 Lessons from “Burn the Boats”

- These Are the Top 3 Lessons from “The Power of Now”

- These Are the Top 3 Lessons from “The Psychology of Selling”

- These Are the Top 3 Lessons from “Mind Over Money”

- These Are the Top 3 Lessons From “The War Of Art”

- These Are the Top 3 Lessons from “The Dip”

- These Are the Top 3 Lessons from “Ikigai”

- These Are the Top 3 Lessons from “The 10X Rule”

- These Are the Top 3 Lessons from “The Subtle Art of Not Giving a Fuck”

- These Are the Top 3 Lessons from the “Man’s Search For Meaning”

- Should You Start a Dropshipping Business? (If Yes, How?)

- Should You Buy an REO (Real-Estate Owned) Property?

- This Is What Pet Insurance Covers

- This Is How Much Cash You Should Keep in the Bank

- This Is How to Make a Living Will (In 5 Simple Steps)

- These Are the Top 7 Dividend ETFs

- These Are the Top 10 ETFs (U.S. & International)

- These Are the Top 7 Money Market Accounts

- These Are the Top 9 Budget-Friendly Cities for Christmas

- This Is How FDIC, NCUA, and SIPC Protect Your Money

- Should You Use an Oven or Air Fryer?

- Should You Use a Dishwasher or Hand Wash?

- This Is the Difference Between a Salary and Hourly Pay

- This Is the Definition of a Christmas Club Account

- This Is How to Open an IRA (In 5 Simple Steps)

- If You Rent, It’s OK (Here Are 10 Reasons Why)

- Is There a Best Time to Buy or Sell Stocks? (Let’s See)

- This Is What the Value Line Composite Index Tells Investors

- This Is the Difference Between Technical and Fundamental Analysis

- This Is What Alpha and Beta Means in Investing

- This Is What Banking Desert Means

- So, You Want to Invest in Stocks (Here Are 5 Simple Steps)

- Do You Really Need Life Insurance? (Probably Yes)

- These Are the 6 Worst Student Loan Mistakes You Can Make

- Should You Apply for a Private or a Federal College Loan?

- Here’s the Difference Between Fixed and Adjustable Rate Mortgages

- This Is How Much the American Dream Costs Now

- This Is How to Become a Millionaire in 6 Simple Steps

- This Is What Famous Billionaires Did As Their First Job

- Here Are the 9 Most Common Motorcycle Types

- This Is the Difference Between Hard and Soft Money

- This Is How to Exercise Your Stock Warrants

- After Thanksgiving Comes Cyber Monday (What’s the Story?)

- So Long Mr. Munger: A Life Well Spent

- So, You Wanna Buy a Busa? (Here’s All You Need to Know)

- Capitalism Makes the World Go Round? (Let’s Find Out)

- Interested in Bitcoin Mining? (Here’s How It Works)

- The World’s Largest Companies (By Revenue)

- The World’s Most Profitable Companies (By Net Income)

- This Is How Much Jay-Z Is Worth

- Millennial Women Prefer Real Estate than Stocks (Survey Says)

🔥 Daily Inspiration 🔥

It is always better to imitate a successful man than to envy him.

Of all the negative emotions, envy is the most insidious.

It is especially sinister because it destroys you from the inside by replacing all that is positive and productive with negative feelings of anger, jealousy, and despair.

But when you congratulate others on their successes and genuinely wish them well, not only do you give credit to those who deserve it, but you also feel better about yourself.

Once you’ve overcome your envy, you should determine the other person’s actions to achieve success.

Meanwhile, you will have strengthened your relationships by recognizing the achievements of others.

— Napoleon Hill