What you'll learn:

How I Invest My Money Summary

👇 How I Invest My Money video summary 👇

What’s the story of How I Invest My Money?

How I Invest My Money (2020) isn’t a guide on how to plan your financial future perfectly. Instead, it gives us a peek into what people who work in finance actually do with their own money.

So, what strategies do they use to invest? Well, it turns out there isn’t just one answer to that. How individuals invest depends on who they are and what they care about.

Who’s the author of How I Invest My Money?

Josh Brown is the co-founder and CEO of Ritholtz Wealth Management, a company that handles more than $1 billion in assets for various clients, from individuals to big companies.

He’s also written books like Backstage Wall Street and Clash of the Financial Pundits.

Brian Portnoy is the brain behind Shaping Wealth, a platform that helps people make smarter financial choices. His earlier books include The Investor’s Paradox and The Geometry of Wealth.

Who’s How I Invest My Money summary for?

Anyone fascinated by the dynamics of motivation, inspiration, money, and investments.

And for those wishing to learn how to maximize their power to their greatest benefit.

Why read How I Invest My Money summary?

Have you ever wondered why investing is not just about which assets to pick or how to plan for retirement?

Sure, there’s endless advice on what stocks to buy or whether property is a better investment than the stock market. But what about the underlying reason behind investing?

In this glimpse into the financial world, we’ll explore the motivations driving six top investors and how these motivations shape their investment strategies.

Understanding the “why” behind your investment goals is just as crucial as knowing the “how.”

Once you identify your financial aspirations, decisions like which assets to invest in or how to structure your retirement fund become clearer.

In this summary, you’ll learn:

-The role dividend stocks play in achieving early retirement.

-Why financial advisors often choose different investment portfolios for themselves compared to their clients.

-Strategies to overcome market anxiety and embrace a worry-free investment approach.

How I Invest My Money Lessons

| What? | How? |

|---|---|

| Investing is personal | Tailor your investment strategy to your goals and values. Consider factors like risk tolerance, time horizon, and financial aspirations when making investment decisions. |

| Some prefer dividend-paying companies | Explore dividend-paying stocks as a source of stable income and potential growth. Research companies with a history of consistent dividends and solid financial performance. |

| Time is more important than money | Prioritize time spent on investments, focusing on long-term goals rather than short-term gains. Allocate resources to activities that align with your values and bring fulfillment. |

| Keep investing simple | Avoid overcomplicating investment strategies. Stick to straightforward approaches, such as diversification and low-cost index funds, to minimize risks and maximize returns. |

| We all make mistakes | Embrace mistakes as opportunities for learning and growth. Reflect on past errors, identify lessons learned, and adjust your investment approach accordingly to improve future outcomes. |

| Losses are inevitable | Acknowledge the inevitability of losses in investing. Maintain a resilient mindset, stay disciplined during market downturns, and focus on long-term goals to navigate through challenges. |

1️⃣ Investing is personal

When it comes to investing, there’s no one-size-fits-all approach. Sandy Gottesman, the billionaire founder of First Manhattan, doesn’t ask potential hires about the hottest stocks or economic forecasts.

Instead, he wants to know what candidates do with their own money and why. This highlights the personal nature of financial decisions.

The main takeaway here is: There are no universal rules in investing.

Surprisingly, only half of US mutual fund managers invest in their own funds, according to Morningstar. But this isn’t necessarily hypocritical. Consider the analogy of how doctors approach their own end-of-life care differently from their patients.

Doctors opt for minimal treatment, recognizing the situation, while patients may seek more aggressive interventions, fueled by hope and lack of medical expertise.

Similarly, financial experts tailor advice to individual needs rather than prescribing universal solutions. For instance, Morgan Housel prioritizes independence in his financial decisions.

Despite increasing incomes, he and his wife maintain a modest lifestyle and funnel all raises into an independence fund. This fund serves as a safety net, enabling them to live life on their own terms in the future.

Ultimately, how you invest should align with your unique goals and values.

Onwards.

👉 Discover More:

- This Is How to Become a Millionaire in 6 Simple Steps

- So, Money Does Buy Happiness (Here’s How)

- Are You Doing These 8 Investing Mistakes Too?

2️⃣ Some prefer dividend-paying companies

Jenny Harrington, CEO of Gilman Hill Asset Management, stumbled upon a winning investment strategy back in 2001 while assisting a client preparing for retirement.

This client, aged 55, sought an income source that not only provided stability but also had the potential to grow over time.

The core message here is: Dividend-paying investments offer a reliable and expanding income stream.

Traditionally, bonds have been favored for stable income, but they lack growth potential. On the other hand, selling stocks periodically to generate income can deplete your investment pool, especially if you’re retiring early.

However, dividend-paying stocks present an alternative solution.

When you invest in dividend stocks, you’re essentially buying a slice of a company. These companies distribute a portion of their profits to shareholders in the form of regular dividends.

As the company’s revenues and profits grow, so do the dividends paid out to investors.

Harrington shifted her client’s investments into a dividend income portfolio, viewing it as a dependable method for generating returns for shareholders. The key lies in selecting the right companies.

Mature businesses with consistent revenue and profit histories, such as AT&T or Verizon, are prime candidates. However, niche options like Douglas Dynamics, a snow plow manufacturer, can also offer promising returns.

Despite fluctuations in yearly sales, Douglas’s long-term sales trend shows consistent growth over an eight-year cycle. By aligning investments with these cycles, Harrington achieved steady capital appreciation and a growing income stream for her client.

In essence, dividend-paying investments provide the dual benefits of stability and income growth, making them a valuable addition to any investment portfolio.

Onwards.

3️⃣ Time is more important than money

Dasarte Yarnway, founder of Berknell Financial Group, places paramount importance on time, viewing it as the most precious asset.

Raised by Liberian parents who fled civil war to seek refuge in the United States, Yarnway’s upbringing instilled in him a deep appreciation for life’s moments.

The central message here is: Investing transcends mere financial returns; it embodies personal values.

Despite financial challenges, Yarnway’s family was rich in love, albeit lacking in material wealth. His father, working tirelessly across multiple jobs, struggled to balance providing for his family with being present for important moments.

Yarnway’s own journey led him to establish Berknell Financial Group in 2015, becoming its sole equity owner.

Investing in his own company serves two purposes for Yarnway. Firstly, it grants him control over his time, a form of wealth beyond monetary value. As a business owner, he determines his schedule, prioritizing being present for his future family.

Secondly, Yarnway sees his role as a servant-leader, embodying values through actions rather than words. Berknell Financial Group is not solely about financial gains but also about empowering his community to pursue their passions and potentials.

For Yarnway, the greatest return on investment lies in witnessing the success and fulfillment of others, demonstrating that investing is not just about financial returns but also about enriching lives and making meaningful contributions to society.

Next.

4️⃣ Keep investing simple

Investment decisions rely on historical data, as predicting the future is impossible. This fundamental truth has significant implications.

While some investors strive to construct complex portfolios tailored to market conditions, others argue that the notion of an “optimal” portfolio is elusive.

Since investing is inherently forward-looking, decisions are based on outdated data. Thus, the true effectiveness of a strategy is only evident in hindsight, rendering it impractical.

Ashby Daniels, an advisor at Shorebridge Wealth Management, sees simplicity as the key to long-term success.

The central message here is: Keeping your investment approach simple can lead to significant rewards over time.

Daniels prioritizes three major financial goals: retirement savings, funding his children’s education, and maintaining an emergency fund. With short-term needs covered by his income, his investment strategy is tailored for the long term.

His portfolio consists entirely of equities, which carry the potential for value appreciation. Despite their volatility, equities offer substantial returns over time.

Daniels acknowledges the emotional rollercoaster of equity investments but highlights the trade-off: reduced short-term volatility typically leads to lower long-term gains.

To mitigate risk, Daniels opts for a diversified mix of index funds, providing broad market exposure without relying on individual stock performance.

He emphasizes patience and advises against frequent adjustments to investments, as attempting to outperform the market often results in underperformance.

In essence, embracing simplicity in investment strategy, maintaining a diversified portfolio, and exercising patience can yield significant long-term rewards, offering a balanced approach to wealth accumulation.

Next.

👉 Discover More:

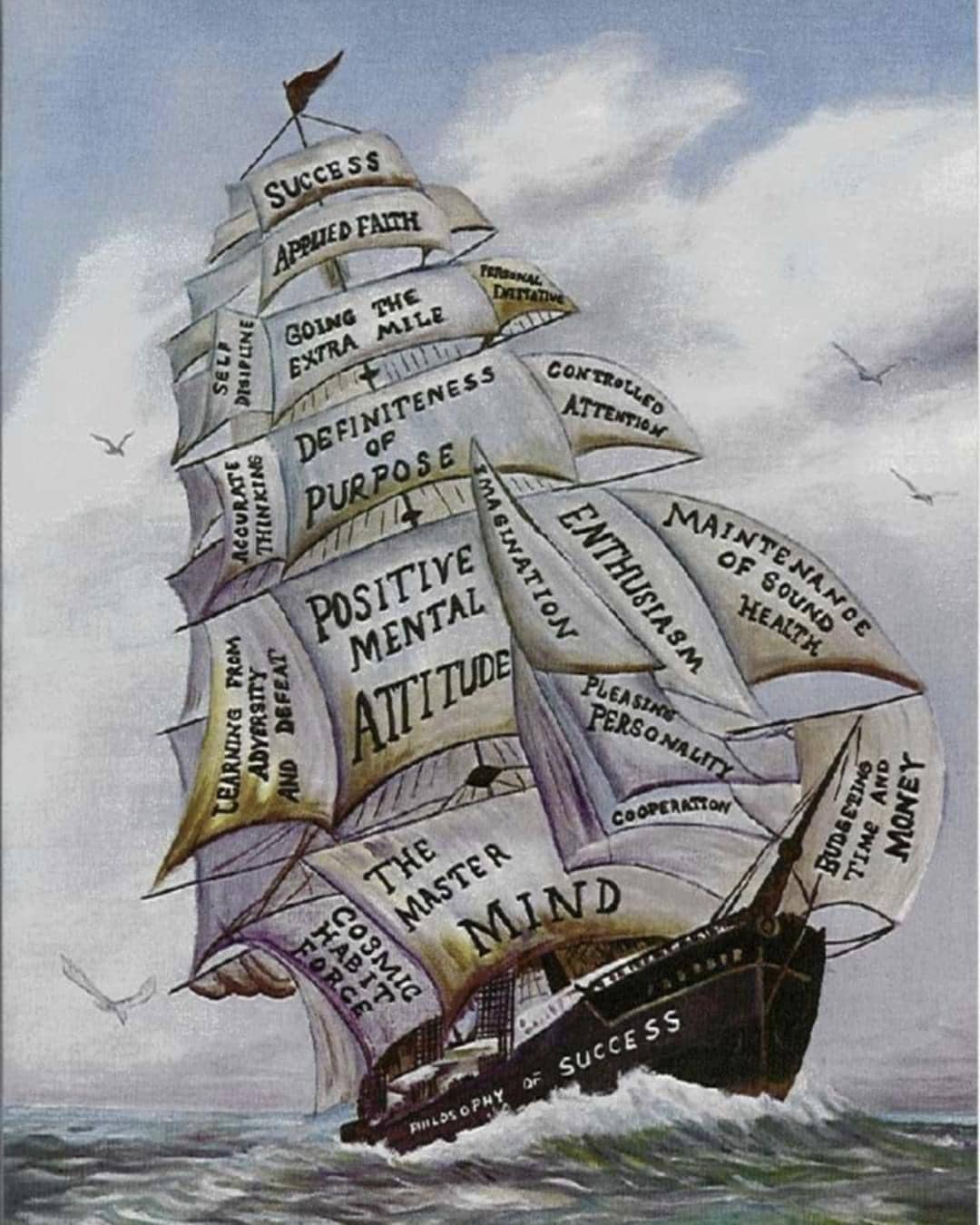

- 10 Powerful Lessons From “Think and Grow Rich”

- 12 Timeless Lessons From “The Daily Stoic”

- 12 Hidden Secrets From “The 48 Laws of Power”

5️⃣ We all make mistakes

Tyrone Ross, a rising star in wealth management, had humble beginnings, growing up in poverty in a financially illiterate environment.

Despite lacking knowledge about the stock market until age 26, Ross’s journey exemplifies the transformative power of learning from mistakes.

The central message here is: Mistakes are inevitable, but they can also lead to unexpected opportunities.

Ross’s introduction to finance came unexpectedly during a job interview, where he leveraged his experience as a probation officer to secure a position at a financial firm.

However, his initial lack of understanding about financial concepts, such as 401(k) plans, led to poor financial decisions, including draining his retirement account to support a lavish lifestyle.

These missteps, though costly, propelled Ross’s learning journey. A stint at a chop shop provided hands-on experience in the market, ultimately leading to opportunities at Merrill Lynch, where he honed his skills as a financial advisor.

Through exposure to wealth management, Ross gained insights into how affluent individuals manage their finances.

In 2017, Ross transitioned to independent investing, focusing primarily on crypto-assets like Bitcoin, alongside traditional retirement and health savings accounts. Despite the inherent risks, Ross embraces them, recognizing his youth and single status as factors that allow him to bear such risks.

In essence, Ross’s journey underscores the importance of embracing mistakes as valuable learning experiences that can lead to unforeseen opportunities for growth and success in the financial realm.

Moving on.

6️⃣ Losses are inevitable

While investing is undoubtedly serious, some investors become overly obsessed, checking their portfolios incessantly and reacting emotionally to market fluctuations. According to Joshua Rogers, founder and CEO of Arete Wealth, this hyper-focus can be detrimental in the long run.

The central message here is: Sometimes, you just need to learn to let go.

Rogers draws inspiration from Deepak Chopra’s “Law of Giving” from “The Seven Spiritual Laws of Success.” This law emphasizes the importance of generosity and openness in facilitating the flow of wealth. Like blood circulation in the body, money needs to flow freely to thrive.

Rogers applies this principle to his investing strategy by being generous, open-minded, and investing in people he trusts. This approach fosters positivity and abundance, encouraging wealth circulation and growth.

Moreover, Rogers recognizes the inevitability of losses in investing. Rather than dwelling on past mistakes, he emphasizes the importance of quickly letting go of losing investments to seize new opportunities.

This mindset shift allows investors to move forward and refocus on profitable ventures.

In essence, cultivating detachment in investing involves adopting a mindset of generosity, openness, and resilience, enabling investors to navigate market uncertainties with grace and seize new opportunities for growth and success.

👉 Discover More:

- An Open Letter to My Future Son & Daughter: Step 2

- An Open Letter to My Future Son & Daughter: Step 1

- An Open Letter to My Future Son & Daughter: Intro

How I Invest My Money Review ⭐️⭐️⭐️⭐️✩

In summary, the main takeaway from these insights is that money is deeply personal, and investment strategies should align with individual goals and values. Whether aiming for early retirement or prioritizing family time, there is no one-size-fits-all approach to investing.

For those seeking a growing income, dividend investments offer a reliable option, while investing in one’s own business may suit those prioritizing flexibility and family time.

Ultimately, the key message is that there is no universal right way to invest money; it’s about finding what works best for each individual’s unique circumstances and aspirations.

How I Invest My Money Quotes

| Joshua Brown Quotes |

|---|

| “My investment philosophy changed when I read Charles Ellis’ book Winning the Loser’s Game. The book was given to me by my employer at the time, Michael Goodman, founder of Wealthstream Advisors, Inc. Ellis convinced me that trying to beat the market is a losing proposition. In golf, par is a good score, and avoiding bogeys is more important than making birdies. Very few professional investors beat the market consistently, after accounting for the costs. The most important takeaway from Ellis’ books is that the market return is a good return. The proliferation of low-cost index funds means that the market return is ours for the taking, if only we accept it. I have not purchased an individual stock since reading that book.” |

| “It is widely accepted that anything that reduces short-term volatility must also reduce long-term return.” |

| “I can afford to not be the greatest investor in the world, but I can’t afford to be a bad one.” |

| “The idea that anybody could work really hard for some extra savings, then employ those dollars into different businesses to work around the clock for them was, and still is, endlessly fascinating to me!” |

More from thoughts.money

- The Science of Success: 17 Proven Steps to Achieve Any Goal

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

- 4 Money Lessons From “Tax-Free Wealth”

- 5 Practical Tips From “The Value of Debt in Building Wealth”

- 8 Emotional Intelligence Lessons From “The Power of Nunchi”

- 6 Down-to-Earth Lessons From “How I Invest My Money”

- 8 Life Lessons From “The Geometry of Wealth”

- 8 Money Lessons From “The Laws of Wealth”

- 11 Stress-Free Lessons From “Why Zebras Don’t Get Ulcers”

- 8 Health Tips From “The Stress Code”

- 8 Psychology Lessons From “The Behavioral Investor”

- 7 Life Secrets From “The Happiness Equation”

- 11 Humankind Lessons From “Sapiens”

- 7 Health Lessons From “The Upside of Stress”

- 9 Smart Lessons From “Emotional Intelligence”

- 10 Controversial Truths From “The Hour Between Dog and Wolf”

- 10 Powerful Sales Lessons From “The 3-Minute Rule”

- 7 Strategies for Wealth and Happiness by Jim Rohn

- 9 Lessons to Apply Today From “The Daily Laws”

- 7 Must-Know Truths From “What I Learned Losing a Million Dollars”

- 4 Never-Before-Published Lessons From “Pathways to Peace of Mind”

- 4 Long-Lost Lessons From “Outwitting the Devil”

- 8 Untold Secrets From “Napoleon Hill’s Golden Rules”

- 12 Hidden Secrets From “The 48 Laws of Power”

- 8 Practical Lessons From “The New Trading for a Living”

- Financial Wisdom From “Charlie Munger”

- Power Lessons From “13 Things Mentally Strong People Don’t Do”

- 4 Investing Lessons From “Trade Like a Stock Market Wizard”

- 7 Investing Lessons From “How to Make Money in Stocks”

- 12 Timeless Lessons From “The Daily Stoic”

- 6 Simple Lessons From “The Little Book of Common Sense Investing”

- 7 Super Ideas From “One Small Step Can Change Your Life”

- 8 Killer Lessons From “The Millionaire Real Estate Agent”

- 7 Counter-Intuitive Life Lessons From “Lives of the Stoics”

- 5 Important Life Lessons From “Million Dollar Habits”

- 6 School Lessons From “Why A Students Work for C Students”

- 9 Financial Freedom Lessons From “Rich Dad’s Cashflow Quadrant”

- 6 Wealth Lessons From “Millionaire Success Habits”

- 7 Unspoken Truths From Rich Dad’s “Retire Young Retire Rich”

- 9 Must-Know Lessons From “The Intelligent Investor”

- 14 Life Lessons From “The Snowball”

- 5 Investing Lessons From “Warren Buffett’s Ground Rules”

- 8 Money Secrets From “The Richest Man in Babylon”

- 10 Powerful Lessons From “Think and Grow Rich”

- These Are the Top 9 Lessons From “Rich Dad, Poor Dad”

- These Are the Top 5 Lessons From “How Highly Effective People Speak”

- These Are the Top 3 Lessons from “Burn the Boats”

- These Are the Top 3 Lessons from “The Power of Now”

- These Are the Top 3 Lessons from “The Psychology of Selling”

- These Are the Top 3 Lessons from “Mind Over Money”

- These Are the Top 3 Lessons From “The War Of Art”

- These Are the Top 3 Lessons from “The Dip”

- These Are the Top 3 Lessons from “Ikigai”

- These Are the Top 3 Lessons from “The 10X Rule”

- These Are the Top 3 Lessons from “The Subtle Art of Not Giving a Fuck”

- These Are the Top 3 Lessons from the “Man’s Search For Meaning”

- Should You Start a Dropshipping Business? (If Yes, How?)

- Should You Buy an REO (Real-Estate Owned) Property?

- This Is What Pet Insurance Covers

- This Is How Much Cash You Should Keep in the Bank

- This Is How to Make a Living Will (In 5 Simple Steps)

- These Are the Top 7 Dividend ETFs

- These Are the Top 10 ETFs (U.S. & International)

- These Are the Top 7 Money Market Accounts

- These Are the Top 9 Budget-Friendly Cities for Christmas

- This Is How FDIC, NCUA, and SIPC Protect Your Money

- Should You Use an Oven or Air Fryer?

- Should You Use a Dishwasher or Hand Wash?

- This Is the Difference Between a Salary and Hourly Pay

- This Is the Definition of a Christmas Club Account

- This Is How to Open an IRA (In 5 Simple Steps)

- If You Rent, It’s OK (Here Are 10 Reasons Why)

- Is There a Best Time to Buy or Sell Stocks? (Let’s See)

- This Is What the Value Line Composite Index Tells Investors

- This Is the Difference Between Technical and Fundamental Analysis

- This Is What Alpha and Beta Means in Investing

- This Is What Banking Desert Means

- So, You Want to Invest in Stocks (Here Are 5 Simple Steps)

- Do You Really Need Life Insurance? (Probably Yes)

- These Are the 6 Worst Student Loan Mistakes You Can Make

- Should You Apply for a Private or a Federal College Loan?

- Here’s the Difference Between Fixed and Adjustable Rate Mortgages

- This Is How Much the American Dream Costs Now

- This Is How to Become a Millionaire in 6 Simple Steps

- This Is What Famous Billionaires Did As Their First Job

- Here Are the 9 Most Common Motorcycle Types

- This Is the Difference Between Hard and Soft Money

- This Is How to Exercise Your Stock Warrants

- After Thanksgiving Comes Cyber Monday (What’s the Story?)

- So Long Mr. Munger: A Life Well Spent

- So, You Wanna Buy a Busa? (Here’s All You Need to Know)

- Capitalism Makes the World Go Round? (Let’s Find Out)

- Interested in Bitcoin Mining? (Here’s How It Works)

- The World’s Largest Companies (By Revenue)

- The World’s Most Profitable Companies (By Net Income)

- This Is How Much Jay-Z Is Worth

🔥 Daily Inspiration 🔥

Your mental attitude determines what sort of friends you attract.

Choose your friends carefully if you want to be a positive, successful person.

Positive friends and role models will positively affect you, while negative friends will soon kill your initiative.

Do not allow yourself to be lulled into complacency by the masses who believe mediocrity is an acceptable alternative.

Focus on the possibilities for success, not the potential for failure.

Discuss the situation with a cheerful, supportive friend when you doubt yourself.

Everyone needs a boost now and again; make sure your friends are positive, success-oriented people who always build you up, not negative thinkers who seem to find a way to tear you down.

— Napoleon Hill