What you'll learn:

The Behavioral Investor Summary

👇 The Behavioral Investor video summary 👇

What’s the story of The Behavioral Investor?

“The Behavioral Investor” (2018) delves into the subconscious thought patterns and emotions shaping the decisions of financial investors.

Daniel Crosby, the author and a psychologist specializing in behavioral finance, offers valuable insight and guidance.

His aim is to assist you in overcoming your natural inclinations, paving the way for better financial decisions.

Who’s the author of The Behavioral Investor?

Daniel Crosby’s expertise extends beyond the pages of this book.

As a psychologist and behavioral finance expert, his ideas have found a home in prestigious publications such as the Huffington Post, Risk Management Magazine, and a monthly column for Investment News.

Additionally, Crosby co-authored the New York Times best-seller “Personal Benchmark: Integrating Behavioral Finance and Investment Management.”

This background solidifies his authority in guiding readers toward a more informed and rational approach to financial choices.

Who’s The Behavioral Investor summary for?

Anyone fascinated by the dynamics of psychology, money, and investments.

And for those wishing to learn how to maximize their power to their greatest benefit.

Why read The Behavioral Investor summary?

Ever wondered how your actions quietly affect your money? Well, we’re about to uncover that.

Think about your money moves. Are they driven by strong feelings or smart thinking?

Maybe you’ve done well with money before, and that feels great.

But here’s the thing: No matter how good you are at handling money, you’re still a person with a brain that can get a bit wonky when things get tricky or stressful.

So, to be really good with money, you need to get how your brain acts in different situations and how it can lead you down paths you might not even notice until it’s too late.

Only then can you start making better money choices and kick those money mistakes to the curb.

In this summary, you’ll learn:

– The real deal about why the Mona Lisa is so famous.

– The kinda weird reasons you might like some stock names more than others.

– And the link between the weather and how people trade money.

The Behavioral Investor Lessons

| What? | How? |

|---|---|

| 1️⃣ Emotions rule the stock market (not money) | Application: Recognize the influence of emotions on your decisions. Take a moment to assess your emotional state before making investment choices. Develop strategies to manage emotional reactions to market fluctuations. |

| 2️⃣ Humans are not as rational as you think | Application: Accept the limitations of human rationality. Be aware of cognitive biases like confirmation bias and overconfidence. Double-check your decisions to ensure they are based on objective analysis rather than emotional reactions. |

| 3️⃣ Overconfidence kills | Application: Regularly evaluate and reassess your investment skills objectively. Seek feedback from others and consider alternative perspectives. Diversify your portfolio instead of concentrating on a few investments based on overconfidence. |

| 4️⃣ Embrace uncertainty | Application: Develop a mindset that acknowledges the unpredictability of markets. Plan for different scenarios and be flexible in your investment approach. Avoid the illusion of certainty and embrace a long-term perspective. |

| 5️⃣ Broaden your views | Application: Diversify your portfolio across different asset classes and regions. Consider international investments to avoid home bias. Regularly reassess your portfolio’s alignment with global market opportunities. |

| 6️⃣ Manage your emotions | Application: Practice mindfulness and self-awareness to manage emotions. Incorporate meditation or relaxation techniques to stay calm during market volatility. Implement a systematic decision-making process to reduce emotional impact. |

| 7️⃣ Follow a solid plan | Application: Develop a clear investment plan with predefined goals, risk tolerance, and strategies. Stick to your plan during market fluctuations. Periodically review and adjust the plan based on changing circumstances, but avoid impulsive changes. |

| 8️⃣ Bubbles are part of the market | Application: Understand that market bubbles are part of market cycles. Implement a rules-based system to guide decision-making during market bubbles. Focus on long-term strategies and avoid making reactive decisions based on fear. |

1️⃣ Emotions rule the stock market (not money)

So, what really makes the stock market tick?

Some might say money, right? Well, it’s crucial, but here’s the twist – the people behind the money matter even more. Those folks decide when to buy, hold, or sell.

The tricky part? Our decisions often go haywire because our brains, despite being awesome, struggle in complex and stressful situations.

Here’s the deal: If you want to make wise money moves, you’ve got to accept that your brain won’t always guide you perfectly.

Our brains are wired to keep us safe, just like our ancient ancestors dodging saber-toothed tigers. Even though you’re not facing tigers at work, your brain acts like you are.

Now, when it comes to money risk, your brain’s alarm bells ring. It focuses on avoiding threats to keep you alive. The downside? It’s tougher to think clearly, and you might miss important stuff.

Also, our brains love quick rewards. Doing something that brings instant success gives us a dopamine hit, making us feel good. We crave that feeling, sometimes too much. As an investor, you might mess up your plans, chasing short-term wins instead of long-term success.

Sure, you might know it’s not smart to chase every quick buck, but our brains are hungry for money. Dr. Brian Knutson from Harvard says humans are drawn to money, no matter its real value. It’s tempting to go after rewards.

Here’s the catch: Your brain’s money cravings can cloud your judgment. But guess what? If you’re aware of it, you can be on top of things. Knowing your brain’s tricks helps you resist impulses and avoid doing things that could mess up your money game. Smart, huh?

Onwards.

👉 Discover More:

- This Is How to Become a Millionaire in 6 Simple Steps

- So, Money Does Buy Happiness (Here’s How)

- Are You Doing These 8 Investing Mistakes Too?

2️⃣ Humans are not as rational as you think

Ever noticed a connection between the stock market and the weather? It’s a bit quirky – globally, people tend to invest more during spring and summer. This behavior echoes our ancestors, who stashed food in warmer times to survive winter.

Here’s another nugget: markets often show low returns on cloudy days. Scientists think it’s because gloomy weather makes us less happy and more risk-averse.

These patterns shout one thing – our feelings heavily shape our actions. So, drop the act of being a super-rational adult; it’s time to admit the truth.

Key Message: You’re not as rational as you think.

When we decide, we’re pros at justifying our choices, convincing ourselves we’re doing the right thing. We also tend to trash-talk the options we didn’t pick, making us feel even better about our choice.

Challenge our decisions, and we get defensive, ignoring new info that shows we goofed. This ego-driven need to protect our self-identity makes it tough to change course, even when a decision flops. That’s why people cling to sinking investments instead of cutting losses.

Comfort is our jam. We stick to the familiar, even if it’s boring or bad, because change is scary. Fear of loss keeps us holding onto what we have, even if there’s potential for more.

Take the German town example – they could’ve had a shiny new town, but nope, they chose the same old, impractical design.

To rock as an investor, you gotta get comfy with discomfort. Markets change, losses happen, and regrets lurk. But if you accept this, you can take rational steps forward, not letting emotions anchor you in the past or freeze you with fear.

Next.

3️⃣ Overconfidence kills

Picture a world without confidence – no cool scientific discoveries, no innovative businesses, none of the wonders we enjoy today. Confidence can be a powerhouse, but here’s the twist: too much of it can lead to destructive, ego-driven behavior.

Key Message: Overconfidence is a liability.

When investors score wins, they often credit their unique skills, ignoring the fact that the whole market is rising. This overconfidence might make them keep buying, even when prices are sky-high. That’s a no-no in the “buy low, sell high” rule every smart investor should follow.

On average, investors overestimate their yearly returns by 11.5%. Turns out, they’re not as skilled as they think. And when returns drop, they struggle to admit it – egos don’t like facing failure. To succeed, leave your ego at the door each day.

Overconfidence also tricks investors into skipping diversification. When a company’s doing well, it feels like a sure bet. But even if a stock seems rock-solid, don’t put all your eggs in one basket. Aim for around 20 stocks in your portfolio. Why? Because the market is uncertain, and luck plays a part.

Diversification isn’t just about spreading risk; it helps with market predictions. Pooled judgments, considering many opinions, beat individual guesses. Economist R.M. Hogarth says seeking a dozen estimates gives solid guidance.

But beware of confirmation bias – our tendency to seek opinions confirming our own. Get predictions from diverse sources using different methods. Your ego might prefer agreement, but tapping into the crowd’s wisdom ensures informed decisions.

Moving on.

4️⃣ Embrace uncertainty

Take the Mona Lisa, for instance – considered a masterpiece now, but it was a nobody until stolen in 1911. Two days missing, and no one noticed. The media frenzy around its theft made it famous. Turns out, it was the scandal, not just the art, that drew attention.

This story reveals our love for the familiar. Your brain likes shortcuts, and familiar stuff is easier to process. Sadly, this habit puts your investment at risk.

Key Message: To invest successfully, embrace the unfamiliar.

Still skeptical about our love for the familiar? Check your favorite stock tickers. Easy-to-say names like MOO grab attention, while the not-so-easy ones like NTT get the cold shoulder.

This preference for the familiar extends to investing in homegrown stocks. Ideally, your portfolio should match the market size of each country. In reality, not so much.

British investors, for example, load up on local stocks (80%) despite the UK having just 10% of the world market value. Missing out on global opportunities and risking disaster.

Why? Normalcy bias – we think we’ve seen it all and delay reacting to disasters. Accepting financial upheaval is key to being a smart investor. Combat uncertainty by building diverse portfolios to weather the natural ups and downs.

Onwards.

👉 Discover More:

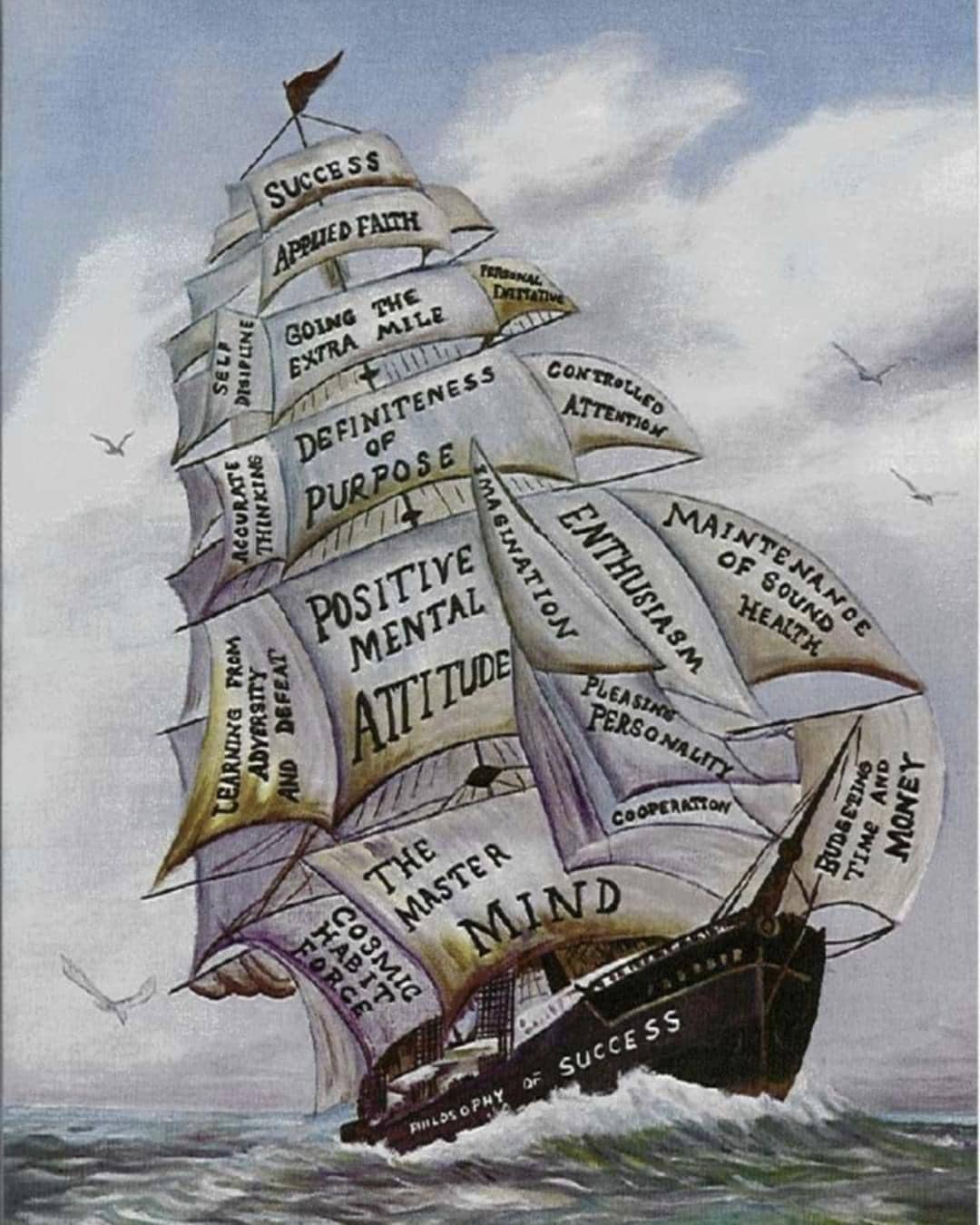

- 10 Powerful Lessons From “Think and Grow Rich”

- 12 Timeless Lessons From “The Daily Stoic”

- 12 Hidden Secrets From “The 48 Laws of Power”

5️⃣ Broaden your views

Travel back to colonial Massachusetts in the 1690s – a time of witch trials. Accused women faced a bizarre test: float in water, and you’re a witch; sink, and you’re innocent. Either way, you’d end up gone.

Why didn’t people see the absurdity? Our attention gets hooked on high-risk, low-probability situations, stirring our emotions. This focus makes us ignore relevant info.

Key Message: To invest successfully, broaden your views.

High-risk situations can blind us to simple solutions. Many investors, in their quest for a market edge, end up with overly complex strategies.

Surprisingly, it’s not a genius manager or a cutting-edge process that predicts a fund’s success – it’s the fees, as found by data analysis company Morningstar. But if you’re obsessed with success and scared of failure, you might overlook this straightforward evaluation tool.

Another slip-up is fixating on a stock’s short-term performance. This is common if your decisions rely on probability, which works better over longer periods.

Daily market checks seem random; monthly trends don’t offer much insight. It’s when you zoom out to annual performance that the big picture emerges. Sadly, many investors bail before stocks reveal their true value.

To be a behavioral investor, take the long view. First, scrub your portfolio of any stocks at risk. Diversify to dodge disasters. Trust time; it’ll help you ride out short-term bumps.

Next.

6️⃣ Manage your emotions

Think about emotions – how many can you name? René Descartes had six in mind, but today we’re looking at a whopping 150-plus, blending into complex feelings.

While making financial decisions daily, these emotions are right there, influencing your choices. Don’t underestimate their power – especially in investing, where emotions can be a big hurdle.

Key Message: To invest successfully, manage your emotions.

Your emotional landscape shapes how you perceive situations, and it influences what you do with your money. Nobel Prize-winning economist Richard Thaler found that how we label money buckets affects our decisions. For instance, we save labeled “rebates” but spend labeled “bonuses.”

Enter goals-based investing, also called personal benchmarking. Split your money into safety, income, and growth buckets, then invest according to your emotions.

While emotions can be part of your strategy, they’re not always investment-friendly. Strong emotions lead to bad decisions. Counter this by slowing down your thinking, a skill you can develop through meditation.

Mindfulness exercises help you become more aware, creating space to consider details and make informed decisions over time.

Meditation is so valuable for investors that companies like BlackRock and Goldman Sachs have programs for their staff. Regular meditation reduces brain activity controlling greed, preventing mistakes from chasing quick rewards.

Even if you see yourself as well-regulated, emotions are so universal that you often don’t notice them. Paying attention helps you know when to follow them and when to keep them in check.

Next.

👉 Discover More:

- An Open Letter to My Future Son & Daughter: Step 2

- An Open Letter to My Future Son & Daughter: Step 1

- An Open Letter to My Future Son & Daughter: Intro

7️⃣ Follow a solid plan

Let’s talk about your brain – a real data-processing champ. It can handle over eleven million bits of data simultaneously, yet only around 50 of these become conscious thoughts. Most of your brain’s power? That’s dedicated to your subconscious mind.

Considering the limited processing power for conscious decisions, it’s no surprise many investors trust their gut instincts. But relying solely on intuition isn’t a reliable investment strategy.

Key Message: To be a successful investor, understand the influence of your intuition.

Conscious thought is great for simple decisions but falls short when things get complicated. The more options you weigh, the tougher the decision-making process becomes. It’s hard to figure out what matters most, and as you struggle, confidence in your decision wavers.

Humans nail decisions when outcomes are predictable, situations are stable, and there’s quality feedback. Unfortunately, these conditions don’t exist in capital markets. Accept that conscious thinking isn’t the ideal decision-making tool for investors.

Here’s the good news – model-based approaches, like extrapolation algorithms, compensate for your brain’s limits. Surprisingly, models perform as well as, and sometimes better than, humans 94 percent of the time. They shine in stressful moments when human judgment falters due to fear.

As an investor, you’re bombarded with financial news, opinions, and the ever-present greed. Without a robust model, stress can break you. But with a committed approach to a model, your investment decisions won’t be hostage to your emotions.

Onwards.

8️⃣ Bubbles are part of the market

Let’s dive into the world of market bubbles – a love affair turned sour during the dot-com boom.

In the tech frenzy, investors went wild, grabbing shares in any company with a techy name. Mannatech Inc., a laxative manufacturer, saw its share price surge by 368% in the first two days of its public offering.

Love for the idea that every tech company would make us rich blinded us to warning signs. Reality hit, the bubble burst, and we had to clean up the mess.

Key Message: To be a successful investor, manage your fear of market bubbles.

Bubbles are part of capital markets, but they’re not as common as we fear. From 1800 to 1940, there were just 23 bubbles in the UK and US markets.

Traumatizing experiences make them stick in public memory. Fear of bubbles can paralyze investors, making it crucial to master emotional management.

To navigate market ups and downs, create a rules-based system. Get more conservative when things get shaky, focus on patience, and act infrequently. Don’t let daily emotions drive reactive decisions.

A momentum-based model with a 200-day moving average is a common system. Hold assets when their price is above the average, sell when it drops below. A ten-month moving average model works similarly.

Long periods of inactivity may seem odd in the fast-paced stock market, but they give you time to shift odds in your favor. Stick to your system even when fear kicks in. It’s the key to managing emotions and avoiding poor decisions driven by instinct.

The Behavioral Investor Review

In the world of capital markets, volatility is primarily fueled by investor decisions rather than the nature of money itself.

Despite our confidence, our brains aren’t flawless decision-makers, and various factors, from weather conditions to the familiarity of a ticker name, can subtly influence our investment choices.

To make better decisions, it’s crucial to comprehend how your brain reacts to stress and consciously choose a more informed approach.

Manage stress using the R.A.I.N. model.

In moments of acute stress, adopt Michele McDonald’s R.A.I.N model to regain a calm state of mind.

Start by Recognizing the physical sensations, like an increased heart rate.

Accept what you’ve observed, even if it’s uncomfortable.

Investigate the narratives you’re telling yourself about the situation and identify alternative thoughts.

Finally, practice Non-identification, acknowledging that feeling stress doesn’t define you.

The Behavioral Investor Quotes

| Daniel Crosby Quotes |

|---|

| “The fact that your brain becomes more risk-seeking in bull markets and more conservative in bear markets means that you are neurologically predisposed to violate the first rule of investing, ‘buy low and sell high.’ Our flawed brain leads us to subjectively experience low levels of risk when risk is actually quite high, a concept that Howard Marks refers to as the ‘perversity of risk.” – Daniel Crosby, The Behavioral Investor |

| “In a path-breaking work on the nature of bubbles, Greenwood, Shleifer and You (‘Bubbles for Fama’) share some fascinating findings. Among the most compelling is that only a slight majority of bubbles actually burst.” – Daniel Crosby, The Behavioral Investor |

| “H.A.L.T. – that would also serve investors very well. The acronym stands for hungry, angry, lonely, tired and is a reminder to abstain from making important decisions in any of these emotional states.” – Daniel Crosby, The Behavioral Investor |

| “When a proposal to change a certain parameter is thought to have bad overall consequences, consider a change to the same parameter in the opposite direction. If this is also thought to have bad overall consequences, then the onus is on those who reach these conclusions to explain why our position cannot be improved through changes to this parameter. If they are unable to do so, then we have reason to suspect that they suffer from status quo bias.” – Daniel Crosby, The Behavioral Investor |

| “Prepare for bursting bubbles without being too fine-tuned to them.” – Daniel Crosby, The Behavioral Investor |

| “Once these basic needs are met, quality of life has less to do with buying happiness and more to do with individual attitudes.” – Daniel Crosby, The Behavioral Investor |

| “While we tend to think of bear markets as risky, true risk actually builds up during periods of prosperity and simply materializes during bear markets. During good times, investors bid up risk assets, becoming less discerning and more willing to pay any price necessary to take the ride.” – Daniel Crosby, The Behavioral Investor |

| “Humans are wired to act; markets tend to reward inaction.” – Daniel Crosby, The Behavioral Investor |

| “Understanding the impact of human physiology on investment decision-making is an underappreciated area of study that represents a unique source of advantage for the thoughtful investor.” – Daniel Crosby, The Behavioral Investor |

| “Revisiting Batnick’s periods of low real returns using Shiller CAPE, we also observe that long periods of poor performance often begin with overvaluation that is worked off over time. The Shiller CAPE levels of the broad market on January 1 of each the years cited above were as follows: 1929 – 27.06 1944 – 11.05 1965 – 23.27 2000 – 43.77 Today – 28.80 Mean – 16.67” – Daniel Crosby, The Behavioral Investor |

| “Intuition is the silent coming together of a lifetime of learning and must be cultivated if it is to be useful.” – Daniel Crosby, The Behavioral Investor |

| “The behavioral investor understands and seeks to mimic the best parts of passive investing – low turnover, rock bottom fees and appropriate diversification – without succumbing to absentminded buying and selling.” – Daniel Crosby, The Behavioral Investor |

| “This book could have easily been three words long: automate, automate, automate. It likely wouldn’t have sold well, and you might have ignored the advice on account of it seeming too simple, but the fact is that many of the thornier elements of emotion can be done away with entirely by slavishly following a system of investment rules in all types of market weather.” – Daniel Crosby, The Behavioral Investor |

| “Being a behavioral investor is less about adhering to some textbook notion of rationality and more about understanding and bending the idiosyncrasies of human nature to our advantage.” – Daniel Crosby, The Behavioral Investor |

| “For a factor to be worthwhile to a behavioral investor it must be empirically supported, theoretically sound and behaviorally intransigent.” – Daniel Crosby, The Behavioral Investor |

| “One of the things that makes adhering to probabilities so difficult (and profitable) for an investor is that emotion has a pronounced impact on how we assess probability. Predictably, positive emotion leads us to overstate the likelihood of positive occurrences and negative emotion does just the opposite. This coloring of probability leads us to misapprehend risk… All too often we confuse the intensity of our longing with the probability of our winning.” – Daniel Crosby, The Behavioral Investor |

| “But the paradox in owning our personal mediocrity is that it makes us, in the strictest sense of the word, exceptional. It is not about believing in yourself – in fact, it’s quite the opposite. It’s about realizing that the less you need to be special, the more special you’ll become… Exceptional investment outcomes are attainable by all of us, if we just stop trying so hard.” – Daniel Crosby, The Behavioral Investor |

| “Far from seamlessly assimilating new ideas into our existing belief framework, research shows that we actually tend to get more firm in our cherished beliefs when those beliefs become challenged.” – Daniel Crosby, The Behavioral Investor |

| “So much of human behavior – political, religious, financial – can be explained by the fact that we want to think the best of ourselves and don’t want to work very hard to do it.” – Daniel Crosby, The Behavioral Investor |

More from thoughts.money

- The Science of Success: 17 Proven Steps to Achieve Any Goal

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

- 4 Money Lessons From “Tax-Free Wealth”

- 5 Practical Tips From “The Value of Debt in Building Wealth”

- 8 Emotional Intelligence Lessons From “The Power of Nunchi”

- 6 Down-to-Earth Lessons From “How I Invest My Money”

- 8 Life Lessons From “The Geometry of Wealth”

- 8 Money Lessons From “The Laws of Wealth”

- 11 Stress-Free Lessons From “Why Zebras Don’t Get Ulcers”

- 8 Health Tips From “The Stress Code”

- 8 Psychology Lessons From “The Behavioral Investor”

- 7 Life Secrets From “The Happiness Equation”

- 11 Humankind Lessons From “Sapiens”

- 7 Health Lessons From “The Upside of Stress”

- 9 Smart Lessons From “Emotional Intelligence”

- 10 Controversial Truths From “The Hour Between Dog and Wolf”

- 10 Powerful Sales Lessons From “The 3-Minute Rule”

- 7 Strategies for Wealth and Happiness by Jim Rohn

- 9 Lessons to Apply Today From “The Daily Laws”

- 7 Must-Know Truths From “What I Learned Losing a Million Dollars”

- 4 Never-Before-Published Lessons From “Pathways to Peace of Mind”

- 4 Long-Lost Lessons From “Outwitting the Devil”

- 8 Untold Secrets From “Napoleon Hill’s Golden Rules”

- 12 Hidden Secrets From “The 48 Laws of Power”

- 8 Practical Lessons From “The New Trading for a Living”

- Financial Wisdom From “Charlie Munger”

- Power Lessons From “13 Things Mentally Strong People Don’t Do”

- 4 Investing Lessons From “Trade Like a Stock Market Wizard”

- 7 Investing Lessons From “How to Make Money in Stocks”

- 12 Timeless Lessons From “The Daily Stoic”

- 6 Simple Lessons From “The Little Book of Common Sense Investing”

- 7 Super Ideas From “One Small Step Can Change Your Life”

- 8 Killer Lessons From “The Millionaire Real Estate Agent”

- 7 Counter-Intuitive Life Lessons From “Lives of the Stoics”

- 5 Important Life Lessons From “Million Dollar Habits”

- 6 School Lessons From “Why A Students Work for C Students”

- 9 Financial Freedom Lessons From “Rich Dad’s Cashflow Quadrant”

- 6 Wealth Lessons From “Millionaire Success Habits”

- 7 Unspoken Truths From Rich Dad’s “Retire Young Retire Rich”

- 9 Must-Know Lessons From “The Intelligent Investor”

- 14 Life Lessons From “The Snowball”

- 5 Investing Lessons From “Warren Buffett’s Ground Rules”

- 8 Money Secrets From “The Richest Man in Babylon”

- 10 Powerful Lessons From “Think and Grow Rich”

- These Are the Top 9 Lessons From “Rich Dad, Poor Dad”

- These Are the Top 5 Lessons From “How Highly Effective People Speak”

- These Are the Top 3 Lessons from “Burn the Boats”

- These Are the Top 3 Lessons from “The Power of Now”

- These Are the Top 3 Lessons from “The Psychology of Selling”

- These Are the Top 3 Lessons from “Mind Over Money”

- These Are the Top 3 Lessons From “The War Of Art”

- These Are the Top 3 Lessons from “The Dip”

- These Are the Top 3 Lessons from “Ikigai”

- These Are the Top 3 Lessons from “The 10X Rule”

- These Are the Top 3 Lessons from “The Subtle Art of Not Giving a Fuck”

- These Are the Top 3 Lessons from the “Man’s Search For Meaning”

- Should You Start a Dropshipping Business? (If Yes, How?)

- Should You Buy an REO (Real-Estate Owned) Property?

- This Is What Pet Insurance Covers

- This Is How Much Cash You Should Keep in the Bank

- This Is How to Make a Living Will (In 5 Simple Steps)

- These Are the Top 7 Dividend ETFs

- These Are the Top 10 ETFs (U.S. & International)

- These Are the Top 7 Money Market Accounts

- These Are the Top 9 Budget-Friendly Cities for Christmas

- This Is How FDIC, NCUA, and SIPC Protect Your Money

- Should You Use an Oven or Air Fryer?

- Should You Use a Dishwasher or Hand Wash?

- This Is the Difference Between a Salary and Hourly Pay

- This Is the Definition of a Christmas Club Account

- This Is How to Open an IRA (In 5 Simple Steps)

- If You Rent, It’s OK (Here Are 10 Reasons Why)

- Is There a Best Time to Buy or Sell Stocks? (Let’s See)

- This Is What the Value Line Composite Index Tells Investors

- This Is the Difference Between Technical and Fundamental Analysis

- This Is What Alpha and Beta Means in Investing

- This Is What Banking Desert Means

- So, You Want to Invest in Stocks (Here Are 5 Simple Steps)

- Do You Really Need Life Insurance? (Probably Yes)

- These Are the 6 Worst Student Loan Mistakes You Can Make

- Should You Apply for a Private or a Federal College Loan?

- Here’s the Difference Between Fixed and Adjustable Rate Mortgages

- This Is How Much the American Dream Costs Now

- This Is How to Become a Millionaire in 6 Simple Steps

- This Is What Famous Billionaires Did As Their First Job

- Here Are the 9 Most Common Motorcycle Types

- This Is the Difference Between Hard and Soft Money

- This Is How to Exercise Your Stock Warrants

- After Thanksgiving Comes Cyber Monday (What’s the Story?)

- So Long Mr. Munger: A Life Well Spent

- So, You Wanna Buy a Busa? (Here’s All You Need to Know)

- Capitalism Makes the World Go Round? (Let’s Find Out)

- Interested in Bitcoin Mining? (Here’s How It Works)

- The World’s Largest Companies (By Revenue)

- The World’s Most Profitable Companies (By Net Income)

- This Is How Much Jay-Z Is Worth

🔥 Daily Inspiration 🔥

The quality and quantity of the service you render, plus the attitude with which you render it, determine the amount of pay you get and the sort of job you hold.

The people who are promoted to the best positions in the company are those who make it a practice to go the extra mile, to do more than they are paid to do, and to do it willingly and cheerfully.

You take the first important step toward determining your own future when you make the conscious decision to approach every task with a positive outlook and to stick with the job until it is done.

If you find this attitude difficult at first, you’ll discover it eventually becomes part of you.

And after you begin to realize the benefits that accrue to you because you are known as someone who always gives a little extra, you wouldn’t consider doing things any other way.

— Napoleon Hill