What you'll learn:

➤ How Much Does the American Dream Cost?

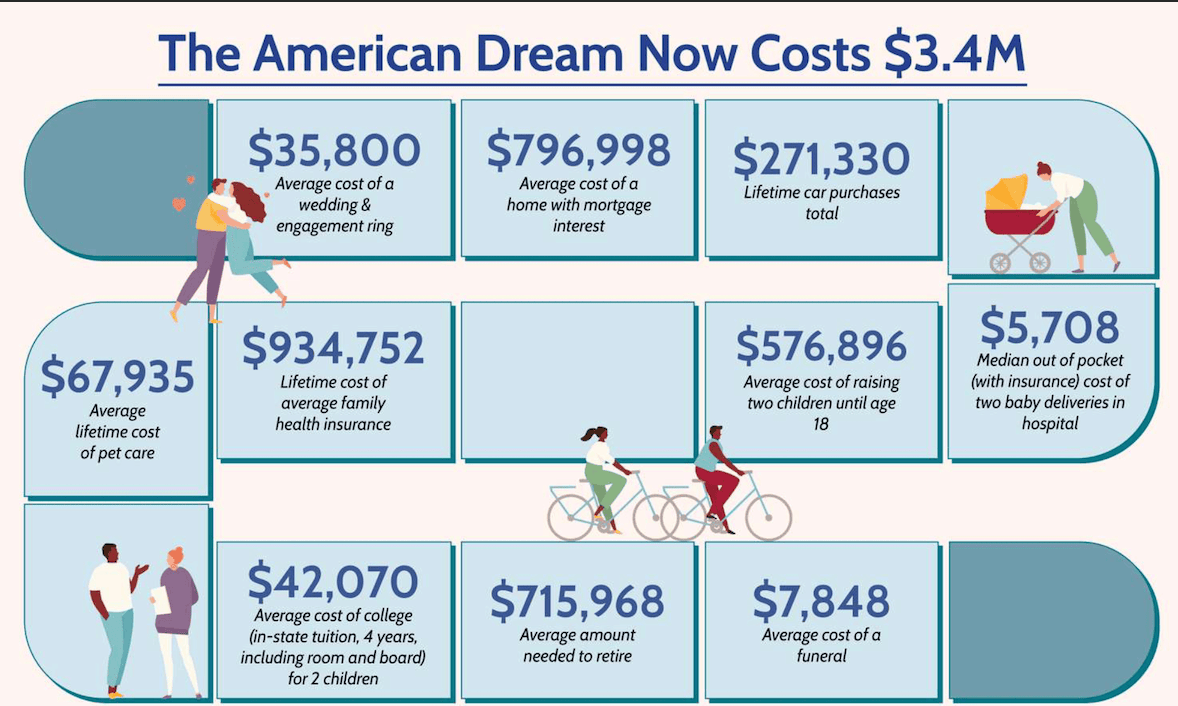

Ever wondered about the price tag on the classic American Dream? Turns out, it’s now ringing in at a hefty $3.4 million. Yeah, that’s a jaw-dropping figure!

So, what’s in this pricey American dream package?

Well, brace yourself. It covers the whole shebang—marriage, kids (two of ’em), a house that feels like home, healthcare, cars to cruise around in, and a top-notch education.

Let’s zoom in on a couple of eye-opening stats. Just raising two kiddos till they’re 18? That’ll set you back over half a million dollars. Yep, parenting comes with a significant price tag.

And that dreamy house with a white picket fence?

The average lifetime cost, including a mortgage with a 10% down payment and a 30-year fixed rate of 7.2%, hits close to $800k. Whoa, that’s a pretty penny!

All these figures might sound staggering, and rightly so. They paint a picture of the modern American Dream—glorious, yes, but also quite the investment.

So, while chasing this dream, it might be worth knowing what it really costs in today’s world.

➤ What is the American dream?

You know that classic “American Dream”? Well, it’s often pictured with a wedding, a couple of kiddos, and those golden college years. But let’s talk numbers for a sec.

| Milestone | Cost | Description |

|---|---|---|

| Hospital Birth | $5,708 | Average out-of-pocket costs for those enrolled in large group plans ($16,011 covered by insurance). Total shown for 2 children. (2018-2020, Peterson-KFF) |

| Raising Children to 18 | $576,896 | Average cost of raising a child until age 18. Total shown for 2 children. (2015 USDA, adjusted for inflation to 2022) |

| Car Purchases | $271,330 | Average purchase price for used car. Total shown for 10 purchases (6-year old used car, lasting around 6 years each) over a lifetime (driving ages 16-80). (2023, iSeeCars.com) |

| College | $42,070 | Average cost of an in-state 4-year institution including room and board. Total shown for 2 children. (2020-21, National Center for Education Statistics) |

| Wedding | $35,800 | Average cost of a wedding and engagement ring (2022, TheKnot.com) |

| Home | $796,998 | Average purchase price for a home, with lifetime mortgage costs. Mortgage assumes 10% down payment, 30-year fixed loan at 7.2% interest. (September 2023 purchase price and rates, Zillow, CFPB, St. Louis Fed) Does not include other costs including taxes, origination and lender charges, etc. |

| Pets | $67,935 | Midpoint cost of lifetime care (15 years) for a dog and cat. (2022, Synchrony) |

| Health Insurance | $934,752 | Average family premium costs. Total showing 39 years of current annual costs (ages 26-65). (2018-2020, Peterson-KFF) |

| Retirement | $715,968 | 80% of 2022 median household income. Total showing 12 years (average life expectancy past 65). (2022, U.S. Census, CDC) |

| Funeral Costs | $7,848 | Average costs of a funeral with a viewing and burial (2023, PolicyGenius) |

Wedding

For those going down the marriage lane, the average cost of saying “I do” and getting that oh-so-precious engagement ring hits around $35,800 as of 2022, according to The Knot.

And here’s where things get real pricey—starting a family isn’t all rainbows and butterflies. Those hospital bills for welcoming two little munchkins into the world?

They’ll put you out an average of $5,708 out-of-pocket per child, if you’re covered under a big health plan.

Kids

But hold onto your hats! Raising those two bundles of joy until they hit 18? Brace yourself—it’s clocking in at over half a million bucks. Yep, you read that right!

College

And let’s not forget the golden ticket to the future—college.

If your kiddos have their sights set on higher education, expect to shell out an average of $42,070 for each kid, including their room and board, at a four-year in-state school.

Pets

Now, if your family’s got a furry addition in the form of a dog or cat, get ready for some costs there too. Over a 15-year lifespan for each pet, you could be looking at a cool $67k in lifetime care.

Home

Let’s talk about two big-ticket items in the American Dream playbook—owning a home and having wheels.

Now, homeownership, that’s been a cornerstone of the American Dream for ages. But here’s the scoop—mortgage rates have been sky-high lately, hitting a whopping 7.79% in October 2023.

With these rates shooting up, home sales took a nosedive, hitting a 13-year low.

Why?

Well, those towering mortgage rates made the dream of owning a home seem like a distant reality for many hopeful buyers.

When you crunch the numbers, the average lifetime cost of owning a home, including a mortgage with a 10% down payment and a 30-year fixed rate of 7.2%, shakes out to around $796,998. That’s a hefty price tag, no doubt about it.

Cars

Now, let’s rev up to cars. Over a lifetime, if you’re looking at buying wheels for yourself and your crew, get ready to shell out roughly $271,330 for 10 car purchases.

Picture this—six-year-old used cars bought every six years from age 16 to 80. It’s a real investment on the road!

Retirement

And hey, retirement—it’s that golden phase we all aim for, right? Experts recommend aiming for about $715,968 saved up if you plan on living off 80% of your pre-retirement annual income.

Seems like a mountain to climb?

Don’t worry, we’ve got your back with retirement investment guides. It’s never too late to start securing your golden years!

References

- Cost of delivering two children: Peterson-KFF’s 2018-2020 Health System Tracker

- Cost of health insurance: KFF’s 2023 Employer Health Benefits Survey

- Cost of raising two children to 18: USDA’s 2015 Expenditures on Children by Families

- Car costs: iSeeCars’ 2023 Study, S&P Global Mobility

- Costs of a lifetime of pet care: Synchrony’s 2022 Lifetime of Care study

- Cost of college: National Center for Education Statistics’ 2020-2021

- Cost of a wedding and engagement ring: The Knot 2022 Real Weddings Study

- Cost of a home and mortgage: Zillow’s average home price estimate, St. Louis Fed

- Cost of retirement: Census.gov, CDC, Investopedia

- Cost of a funeral: PolicyGenius (2023)

More from thoughts.money

- The Science of Success: 17 Proven Steps to Achieve Any Goal

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

- 4 Money Lessons From “Tax-Free Wealth”

- 5 Practical Tips From “The Value of Debt in Building Wealth”

- 8 Emotional Intelligence Lessons From “The Power of Nunchi”

- 6 Down-to-Earth Lessons From “How I Invest My Money”

- 8 Life Lessons From “The Geometry of Wealth”

- 8 Money Lessons From “The Laws of Wealth”

- 11 Stress-Free Lessons From “Why Zebras Don’t Get Ulcers”

- 8 Health Tips From “The Stress Code”

- 8 Psychology Lessons From “The Behavioral Investor”

- 7 Life Secrets From “The Happiness Equation”

- 11 Humankind Lessons From “Sapiens”

- 7 Health Lessons From “The Upside of Stress”

- 9 Smart Lessons From “Emotional Intelligence”

- 10 Controversial Truths From “The Hour Between Dog and Wolf”

- 10 Powerful Sales Lessons From “The 3-Minute Rule”

- 7 Strategies for Wealth and Happiness by Jim Rohn

- 9 Lessons to Apply Today From “The Daily Laws”

- 7 Must-Know Truths From “What I Learned Losing a Million Dollars”

- 4 Never-Before-Published Lessons From “Pathways to Peace of Mind”

- 4 Long-Lost Lessons From “Outwitting the Devil”

- 8 Untold Secrets From “Napoleon Hill’s Golden Rules”

- 12 Hidden Secrets From “The 48 Laws of Power”

- 8 Practical Lessons From “The New Trading for a Living”

- Financial Wisdom From “Charlie Munger”

- Power Lessons From “13 Things Mentally Strong People Don’t Do”

- 4 Investing Lessons From “Trade Like a Stock Market Wizard”

- 7 Investing Lessons From “How to Make Money in Stocks”

- 12 Timeless Lessons From “The Daily Stoic”

- 6 Simple Lessons From “The Little Book of Common Sense Investing”

- 7 Super Ideas From “One Small Step Can Change Your Life”

- 8 Killer Lessons From “The Millionaire Real Estate Agent”

- 7 Counter-Intuitive Life Lessons From “Lives of the Stoics”

- 5 Important Life Lessons From “Million Dollar Habits”

- 6 School Lessons From “Why A Students Work for C Students”

- 9 Financial Freedom Lessons From “Rich Dad’s Cashflow Quadrant”

- 6 Wealth Lessons From “Millionaire Success Habits”

- 7 Unspoken Truths From Rich Dad’s “Retire Young Retire Rich”

- 9 Must-Know Lessons From “The Intelligent Investor”

- 14 Life Lessons From “The Snowball”

- 5 Investing Lessons From “Warren Buffett’s Ground Rules”

- 8 Money Secrets From “The Richest Man in Babylon”

- 10 Powerful Lessons From “Think and Grow Rich”

- These Are the Top 9 Lessons From “Rich Dad, Poor Dad”

- These Are the Top 5 Lessons From “How Highly Effective People Speak”

- These Are the Top 3 Lessons from “Burn the Boats”

- These Are the Top 3 Lessons from “The Power of Now”

- These Are the Top 3 Lessons from “The Psychology of Selling”

- These Are the Top 3 Lessons from “Mind Over Money”

- These Are the Top 3 Lessons From “The War Of Art”

- These Are the Top 3 Lessons from “The Dip”

- These Are the Top 3 Lessons from “Ikigai”

- These Are the Top 3 Lessons from “The 10X Rule”

- These Are the Top 3 Lessons from “The Subtle Art of Not Giving a Fuck”

- These Are the Top 3 Lessons from the “Man’s Search For Meaning”

- Should You Start a Dropshipping Business? (If Yes, How?)

- Should You Buy an REO (Real-Estate Owned) Property?

- This Is What Pet Insurance Covers

- This Is How Much Cash You Should Keep in the Bank

- This Is How to Make a Living Will (In 5 Simple Steps)

- These Are the Top 7 Dividend ETFs

- These Are the Top 10 ETFs (U.S. & International)

- These Are the Top 7 Money Market Accounts

- These Are the Top 9 Budget-Friendly Cities for Christmas

- This Is How FDIC, NCUA, and SIPC Protect Your Money

- Should You Use an Oven or Air Fryer?

- Should You Use a Dishwasher or Hand Wash?

- This Is the Difference Between a Salary and Hourly Pay

- This Is the Definition of a Christmas Club Account

- This Is How to Open an IRA (In 5 Simple Steps)

- If You Rent, It’s OK (Here Are 10 Reasons Why)

- Is There a Best Time to Buy or Sell Stocks? (Let’s See)

- This Is What the Value Line Composite Index Tells Investors

- This Is the Difference Between Technical and Fundamental Analysis

- This Is What Alpha and Beta Means in Investing

- This Is What Banking Desert Means

- So, You Want to Invest in Stocks (Here Are 5 Simple Steps)

- Do You Really Need Life Insurance? (Probably Yes)

- These Are the 6 Worst Student Loan Mistakes You Can Make

- Should You Apply for a Private or a Federal College Loan?

- Here’s the Difference Between Fixed and Adjustable Rate Mortgages

- This Is How Much the American Dream Costs Now

- This Is How to Become a Millionaire in 6 Simple Steps

- This Is What Famous Billionaires Did As Their First Job

- Here Are the 9 Most Common Motorcycle Types

- This Is the Difference Between Hard and Soft Money

- This Is How to Exercise Your Stock Warrants

- After Thanksgiving Comes Cyber Monday (What’s the Story?)

- So Long Mr. Munger: A Life Well Spent

- So, You Wanna Buy a Busa? (Here’s All You Need to Know)

- Capitalism Makes the World Go Round? (Let’s Find Out)

- Interested in Bitcoin Mining? (Here’s How It Works)

- The World’s Largest Companies (By Revenue)

- The World’s Most Profitable Companies (By Net Income)

- This Is How Much Jay-Z Is Worth

- Millennial Women Prefer Real Estate than Stocks (Survey Says)

🔥 Daily Inspiration 🔥

Top 15 Things Money Can’t Buy:

Roy T. Bennett, The Light in the Heart

Time. Happiness. Inner Peace. Integrity. Love. Character. Manners. Health. Respect. Morals. Trust. Patience. Class. Common sense. Dignity.