What you'll learn:

Playing with FIRE Summary

👇 Playing with FIRE video summary 👇

What’s the story of Playing with FIRE?

Playing with FIRE (2019) explores the popular trend known as FIRE, which stands for Financial Independence, Retire Early.

The book shares the personal journey of the author and includes stories of various people who have embraced the FIRE lifestyle.

It offers insights into how changing your spending and investing habits can lead to pursuing your passions and living a more fulfilling life.

Who’s the author of Playing with FIRE?

Scott Rieckens is a well-rounded individual with experience as an Emmy-nominated producer, author, and entrepreneur.

Before delving into the FIRE movement, he worked on producing films and videos for renowned platforms such as WIRED, Facebook, and NBC.

Recently, he completed a documentary called “Playing with FIRE,” which chronicles his journey within the FIRE community.

Who’s Playing with FIRE summary for?

Anyone fascinated by the dynamics of retirement, money, and investments.

And for those wishing to learn how to maximize their power to their greatest benefit.

Why read Playing with FIRE summary?

Scott Rieckens, just like many of us, found himself caught in the cycle of overworking to sustain a lifestyle he believed he needed after college.

However, everything changed for him one day while driving to work and listening to a podcast featuring financial guru Mr. Money Mustache discussing the FIRE movement.

This revelation transformed Rieckens’ life.

Within a short span of five months, Rieckens quit his job, drastically reduced his family’s expenses, and embarked on a journey to create a documentary about his FIRE experience.

Fast forward two years, he’s now only nine years away from retirement, completed the documentary “Playing with FIRE,” and authored this book along the way.

These insights are not just about managing money; they’re about reclaiming your time and focusing on what truly matters. Through the stories shared in this book, you’ll discover practical strategies to optimize your finances.

Whether it’s retiring early, pursuing passion projects, or simplifying your life, the FIRE lifestyle offers something for everyone.

And the best part? It’s not reserved for the wealthy or those willing to make extreme sacrifices; it’s accessible to anyone seeking a more intentional way of living.

In this summary, you’ll learn:

– the best price to pay for a car

– why investing in the stock market isn’t as risky as it seems

– and how you can enjoy the holiday season without compromising your FIRE goals.

Playing with FIRE Lessons

| What? | How? |

|---|---|

| You need to change your lifestyle if you want to retire early | Assess your current spending habits and identify areas where you can cut expenses. Consider downsizing your living space, reducing discretionary spending, and prioritizing saving and investing. |

| You don’t need to retire, but you won’t need to work for money | Shift your mindset from traditional retirement to financial independence. Understand that achieving FIRE doesn’t necessarily mean stopping work altogether but having the freedom to choose how you spend your time without financial constraints. |

| To retire early, save a lot and spend a little | Commit to aggressive saving and investing. Aim to save a significant portion of your income (50-70%) and focus on low-cost investment strategies to maximize returns. Prioritize long-term financial goals over short-term gratification. |

| Stay close to people who share the same values | Surround yourself with individuals who support your FIRE journey and share similar values. Join online forums or attend FIRE meetups to connect with like-minded individuals, share experiences, and gain valuable insights and encouragement. |

| Don’t wait for a six-digit salary to start | Start your FIRE journey regardless of your current income level. Recognize that financial independence is achievable for people of all income brackets. Begin by setting clear financial goals, creating a budget, and implementing savings and investment strategies. |

1️⃣ You need to change your lifestyle if you want to retire early

Scott Rieckens found himself stuck in a lifestyle that felt unsustainable. Like many, he believed that working until his mid-sixties was the norm, necessary for financial security. However, upon closer examination, he realized something didn’t quite add up.

Consumer culture often pressures people to overwork for unnecessary luxuries. Rieckens and his wife, Taylor, were caught in this cycle, striving for a seemingly perfect lifestyle in Coronado, California.

Despite their combined income of $142,000, they found themselves living beyond their means, splurging on items like an expensive blender and dining out regularly.

Yet, looming expenses such as buying a house and saving for their daughter’s college fund made them realize their financial shortcomings. Despite contributing to their 401k retirement accounts, they were left feeling financially insecure.

Rieckens faced the dilemma of whether he’d have to remain in his salaried position indefinitely, sacrificing his entrepreneurial dreams in the process.

However, everything changed one February morning in 2017 during Rieckens’ commute to work. He stumbled upon an interview with Mr. Money Mustache, aka Pete Adeney, on his favorite podcast, The Tim Ferriss Show.

Mustache, who retired at thirty near Boulder, Colorado, had amassed a following of individuals seeking early retirement through financially savvy choices.

This encounter introduced Rieckens to the FIRE movement—Financial Independence, Retire Early. Utilizing a simple retirement calculator, Rieckens discovered that by halving their expenses and investing their savings, they could retire in just ten years.

This epiphany led Rieckens to realize that he didn’t need a stroke of luck; he needed to change his lifestyle. Thus, his journey into the FIRE movement began, marking a pivotal shift towards financial independence and a more intentional way of living.

Moving on.

👉 Discover More:

- This Is How to Become a Millionaire in 6 Simple Steps

- So, Money Does Buy Happiness (Here’s How)

- Are You Doing These 8 Investing Mistakes Too?

2️⃣ You don’t need to retire, but you won’t need to work for money

Financial independence doesn’t mean traditional retirement; it means freedom from needing to work for money. Many who achieve financial independence through FIRE don’t actually stop working altogether.

Instead, they have the flexibility to make various career choices. Take Sylvia, for example. After Hurricane Katrina, she embraced a frugal lifestyle and worked as a delivery driver alongside her job as a lawyer. Even as her income grew, she maintained her thrifty habits.

Now, at 38, she’s financially independent and has the freedom to start her own law firm.

Others use FIRE to pursue passions like travel, charity work, or creative endeavors. Ultimately, what you do with your financial independence is entirely up to you.

But how much money do you need to achieve this? According to the FIRE Formula, you should save and invest twenty-five times your annual expenses.

For the Rieckenses, aiming for $60,000 in yearly expenses meant they needed to save $1.5 million. With a conservative estimate of a five percent rate of return, they could expect $75,000 annually from their investments.

Moreover, following the “4 percent rule,” withdrawing only four percent of their savings annually ($60,000) should sustain them indefinitely. This rule allows for buffer savings to withstand market fluctuations and inflation, ensuring their $1.5 million principal remains intact.

Now, the author’s task was to find ways to reduce his family’s spending to meet their target of $60,000 per year. This challenge marked the beginning of their journey towards financial independence and a life with more freedom and flexibility.

Next.

3️⃣ To retire early, save a lot and spend a little

The key to achieving FIRE is to save aggressively and make smart, low-cost investments. The math behind financial independence is straightforward: trim your expenses and build up enough assets to live off the returns. Let’s break down how to get started on this path.

First, track where every dollar of your money is going. Understanding your spending habits allows you to make necessary adjustments.

In the world of FIRE, the goal is to save and invest around 50 to 70 percent of your income. If this sounds overwhelming, start by focusing on the biggest expense categories: housing, transportation, and food.

Scott and Taylor embarked on their FIRE journey by traveling for a year to save money and find an affordable city to settle in. They discovered Bend, Oregon, with its outdoor activities and reasonably priced housing market.

Addressing transportation, they opted for one car—a used AWD Honda CRV for $7,500, following advice from FIRE blogger Brandon. While they initially aimed for a $5,000 car, they prioritized reliability for their mountainous terrain.

When it came to investing their savings, the Rieckenses were newbies. They diversified their investments across low-cost index funds, real estate, and entrepreneurial projects.

Low-cost index funds, in particular, offer broad exposure to the stock market with minimal fees, making them a favored option. Even Warren Buffett recommends them for their profitability.

If market fluctuations make you nervous, you can adjust your savings goals or withdrawal rate accordingly. This might mean working longer or further reducing expenses.

The key is finding a balance that aligns with your comfort level and financial goals as you work towards achieving financial independence.

Onwards.

👉 Discover More:

- 10 Powerful Lessons From “Think and Grow Rich”

- 12 Timeless Lessons From “The Daily Stoic”

- 12 Hidden Secrets From “The 48 Laws of Power”

4️⃣ Stay close to people who share the same values

Bringing up the topic of FIRE with your partner requires tact and understanding, especially if you’re asking them to embrace a new lifestyle. Start by discussing your values together before diving into the details of financial independence.

If you’re unsure how your partner will react, try a simple exercise like the “Ten Things Exercise.” Have them list the ten things that bring them happiness on a weekly basis. You might find that your values align more closely than you expected.

Scott hesitated to broach the topic of FIRE with his wife, Taylor, fearing her reaction and acknowledging her role as the primary breadwinner.

However, when they compared their lists of happiness-inducing activities, they realized that their current spending habits didn’t align with their values. This realization made it easier to discuss FIRE together.

When sharing your plans with friends, avoid coming across as preachy. Instead, focus on finding like-minded individuals within the FIRE community. Scott and Taylor’s journey into FIRE gained momentum when Scott’s idea for a documentary attracted attention.

Through this project, they connected with prominent figures in the FIRE movement, such as Mr. Money Mustache, and found a supportive community of individuals pursuing similar goals.

Enthusiasm for FIRE is driven by shared values, attracting a diverse range of people to the movement.

By communicating openly with your partner and connecting with the FIRE community, you can find support and encouragement as you embark on your journey towards financial independence and a more intentional way of living.

Next.

5️⃣ Don’t wait for a six-digit salary to start

FIRE isn’t just for the wealthy; it’s a lifestyle that people of all income levels can embrace. While a higher income might accelerate your path to financial independence, it’s not a prerequisite for practicing FIRE.

Consider Kalen, a management analyst earning under $50,000 annually. Feeling unsatisfied with the prospect of working until her mid-sixties, she discovered FIRE and began practicing it with her boyfriend, Kyle.

By reducing their expenses to $32,000 per year, they’re on track to achieve financial independence in just six years. However, their goal isn’t solely early retirement; it’s about prioritizing happiness over materialism.

FIRE may seem extreme to some, but it can be as flexible as you want it to be. Scott and Taylor, for instance, encountered challenges during their journey, such as budgeting for Christmas while staying with family.

Despite feeling the pressure to adhere strictly to their frugal lifestyle, they realized that FIRE is about making choices that align with long-term happiness, not deprivation.

Their experience taught them the importance of intentionality in spending. They found ways to celebrate Christmas without overspending, demonstrating that FIRE isn’t about strict austerity but about making conscious decisions that reflect your values.

By embracing FIRE, individuals can achieve financial independence and design a lifestyle that brings them fulfillment, regardless of their income level.

It’s about finding a balance between saving for the future and enjoying life in the present, making it an accessible and flexible approach to financial well-being.

👉 Discover More:

- An Open Letter to My Future Son & Daughter: Step 2

- An Open Letter to My Future Son & Daughter: Step 1

- An Open Letter to My Future Son & Daughter: Intro

Playing with FIRE Review

The key takeaway from these insights is that FIRE (Financial Independence, Retire Early) offers a pathway to financial empowerment and fulfillment for everyone, regardless of income level.

Whether it’s relocating to a more affordable area or making small changes to daily spending habits, taking control of your finances through FIRE can lead to a more intentional and rewarding life. While aggressive savings and low-cost investments can accelerate the journey to retirement, FIRE is ultimately about aligning your consumption habits with your values.

Join an online forum to discuss your finances: Finances can be a sensitive topic, often leading to isolation for those pursuing FIRE. However, the FIRE community encourages collaboration and openness.

Online forums provide a supportive environment where you can anonymously engage with like-minded individuals, share experiences, and gain valuable insights on your journey towards financial independence.

Playing with FIRE Quotes

| Scott Rieckens Quotes |

|---|

| “Retirement” |

| “The general path to FIRE is to save 50 to 70 percent of your income, invest those savings in low-fee stock index funds, and retire in roughly ten years.” |

| “Like the Ocean Cleanup project or raising awareness of the Effective Altruism movement.” |

| “What are your most important life goals? •What would you do if you only had six months to live? •How do you want to spend the next five years?” |

| “For traditional employment, don’t pursue your passion. Find a company that appreciates its employees and will provide challenging work for equitable compensation. Make the rest of your life about pursuing your passions.” |

More from thoughts.money

- The Science of Success: 17 Proven Steps to Achieve Any Goal

- 8 Proven Money Lessons From “The FALCON Method”

- A Must-Know Lesson From “The First Rule of Mastery”

- 5 Early Retirement Tips From “Playing with FIRE”

- 7 Life Lessons From “Die with Zero”

- 4 Money Lessons From “Tax-Free Wealth”

- 5 Practical Tips From “The Value of Debt in Building Wealth”

- 8 Emotional Intelligence Lessons From “The Power of Nunchi”

- 6 Down-to-Earth Lessons From “How I Invest My Money”

- 8 Life Lessons From “The Geometry of Wealth”

- 8 Money Lessons From “The Laws of Wealth”

- 11 Stress-Free Lessons From “Why Zebras Don’t Get Ulcers”

- 8 Health Tips From “The Stress Code”

- 8 Psychology Lessons From “The Behavioral Investor”

- 7 Life Secrets From “The Happiness Equation”

- 11 Humankind Lessons From “Sapiens”

- 7 Health Lessons From “The Upside of Stress”

- 9 Smart Lessons From “Emotional Intelligence”

- 10 Controversial Truths From “The Hour Between Dog and Wolf”

- 10 Powerful Sales Lessons From “The 3-Minute Rule”

- 7 Strategies for Wealth and Happiness by Jim Rohn

- 9 Lessons to Apply Today From “The Daily Laws”

- 7 Must-Know Truths From “What I Learned Losing a Million Dollars”

- 4 Never-Before-Published Lessons From “Pathways to Peace of Mind”

- 4 Long-Lost Lessons From “Outwitting the Devil”

- 8 Untold Secrets From “Napoleon Hill’s Golden Rules”

- 12 Hidden Secrets From “The 48 Laws of Power”

- 8 Practical Lessons From “The New Trading for a Living”

- Financial Wisdom From “Charlie Munger”

- Power Lessons From “13 Things Mentally Strong People Don’t Do”

- 4 Investing Lessons From “Trade Like a Stock Market Wizard”

- 7 Investing Lessons From “How to Make Money in Stocks”

- 12 Timeless Lessons From “The Daily Stoic”

- 6 Simple Lessons From “The Little Book of Common Sense Investing”

- 7 Super Ideas From “One Small Step Can Change Your Life”

- 8 Killer Lessons From “The Millionaire Real Estate Agent”

- 7 Counter-Intuitive Life Lessons From “Lives of the Stoics”

- 5 Important Life Lessons From “Million Dollar Habits”

- 6 School Lessons From “Why A Students Work for C Students”

- 9 Financial Freedom Lessons From “Rich Dad’s Cashflow Quadrant”

- 6 Wealth Lessons From “Millionaire Success Habits”

- 7 Unspoken Truths From Rich Dad’s “Retire Young Retire Rich”

- 9 Must-Know Lessons From “The Intelligent Investor”

- 14 Life Lessons From “The Snowball”

- 5 Investing Lessons From “Warren Buffett’s Ground Rules”

- 8 Money Secrets From “The Richest Man in Babylon”

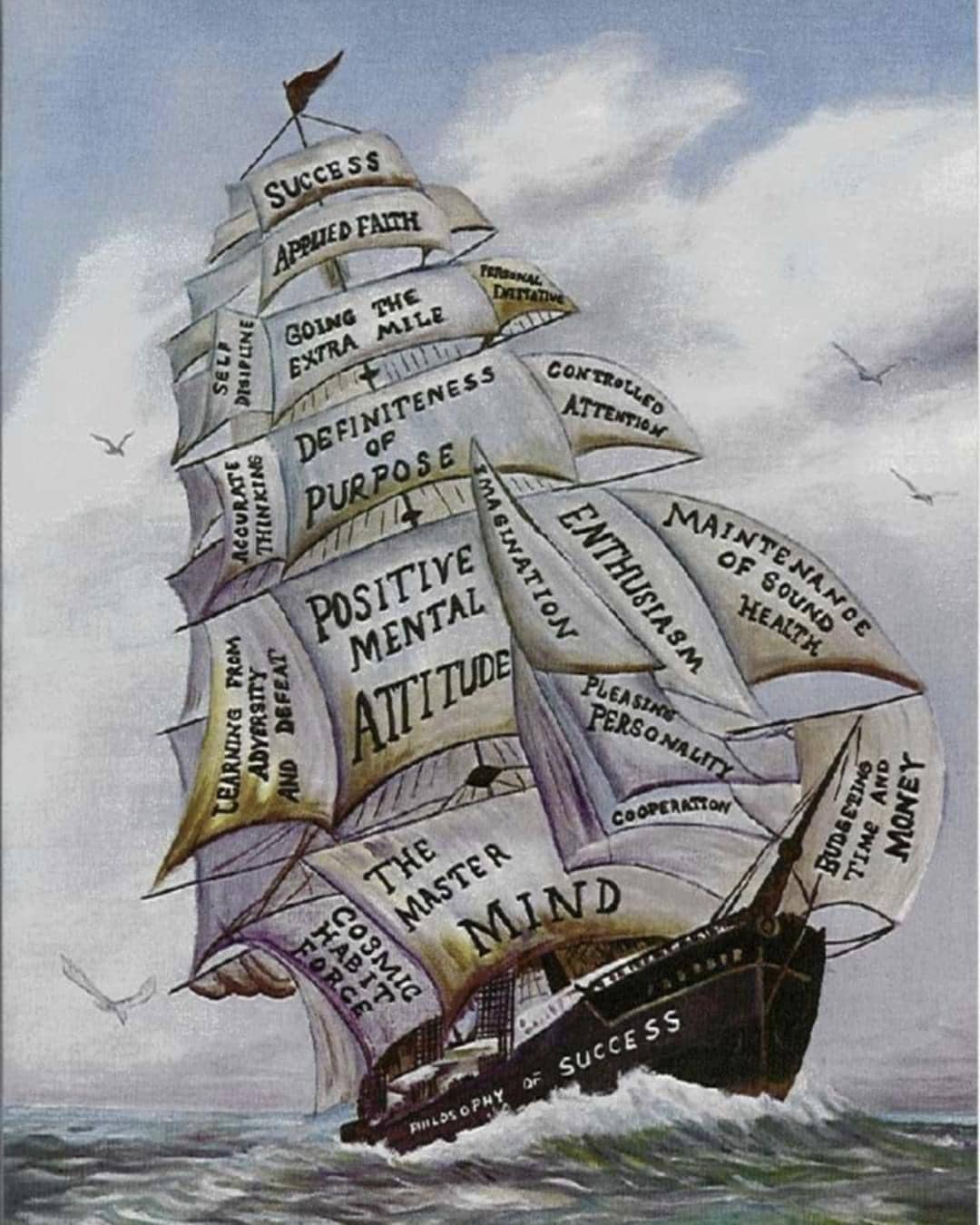

- 10 Powerful Lessons From “Think and Grow Rich”

- These Are the Top 9 Lessons From “Rich Dad, Poor Dad”

- These Are the Top 5 Lessons From “How Highly Effective People Speak”

- These Are the Top 3 Lessons from “Burn the Boats”

- These Are the Top 3 Lessons from “The Power of Now”

- These Are the Top 3 Lessons from “The Psychology of Selling”

- These Are the Top 3 Lessons from “Mind Over Money”

- These Are the Top 3 Lessons From “The War Of Art”

- These Are the Top 3 Lessons from “The Dip”

- These Are the Top 3 Lessons from “Ikigai”

- These Are the Top 3 Lessons from “The 10X Rule”

- These Are the Top 3 Lessons from “The Subtle Art of Not Giving a Fuck”

- These Are the Top 3 Lessons from the “Man’s Search For Meaning”

- Should You Start a Dropshipping Business? (If Yes, How?)

- Should You Buy an REO (Real-Estate Owned) Property?

- This Is What Pet Insurance Covers

- This Is How Much Cash You Should Keep in the Bank

- This Is How to Make a Living Will (In 5 Simple Steps)

- These Are the Top 7 Dividend ETFs

- These Are the Top 10 ETFs (U.S. & International)

- These Are the Top 7 Money Market Accounts

- These Are the Top 9 Budget-Friendly Cities for Christmas

- This Is How FDIC, NCUA, and SIPC Protect Your Money

- Should You Use an Oven or Air Fryer?

- Should You Use a Dishwasher or Hand Wash?

- This Is the Difference Between a Salary and Hourly Pay

- This Is the Definition of a Christmas Club Account

- This Is How to Open an IRA (In 5 Simple Steps)

- If You Rent, It’s OK (Here Are 10 Reasons Why)

- Is There a Best Time to Buy or Sell Stocks? (Let’s See)

- This Is What the Value Line Composite Index Tells Investors

- This Is the Difference Between Technical and Fundamental Analysis

- This Is What Alpha and Beta Means in Investing

- This Is What Banking Desert Means

- So, You Want to Invest in Stocks (Here Are 5 Simple Steps)

- Do You Really Need Life Insurance? (Probably Yes)

- These Are the 6 Worst Student Loan Mistakes You Can Make

- Should You Apply for a Private or a Federal College Loan?

- Here’s the Difference Between Fixed and Adjustable Rate Mortgages

- This Is How Much the American Dream Costs Now

- This Is How to Become a Millionaire in 6 Simple Steps

- This Is What Famous Billionaires Did As Their First Job

- Here Are the 9 Most Common Motorcycle Types

- This Is the Difference Between Hard and Soft Money

- This Is How to Exercise Your Stock Warrants

- After Thanksgiving Comes Cyber Monday (What’s the Story?)

- So Long Mr. Munger: A Life Well Spent

- So, You Wanna Buy a Busa? (Here’s All You Need to Know)

- Capitalism Makes the World Go Round? (Let’s Find Out)

- Interested in Bitcoin Mining? (Here’s How It Works)

- The World’s Largest Companies (By Revenue)

- The World’s Most Profitable Companies (By Net Income)

- This Is How Much Jay-Z Is Worth

🔥 Daily Inspiration 🔥

If you don’t believe it yourself, don’t ask anyone else to do so.

It is virtually impossible not to transmit your doubts and insecurities to others through body language, tone of voice, inflection, word choice, and other subtle characteristics.

When you show by your actions that you lack self-confidence, other people doubt your ability to perform.

You can gain the respect and confidence of others.

Begin by listing all the things you like about yourself and what you would like to change.

Make a conscious effort to build upon your positive strengths and correct your weaknesses.

It may not be easy, but you will eventually prevail if you assess yourself objectively and persevere in your efforts.

— Napoleon Hill